Virtual Prepaid Card: A Simple Way to Spend and Control Your Money Online

As online payments continue to grow globally, virtual prepaid card is becoming a preferred choice for individuals and businesses looking for safe and flexible payment options.

Bycard has emerged as one of the platforms making this process simpler. It allows users to generate virtual cards instantly, fund them securely, and manage transactions from one dashboard, no long forms or waiting times.

- Virtual Prepaid Card: A Simple Way to Spend and Control Your Money Online

- Understanding Virtual Prepaid Card

- How to Create a Bycard Virtual Card

- Virtual Prepaid Card vs Debit and Credit Card

- Type of Virtual Prepaid Card and Alternatives

- Benefits of Using a Virtual Prepaid Card

- Limitations to Keep in Mind

- Who Benefits Most from a Virtual Prepaid Card?

- Business Use Cases for Virtual Prepaid Card

- Choosing the Right Virtual Prepaid Card Provider

Understanding Virtual Prepaid Card

A virtual prepaid card functions just like a physical card, but it lives entirely online. You receive card details such as a number, CVV, and expiry date, which you can use for online purchases, subscriptions, or ad payments.

The main difference is that you load funds in advance. Once your balance runs out, you simply reload it. This gives you total control over how much you spend and protects your main account from fraud or overspending.

Bycard’s virtual prepaid card allows instant issuance and top-ups through multiple channels, making it a simple choice for users who want seamless access to secure payments without waiting for a physical card to arrive.

How to Create a Bycard Virtual Card

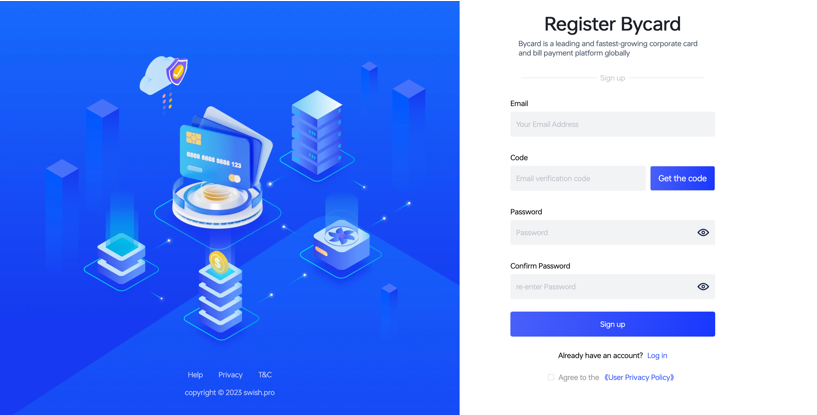

Getting started with a Bycard virtual card is quick and straightforward. You can set up and start using your card in just a few steps:

1. Sign Up and Log In

Head to Bycard’s website or download the app. Click “Sign Up” and enter your email, password, and phone number. Verify your details using the link or code sent to you. Once verified, log in with your credentials to access your dashboard.

2. Complete Verification

To activate your account fully, you’ll need to complete the KYC (Know Your Customer) process. Provide your legal name, date of birth, and address, then upload a valid ID and proof of address. This step helps secure your transactions and usually takes only a few minutes to process.

3. Apply for a Virtual Prepaid Card

Inside your dashboard, go to “My Virtual Cards” or “Apply for Card.” Choose your card type, maybe one for subscriptions or business expenses, then set spending limits and other preferences. Once done, your Bycard virtual card is issued instantly with a unique card number, CVV, and expiry date.

4. Fund Your Wallet

Before using your card, you’ll need to add money to your Bycard wallet. You can fund it through a bank transfer or debit card, then allocate money from your wallet to any of your virtual cards. Funds appear instantly, so you can start spending right away.

5. Track and Manage Transactions

Bycard lets you monitor every transaction in real time. You can view your spending history, block or cancel cards when necessary, and even dispute unauthorized charges, all from your dashboard.

Virtual Prepaid Card vs Debit and Credit Card

While debit and credit cards remain popular, a virtual prepaid card offers unique advantages in flexibility and security:

| Feature | Virtual Prepaid Card | Debit Card | Credit Card |

| Linked Account | Not linked to main bank account | Directly linked | Borrowed credit |

| Spending Limit | Based on loaded balance | Based on account balance | Based on credit limit |

| Fraud Risk | Very low | Moderate | Higher |

| Approval Process | Instant | Bank verification required | Credit check |

| Ideal Use | Budget control, online spending | Daily use | Credit building |

Type of Virtual Prepaid Card and Alternatives

Depending on your needs, there are several kinds of virtual cards available through platforms like Bycard:

- Reloadable virtual cards: Reusable and easy to top up.

- Single-use cards: Ideal for one-time online payments or trials.

- Business expense cards: Perfect for managing ad spend or team budgets.

- Multi-currency cards: Useful for freelancers or global travelers.

Bycard offers a flexible system that supports different spending habits, making it suitable for individuals, small businesses, and digital marketers.

Benefits of Using a Virtual Prepaid Card

1. Full Control Over Spending

A virtual prepaid card ensures you never spend beyond what you load. This is especially useful for budgeting or limiting recurring payments.

2. Better Fraud Protection

Because your Bycard virtual card isn’t linked to your main account, it provides a safety barrier. Even if your card details are compromised, your core funds remain untouched.

3. Perfect for Online Purchases and Ads

Whether you’re paying for Netflix, Shopify, or Meta Ads, the Bycard virtual card works across major online platforms with reliable acceptance.

4. Global Access

You can use it for transactions in multiple currencies, making it ideal for travelers, freelancers, and businesses managing cross-border expenses.

5. Instant Issuance and Reload

No waiting period, no paperwork. Bycard allows instant card creation and top-ups, so you can start transacting immediately.

Limitations to Keep in Mind

While the prepaid card is highly flexible, users should understand a few limits:

- Some merchants may not accept prepaid cards for recurring or offline payments.

- Currency conversion or reload fees may apply depending on location.

- Virtual cards typically do not build credit history.

Bycard minimizes these pain points with transparent pricing, multi-currency support, and round-the-clock assistance.

Who Benefits Most from a Virtual Prepaid Card?

A virtual card fits many lifestyles and professions:

- Freelancers and remote workers managing international payments.

- Digital marketers funding Google or TikTok ad campaigns safely.

- Parents giving teens controlled access to online spending.

- Small business owners who want to separate personal and company expenses.

- Travelers needing a secure card for international purchases.

Bycard’s solution supports each of these use cases with customizable options and fast funding.

Business Use Cases for Virtual Prepaid Card

1. Managing Ad Spend

Businesses use virtual prepaid cards to manage ad budgets on platforms like Google and Meta. Each campaign can have its own card, reducing mix-ups and fraud risk.

2. Contractor and Team Payments

Bycard makes it easy for companies to issue multiple cards to employees or contractors for expense tracking, without sharing one central account.

3. Subscription Management

Virtual prepaid cards simplify the process of paying for SaaS tools and online services. If a tool isn’t needed anymore, the card can simply be deactivated, no need to chase refunds or cancellations.

Choosing the Right Virtual Prepaid Card Provider

When selecting a virtual prepaid card, focus on these key factors:

- Licensing and Security: Always choose a regulated provider.

- Fee Transparency: Look for clear pricing with no hidden charges.

- User Dashboard: Real-time tracking and instant notifications.

- Multi-Currency Support: Especially for businesses with global clients.

- Instant Access: The ability to create and fund cards on demand.

Bycard checks all these boxes, combining speed, safety, and flexibility. Its user interface is intuitive, and transactions are processed in seconds, giving users peace of mind and control over every payment.

Conclusion

The Bycard virtual prepaid card represents a modern, secure, and flexible way to manage money in a digital world. It simplifies how you spend, whether that’s shopping online, paying for ads, or managing business expenses.

With instant setup, global reach, and strong fraud protection, Bycard isn’t just another fintech tool, it’s a practical solution for anyone who values control, safety, and convenience in one simple card.