Fraud prevention and why do virtual cards help?

Fraud prevention works best when you isolate risk, cap spend and react fast. Virtual cards add unique numbers, tokenization in wallets, and instant freeze-and-replace, which limits damage from data breaches and blocks most phishing scams. Fraud prevention reduces unauthorized use and loss.

You stop bad charges before they settle, and you limit the impact if they slip through. Virtual cards help because each card has a unique number, clear limits, and quick replacement. You keep normal checkout speed while shrinking the attack surface.

The basic idea in one line: Smaller exposure per card means smaller losses, faster reviews, and fewer disputes.

Where Virtual Cards matters most

- Online stores and subscriptions

- Ad platforms and marketplaces

- Vendor payments and trials

- Travel, logistics, and temporary teams

- Fraud prevention and why do virtual cards help?

- How do virtual cards work in modern fraud prevention?

- How does tokenization strengthen fraud prevention?

- What threats do virtual cards reduce in 2025?

- How should a business design a card-per-vendor program?

- How do virtual cards help ad payments specifically?

- What policies anchor good fraud prevention?

- How should incident response work for card fraud?

- What does strong authentication add to fraud prevention?

- Where does Bycard fit in this picture?

How do virtual cards work in modern fraud prevention?

Virtual cards create controlled, single-purpose payment identities. You issue a card in seconds, name it for the vendor or campaign, and set limits. The card can be locked to one merchant category. You can expire it on a date. If trouble hits, you freeze and replace it without touching other cards. One leak no longer drains every budget line. Finance sees clean logs tied to a single purpose.

Controls that reduce risk

- Per-card daily and monthly caps

- Merchant lock and MCC filters

- Start and end dates for trials and projects

- Real-time alerts on spikes and declines

How does tokenization strengthen fraud prevention?

Tokenization replaces the real card number with a device or network token.

Wallets like Apple and Google create tokens that stand in for the PAN. Merchants never see the raw number at tap or in supported online flows. If a token leaks, reuse is hard or impossible. Use wallet tokens for in-person taps and keep the virtual cards for online and vendor-locked payments. Together they lift security without adding friction. Here are the benefits you notice:

- Fewer successful replay attacks

- Lower value for stolen data

- Better approval rates at many terminals

Perfect Card for running ads!

What threats do virtual cards reduce in 2025?

Virtual cards limit damage from data breaches and social tricks.

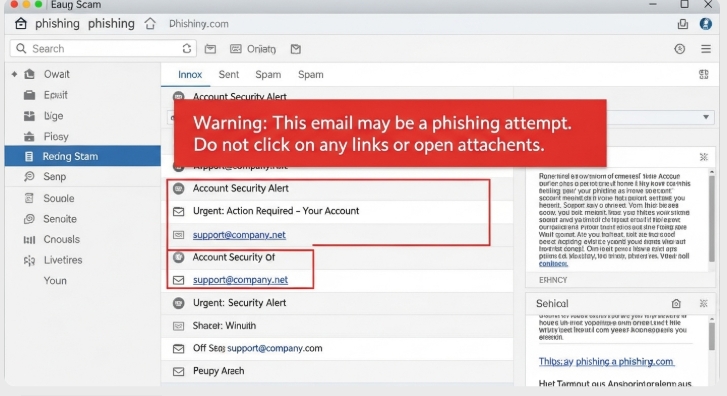

Retailers, SaaS tools, or ad platforms may suffer data breaches. A leaked number on a virtual card is easy to replace. Phishing scams try to trick staff into sharing one-time codes or updating billing on fake pages. Short-life, low-limit cards blunt that risk.

Data breaches, in practice

- Impact: stored PANs or tokens leak

- Prevention: card-per-vendor, low caps, rotation

- Response: freeze, re-issue, and audit logs

Phishing scams, in practice

- Impact: fake “support” asks for OTP or passwords

- Prevention: MFA, passkeys, and strict helpdesk rules

- Response: reset access, review charges, re-issue cards

Do virtual cards stop all fraud?

Fraud prevention lowers risk but does not reach zero. Insiders can misuse cards. Weak login security can expose dashboards. Some merchants do not support advanced checks. You still need monitoring, policies, and clean offboarding. Use roles, approvals, and quarterly reviews. Keep alerts on. Rotate cards at project end.

Gaps to watch

- Shared logins to the card platform

- Overbroad limits with no end date

- No review of refunds and credits

How should a business design a card-per-vendor program?

You assign one virtual card per vendor, project, or campaign.

Name cards with a clear pattern. Example: VENDOR–TEAM–GEO–MMYY. Set limits to the plan plus a small buffer. Lock to the merchant or MCC. Add an end date.

Setup steps you can copy

- Define naming, owners, approvers

- Issue card with cap and lock

- Turn on alerts: first charge, velocity, spikes, declines

- Export logs weekly to finance

- Close or rotate at project end

Metrics that show control

- Approval rate by merchant

- Time-to-freeze after an alert

- Refund match rate to credits

- Dispute rate per 1,000 transactions

How do virtual cards help ad payments specifically?

Fraud prevention improves when every ad account uses its own card.

Ad platforms bill in bursts and at odd hours. A shared card fails loudly. A virtual card per campaign isolates risk and speeds reconciliation. When a decline hits, a backup card keeps delivery live.

Ad-buyer SOP

- Card-per-platform or per-campaign

- Weekly cap equals plan +10%

- Merchant lock to ad MCC only

- Backup card on file before launch

Alerts worth enabling

- First charge on a new account

- Three charges in five minutes

- Three declines in ten minutes

- Spend over 3× your 30-day median

What policies anchor good fraud prevention?

Written rules make virtual cards safer and easier to audit.

You define issuance, approvals, limits, and reviews. You train teams on phishing scams and refunds. You document evidence and keep it searchable. Short refreshers, phishing drills, and “never share a code” reminders in chat tools.

Minimum policy set

- Issuance criteria and role permissions

- Default caps, buffers, and end dates

- Receipt and refund handling

- Quarterly card and vendor reviews

How should incident response work for card fraud?

You freeze first, then investigate, then recover.

Move in a fixed order so you do not lose time.

The fast path

- Freeze the card

- Snapshot logs and receipts

- Re-issue with same cap and lock

- File dispute or chargeback with evidence

- Note the root cause and policy fix

Evidence that wins cases

- Timestamps, order IDs, and IP or device data

- Contract or terms for refunds

- Chat transcripts and delivery records

What does strong authentication add to fraud prevention?

Strong authentication blocks impostors at key steps.

Use MFA or passkeys on the card dashboard. Use 3DS or step-up checks for risky payments. This limits the payoff from phishing scams and reduces account takeover.

Where to require step-ups

- New merchant or country

- Unusual time of day

- Spend above a set threshold

Where does Bycard fit in this picture?

Bycard turns best practices into default behaviour.

You issue virtual cards in seconds, lock them to a merchant or MCC, and set hard caps. Tokenization works with Apple and Google wallets. Alerts fire on first charges, spikes, and decline clusters. If a data breach hits a vendor, you freeze and replace the card without breaking other workflows. Finance gets clean exports for audits.

Bycard features mapped to fraud prevention

- Card-per-vendor and card-per-campaign templates

- Merchant lock, MCC filters, and end dates

- Real-time alerts and webhooks

- Role-based issuance and approval flows

- CSV exports with tags for cost centers and projects

Conclusion

Fraud prevention is a system, not a switch. Virtual cards give you small, focused payment identities that cap loss and speed reviews. Tokenization in wallets hides real numbers. Training stops phishing scams. A short runbook keeps responses fast. With Bycard, you turn these ideas into daily practice: instant issuance, merchant locks, alerts, and clean records that finance trusts.