Card Security Code: Why It Matters and How It Protects Your Transactions

When you make a purchase online or over the phone, you’re often asked for a Card Security Code. It may seem like a small number tucked away at the back or front of your card, but it plays a big role in safeguarding your money. Many people ask, “What is card security code, and why is it important?” The answer goes beyond just entering digits, it ties into CVV, layers of fraud prevention, and global standards like PCI DSS.

The Card Security Code is not only about protecting transactions, it’s part of a wider system that keeps digital payments safe. Providers such as Bycard have built their services around these principles, combining security features with practical tools that help individuals and businesses stay protected against credit card fraud.

What Is Card Security Code and Why Do Merchants Ask for It?

The first step is understanding what is card security code. Simply put, it’s a three- or four-digit number printed on your card, separate from the main credit card information like your number and expiration date. Depending on the card network, it may be referred to as CVV (Card Verification Value), CVC (Card Verification Code), or CID (Card Identification Number).

Merchants ask for this number because it shows that the customer has physical possession of the card. Even if someone knows your credit card information, they may not have access to the Card Security Code, making it harder for criminals to complete fraudulent transactions.

With Bycard, this step is further reinforced. Every virtual card issued is designed with strict security features that ensure your credit card security code is part of a larger defense system against misuse.

- Card Security Code: Why It Matters and How It Protects Your Transactions

- What Is Card Security Code and Why Do Merchants Ask for It?

- The Role of CVV in Fraud Prevention

- How Card Security Code Fits Into PCI DSS Standards

- Credit Card Fraud and the Importance of the Security Code

- The Connection Between 3D Secure and the Card Security Code

- Everyday Tips for Protecting Your Credit Card Information

The Role of CVV in Fraud Prevention

When talking about CVV, it’s important to highlight how it strengthens fraud prevention. Card numbers can be stolen in data breaches, but without the Card Security Code, thieves face an extra hurdle. This is why the credit card security code is never stored by merchants under PCI DSS compliance rules.

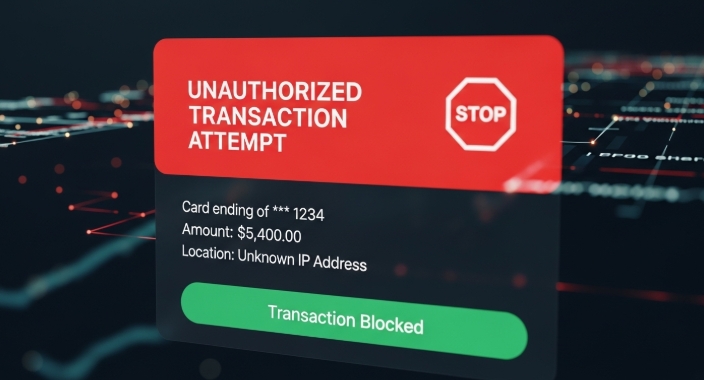

For online shopping, requiring CVV makes it less likely that stolen numbers alone can be used. It also helps banks flag suspicious transactions. Platforms like Bycard enhance this layer by offering instant notifications for every transaction and allowing you to freeze or cancel a card immediately if you suspect credit card fraud.

How Card Security Code Fits Into PCI DSS Standards

The PCI DSS (Payment Card Industry Data Security Standard) sets rules for handling credit card information. One key rule is that merchants cannot store the Card Security Code after a transaction. This ensures that even if a company’s database is compromised, criminals don’t get hold of the credit card security code.

Bycard aligns with these global standards. Its platform is designed around PCI DSS compliance, meaning your card details and Card Security Code are always managed securely, giving you peace of mind with every payment.

Your shield against credit card fraud

Credit Card Fraud and the Importance of the Security Code

Credit card fraud comes in many forms, skimming devices, phishing emails, or hacking databases. But a missing piece of information often protects you: the Card Security Code. Even if attackers manage to steal your credit card information, they still need the CVV to finalize most online payments.

That doesn’t mean it’s foolproof. Criminals sometimes attempt “guessing attacks,” where they try multiple Card Security Code combinations. This is where Bycard adds value, its advanced fraud prevention tools monitor unusual spending patterns and give users control to set spending limits, helping minimize exposure to fraud.

The Connection Between 3D Secure and the Card Security Code

Many cardholders have noticed additional verification steps when shopping online. That’s where 3D Secure comes in, a protocol that asks you to confirm transactions through a password, SMS code, or biometric authentication.

The Card Security Code works alongside 3D Secure, creating two separate layers of defence. The CVV proves you have the physical card, while 3D Secure proves you are the legitimate cardholder. Together, they dramatically reduce cases of credit card fraud.

Even if 3D Secure isn’t triggered on every transaction, it’s only one part of the bigger security picture. That’s why solutions like Bycard emphasize layered protection, combining the security of your Card Security Code with features such as instant card issuance, easy card freezing, and proactive alerts to keep your credit card information safe in real-world scenarios.

Everyday Tips for Protecting Your Credit Card Information

While systems like PCI DSS and 3D Secure are in place, you also play a role in fraud prevention. Here are a few everyday habits:

- Never share your Card Security Code over email or text.

- Watch out for phishing sites that ask “What is card security code?” outside of a secure checkout page.

- Ensure the websites you shop on use SSL encryption (look for “https”).

- Report lost or stolen cards immediately, without delay, fraudsters can attempt transactions using your credit card information.

- Enable alerts from your card provider to spot unauthorized charges quickly.

Platforms like Bycard make this process easier by giving users more control over their transactions. With features such as instant virtual cards, spending controls, and real-time alerts, Bycard ensures your credit card security code and other sensitive details are always protected.

Conclusion

The Card Security Code may look like just a few digits, but it’s a frontline defence in the fight against credit card fraud. From answering the question, “What is card security code?” to understanding its connection with CVV, PCI DSS, and 3D Secure, it’s clear that this small number carries a lot of weight.

That’s also why modern platforms like Bycard emphasize security as much as convenience. Bycard doesn’t just give you access to virtual and physical cards; it builds layers of fraud prevention into every transaction. Whether you’re issuing a card for online shopping, setting spending limits, or managing credit card information securely, Bycard keeps your financial safety at the centre.

So, the next time you enter your Card Security Code, know that those numbers, combined with secure payment tools like Bycard, are quietly working behind the scenes to protect your money and build trust in every digital payment.