Vendor Management and Strategies for Better Payments

Managing vendors is a reality every business faces. From small companies outsourcing design work, or a multinational relying on dozens of suppliers across borders, vendor management is at the heart of operations, if properly done, strengthens relationships, streamlines operations, and keeps projects on track. Done poorly, it introduces delays, risks, and unnecessary costs.

But here’s the thing, vendor management is not just about tracking suppliers on a spreadsheet. It’s a blend of strategy, people, and technology. It covers everything from vendor selection to vendor payments, contract oversight, and tackling daily vendor management challenges. More recently, businesses are adopting vendor management systems to bring order to the chaos.

- Vendor Management Is More Than Just Paying Invoices

- Vendor Management Challenges That Can Break a Business

- The Payment Factor: Closing the Gap Between Vendor Management and Finance

- Vendor Management in a Global Economy

- Building Stronger Vendor Relationships with Vendor Management Systems

- What Happens When Vendor Payments Run Themselves

Vendor Management Is More Than Just Paying Invoices

Many companies think of vendor management as simply “hiring and paying vendors.” That view is far too narrow. Vendor management involves:

- Selecting vendors: evaluating quality, cost, reliability.

- Contracting: negotiating agreements, defining service levels.

- Onboarding: integrating vendors into systems and workflows.

- Ongoing management: ensuring work quality, resolving issues.

- Vendor payments: tracking invoices, reconciling amounts, paying on time.

- Risk oversight: monitoring compliance, financial stability, and delivery.

- Offboarding: wrapping up projects and final payments cleanly.

Each of these steps ties together. A brilliant vendor selection means little if your payment system is slow. And efficient vendor payments won’t fix poor oversight. That’s why vendor management must be viewed as a full cycle.

Vendor Management Challenges That Can Break a Business

Even with good intentions, businesses run into recurring vendor management challenges. Let’s look at some of the big ones:

- Scattered Data

Vendor details, contracts, tax forms, invoices often sit in silos. Without a central view, mistakes are inevitable. - Unclear Vendor Payments

Missing payment terms or late vendor payments create unnecessary tension. Vendors who don’t get paid on time may halt work or deliver late. - Weak Contract Oversight

Many businesses forget to revisit contracts, leaving gaps in expectations or renewals. This makes disputes harder to resolve. - Compliance Risks

Vendors who aren’t compliant with regulations (like GDPR or tax laws) expose the hiring business to penalties. - Over-reliance on One Vendor

Depending too heavily on one vendor without backup, creates operational risk. - Manual Processes

Managing dozens of vendors through spreadsheets and email chains slows everything down and increases error rates. - Scaling Problems

As businesses grow, the number of vendors grows too. Without proper systems, oversight becomes nearly impossible.

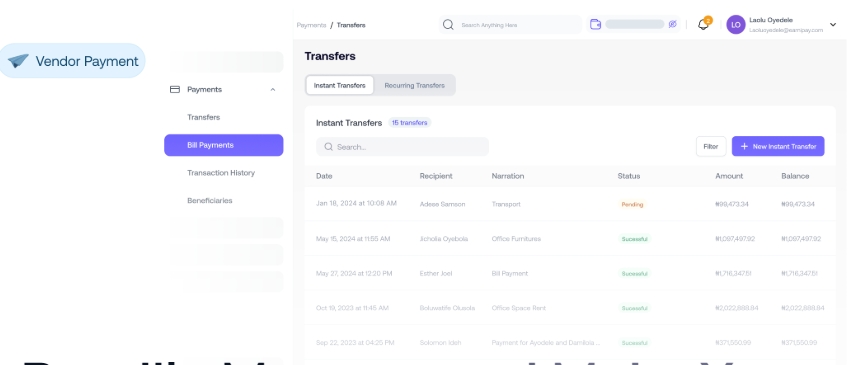

When left unchecked, vendor payment issues create costs, risks, and strained relationships. Payments aren’t just transactions, they signal trust. That’s why more businesses now rely on vendor management systems and tools like Bycard, which uses virtual cards, spending limits, and instant controls to reduce errors and bring structure to vendor payments.

The Payment Factor: Closing the Gap Between Vendor Management and Finance

Most businesses still treat vendor management and finance as two separate silos. Procurement picks the vendor, then finance handles vendor payments. The gap often leads to errors.

For example, procurement might agree to pay in 30 days, but finance delays it to 60 days. Or procurement may approve a budget, but finance overshoots payments due to miscommunication. These disconnects are among the most overlooked vendor management challenges.

The real missing link is connecting vendor management systems with payment tools. That’s where solutions like Bycard come in. By integrating spend controls, like multi-currency virtual cards, spending limits, and instant card locking, with vendor management systems, businesses can ensure payments happen exactly as agreed.

It’s not just about paying; it’s about keeping vendor management and finance aligned.

Vendor Management in a Global Economy

Vendor management has always existed, but globalization has added new layers of complexity. A U.S. startup, for example, might rely on a supplier in Asia for critical components or outsource creative work to freelancers in Europe.

Each of these relationships involves cross-border vendor payments, varying compliance requirements, and financial risks. Currency fluctuations alone can cause recurring headaches, leading to delays or disputes if not managed properly.

While vendor management systems help track contracts and performance, businesses also need reliable tools to streamline payments. This is where Bycard makes a difference. With its multi-currency support, U.S. companies can pay international vendors in their local currency, reducing both delays and conversion issues. That directly addresses one of the most persistent vendor management challenges in today’s global economy.

Perfect Card for running ads!

Building Stronger Vendor Relationships with Vendor Management Systems

While tools and systems matter, vendor management isn’t purely technical. At its core, it’s about relationships.

Vendors who feel undervalued, through late vendor payments, poor communication, or unclear expectations, are unlikely to prioritize your business. On the other hand, vendors who are paid promptly, given clear KPIs, and engaged in ongoing dialogue often become long-term partners.

A good vendor management system provides data, but relationships thrive when businesses add a human touch. For example:

- Giving constructive feedback instead of just complaints.

- Acknowledging good performance.

- Being transparent about budget or operational constraints.

When paired with timely vendor payments, this approach creates loyalty. And in industries where good vendors are hard to find, loyalty is worth more than any system

What Happens When Vendor Payments Run Themselves

Vendor management isn’t standing still. Artificial intelligence is starting to predict vendor risks before they occur. Automation is cutting down on endless approvals, compliance checks, and vendor payments. Vendor management systems are being paired with fintech tools like Bycard, while predictive controls flag overspending before finance teams even notice.

Imagine this: your system detects a vendor underperforming, pauses payments automatically, and notifies procurement to re-evaluate, all without you lifting a finger. That’s the direction businesses are heading.

Bycard fits neatly into this shift. With the ability to issue multiple cards, set precise limits per vendor, and manage payments across borders, it doesn’t just support a vendor management system, it strengthens it. The messy part of vendor management, payments, suddenly becomes smoother, faster, and more reliable.

Conclusion

Vendor management may sound like back-office work, but it’s central to how businesses grow. Smooth vendor payments, fewer vendor management challenges, and the right vendor management systems directly impact costs, relationships, and scalability.

Bycard isn’t just a payment tool; it’s a bridge between procurement and finance, helping businesses manage vendor payments with transparency and control. Whether you’re running ads with multiple small vendors, or paying international suppliers, Bycard’s virtual cards, multi-currency support, and spend limits address some of the most difficult gaps in vendor management.