What Is a Virtual Card and How It Works for Modern Payments

Online payments have transformed how we move money, and virtual cards are at the centre of that evolution. But what is a virtual card? It’s a fully digital version of your debit or credit card that lets you pay online safely without exposing your actual account details.

As digital transactions continue to grow, the need for flexible and secure payment tools has never been greater. Virtual cards offer exactly that, speed, control, and stronger protection against fraud. With Bycard, you can create virtual cards instantly, set spending limits, and manage every transaction in one secure dashboard, whether it’s for personal use, business payments, or online shopping.

- What Is a Virtual Card and How It Works for Modern Payments

How a Virtual Card Works: Understanding What Is a Virtual Card

To understand what is a virtual card in practice, here’s a quick look at how it works:

- Reconciliation & Tracking

Each virtual card has a unique ID, making it easy to track expenses, match invoices, and audit spending. - Setup & Issuance

A virtual card is created by a bank, fintech, or card issuer. It comes with a 16-digit number, expiry date, and CVV. The card links to a funding source like a wallet, credit line, or bank account. - Control Rules & Limits

Virtual cards can have spending caps, merchant restrictions, and time limits. Some are even single use for added security. - Usage / Transaction

The merchant sees the virtual card details like any regular card. Payments are processed online or via API through card networks like Visa or Mastercard. - Monitoring & Cancellation

After use, a single-use card can be disabled immediately. If there’s any suspicious activity, it can be frozen or cancelled in real time.

What Is a Virtual Card and Why You Should Use One

When you ask what is a virtual card in terms of “why bother,” here are key advantages, backed by data and industry trends.

Enhanced security & fraud protection

- Virtual cards use unique card numbers, reducing exposure of your main account.

- Even if leaked, spending limits and merchant restrictions minimize potential damage.

Better expense control & visibility

- Each vendor or project can have its own virtual card, creating clear transaction trails.

- Built-in controls let you set spending limits and simplify reconciliation.

Faster procurement & reduced manual friction

- Virtual cards can be issued instantly, no waiting for physical delivery.

- They integrate easily with finance tools, speeding up approvals and payments.

Cost savings & operational efficiencies

- Lower overhead vs. issuing physical cards or handling checks and manual payments.

- Less manual reconciliation, fewer billing errors.

Potential drawbacks to watch for

- Certain providers may charge fees or issue cards with short expiration periods.

- Not every merchant accepts virtual cards, particularly in-person or POS scenarios.

Perfect Card for running ads!

Typical Use Cases: Where Virtual Cards Shine

To make what is a virtual card more tangible, here are common real-world use cases (and match them to how ByCard can help):

| Use Case | Challenge | Virtual Card Solution |

| SaaS / subscription payments | Recurring payments cause fear of surprise charges after cancellation | Issue a virtual card just for that vendor, set tight limits, cancel when unused |

| Marketplace or one-time vendor payments | Sharing primary account detail is risky | Use a single-use virtual card to isolate risk |

| Ad campaigns, media buying | Need control over budgets across campaigns | Create separate virtual cards per campaign to enforce limits |

| Travel & expense reimbursement | Employee overspend or misreporting | Issue a card per employee or trip with predefined limits and expiry |

| Vendor payments, procurement | Reconciliation and audit headaches | Match each vendor payment to a unique virtual card for clear audit trail |

ByCard’s virtual card solution is tailored especially to some of these: for instance, ByCard lets you generate cards instantaneously, set merchant rules, control budgets, and monitor usage in the dashboard. That way, your procurement, marketing, or operations teams stay productive without sacrificing security.

Technical & Risk Considerations

When you understand what is a virtual card, you also need to see the limitations and trade-offs. Here are advanced points to watch:

Card network & infrastructure constraints

Virtual cards depend on standard payment rails (Visa, Mastercard). Issuers must be certified and integrated.

Lifecycle & expiration strategy

A tradeoff: shorter expiration enhances security but may inconvenience recurring vendors. Some providers allow extended expiration for trusted vendors.

Merchant acceptance & fallback paths

If a vendor doesn’t accept virtual cards, you need fallback (bank transfer, invoice). Always maintain flexibility.

Dispute & chargeback management

Even though the card number is virtual, disputes still go through usual chargeback channels. Ensure your provider offers support for chargebacks and reversals.

Regulatory, KYC, AML compliance

Issuers must enforce identity verification, monitor for suspicious activity, and comply with jurisdictional money-movement rules. This sometimes limits availability in certain geographies.

Integration with accounting & ERP systems

Max value comes when virtual card transactions flow into your general ledger seamlessly, with metadata, tagging, and classification. Without this, you lose the visibility advantage.

ByCard: What Is a Virtual Card and How It Works on Our Platform

Now that you know what is a virtual card and the ecosystem, here’s how ByCard delivers on those advantages, and what sets it apart.

Core Bycard features

- Instant Issuance

Create virtual cards in seconds through the Bycard dashboard or API, ready to use instantly for online payments or ad spend. - Security You Can Trust

Bycard uses advanced encryption, fraud protection, and PCI DSS compliance to keep your transactions safe. - Flexible Funding Options

Top up your wallet from $200 with a 1–3% service fee, pay a $1 issuance fee per card, and enjoy zero transaction fees from wallet to cards. - Unlimited Card Generation

Bycard supports 30+ BINs, and issues as many virtual cards as you need. - Custom Rules & Spending Limits

Set card limits, expiry dates, or merchant restrictions to prevent overspending. - Real-Time Tracking & Alerts

Monitor transactions & receive instant notifications for easy reconciliation - Finance Management Tools

Beyond payments, Bycard helps you track and organize spend. Access budgeting tools, and even crypto payment options. - Built for Scale

Run ads, manage client accounts, or automate USDT payments effortlessly.

How ByCard fits your needs

- For marketing/ads: Assign a card per campaign to prevent accidental overspend.

- For ops / procurement: Issue a vendor-specific card to automate payments.

- For freelancers & small businesses: Control subscription expenses or freelance payments using disposable cards.

How to Create a Virtual Card on Bycard

Setting up a virtual card on Bycard is quick and secure. Follow these simple steps to get started:

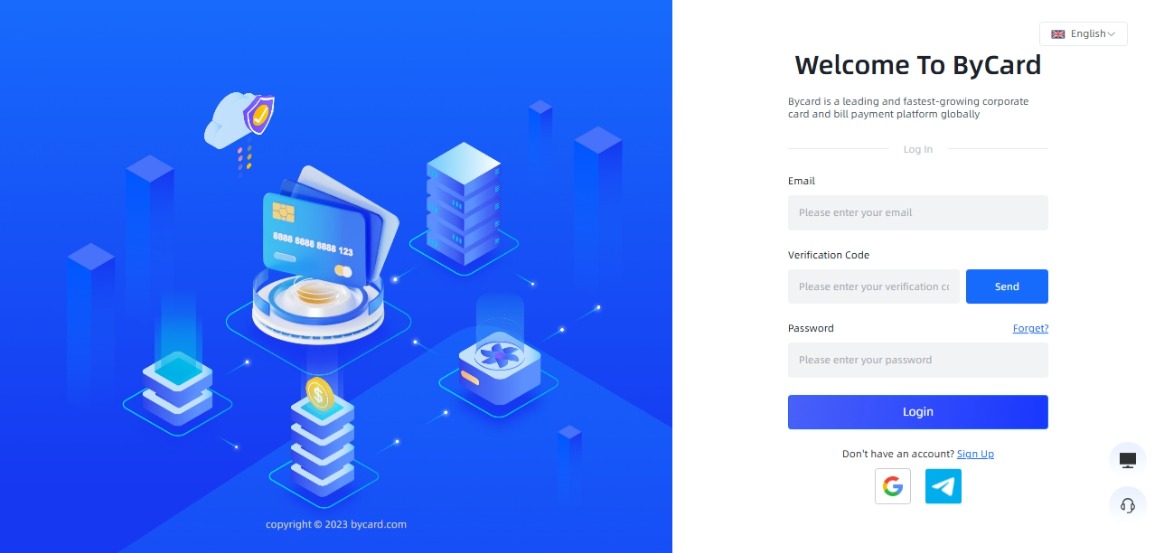

Step 1: Sign Up or Log In

Visit the Bycard website, then log in or create an account. Enter your email, set a password, and verify your account through the confirmation code sent to your email.

Step 2: Complete ID Verification (KYC)

Go to User Center → ID Verification and complete your KYC. This ensures your account is verified and authorized for secure transactions.

Step 3: Apply for a Virtual Card

From the dashboard, navigate to Apply for Cards or My Virtual Cards to create a new one. Each virtual card includes unique details, card number, security code, and spending controls.

Step 4: Use Your Virtual Card for Transactions

Use your virtual card for online purchases or link it to payment apps. You can lock or unlock your card anytime, set budgets, and even delete it instantly if needed.

Step 5: Monitor and Manage Cards

Track all transactions in real time through your dashboard. Set spending alerts, manage multiple cards for different purposes, and export reports for better budgeting or accounting.

Measuring Success: Metrics to Track

To really internalize what is a virtual card from a performance lens, here are key metrics you should monitor:

- Fraud rate (as % of transactions): compare virtual vs. traditional card use.

- Reconciliation time: hours or days saved per month.

- Number of cards issued per vendor / campaign: reflects granularity.

- Total spend volume on virtual cards: growth trend.

- Dispute & chargeback incidents: for assessing risk.

- Cost savings from manual process reduction (e.g. checks, manual ledger entries).

By measuring these, you can adjust how aggressively you adopt virtual cards via ByCard, and which teams should use them.

Perfect Card for running ads!

Conclusion

Understanding what is a virtual card is more than theoretical, it can transform how your business handles payments: reducing risk, tightening control, and streamlining workflow. ByCard offers a solution that brings those advantages into your hands with real flexibility, tracking, and control.