Virtual Cards for Facebook Ads vs TikTok Ads: Payment Flow Differences

When ads stop delivering, most advertisers first look at creatives, targeting, or bids. But more often than people admit, the real issue sits quietly in the background: payments.

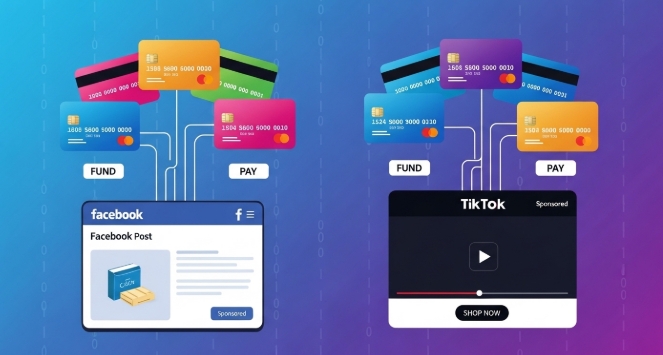

Facebook Ads and TikTok Ads both allow virtual cards, but they don’t process them the same way. The difference in payment flow, billing logic, and risk checks can determine whether campaigns scale smoothly or pause without warning.

This matters even more now that virtual cards are the default payment method for agencies, freelancers, and brands managing multiple ad accounts. Understanding how each platform treats these cards, and how providers like Bycard fit into the picture, helps prevent unnecessary disruptions.

- Virtual Cards for Facebook Ads vs TikTok Ads: Payment Flow Differences

- Why Advertisers Rely on Virtual Cards for Paid Ads

- Virtual Cards for Facebook Ads: How the Payment Flow Works

- Why Facebook Ads Prioritizes Virtual Card Stability

- Common Facebook Ads Issues with Virtual Cards

- Virtual Cards for TikTok Ads: A Very Different Payment Flow

- Why TikTok Ads Is Stricter with Virtual Cards

- BIN Trust and Region Matching: A Key Factor for Virtual Cards

- Authentication and 3D Secure Differences

- Virtual Cards for Facebook Ads vs TikTok Ads: Key Differences

- How Advertisers Use Virtual Cards Successfully on Facebook Ads

- How Advertisers Use Virtual Cards Successfully on TikTok Ads

- Where Bycard Fits into Virtual Card Use for Ads

- Why Advertisers Choose Bycard for Virtual Cards

Why Advertisers Rely on Virtual Cards for Paid Ads

Across the advertising ecosystem, digital payments have become operational tools, not just payment alternatives.

Advertisers use digital payment to:

- Separate ad spend from core business funds

- Assign one card per platform, client, or campaign

- Control budgets without manual reconciliation

- Reduce risk if a card is flagged or compromised

Instead of exposing a primary bank card to repeated online charges, digital cards allow advertisers to isolate risk and manage spend more deliberately. This becomes especially important when platforms like Facebook and TikTok apply automated payment reviews.

Virtual Cards for Facebook Ads: How the Payment Flow Works

Facebook Ads runs on a postpaid billing system, which directly affects how digital payments behave.

How Facebook Ads Charges Virtual Cards

On Facebook Ads:

- Campaigns start running before payment is collected

- Spend accumulates until a billing threshold or billing date

- Facebook then charges the card automatically

This means Facebook interacts with your virtual card repeatedly over time. It expects the card to handle recurring authorizations without interruption.

Why Facebook Ads Prioritizes Virtual Card Stability

From advertiser experience and platform behavior, Facebook evaluates virtual cards based on consistency rather than first-time success.

Facebook looks for:

- Successful billing history

- Few or no failed charge attempts

- Minimal card changes

- Stable balances during billing cycles

If a Virtual Card fails multiple times, Facebook may pause ads, lower payment trust, or temporarily restrict the ad account. This is why frequent card rotation often causes more harm than good.

Providers like Bycard fit well into this model because advertisers can issue dedicated digital Cards per ad account, apply spending limits, and maintain predictable funding, all of which align with Facebook’s preference for stable payment methods.

Common Facebook Ads Issues with Virtual Cards

In practice, Facebook Ads payment issues with virtual cards often show up as:

- Ads pausing after overnight billing attempts

- “Payment failed” alerts without detailed reasons

- Spending limits being reduced

- Ad accounts requiring manual payment resolution

These problems usually aren’t caused by the card type itself, but by low balances or inconsistent usage patterns. Real-time transaction visibility, something platforms like Bycard provide, helps advertisers catch these issues before ads stop.

Virtual Cards for TikTok Ads: A Very Different Payment Flow

TikTok Ads approaches payments differently, which changes how digital cards are evaluated.

How TikTok Ads Uses Virtual Cards

Most TikTok Ads accounts operate on a prepaid balance system:

- Funds are added upfront

- Ads spend down from the available balance

- When the balance hits zero, ads stop immediately

Because TikTok interacts with Virtual Cards mainly during top-ups, it places heavy emphasis on initial acceptance.

Why TikTok Ads Is Stricter with Virtual Cards

Advertisers consistently report that TikTok Ads is:

- More sensitive to BIN reputation

- Stricter about matching card region with account region

- Faster to reject unfamiliar or inconsistent cards

If a Virtual Card fails during the first funding attempt, TikTok often won’t allow it to be reused on that account. This makes testing and backup cards essential.

Bycard’s instant card issuance and multi-currency support help advertisers test smaller top-ups first, reducing the risk of losing a card after one failed transaction.

BIN Trust and Region Matching: A Key Factor for Virtual Cards

One topic frequently discussed online, but often missing from surface-level guides, is BIN trust.

The BIN reveals:

- Issuing country

- Card type

- Issuing institution

For both Facebook Ads and TikTok Ads:

- BIN country should align with the ad account’s region

- Mismatches increase the chance of rejection or review

- Low-trust BINs are more likely to be flagged

This is where specialized digital Cards providers matter. Bycard positions its cards for global online payments and advertising use, which helps reduce friction tied to BIN reputation and regional mismatch.

Perfect Card for running ads!

Authentication and 3D Secure Differences

Another recurring issue with digital Cards, especially on TikTok Ads, is authentication.

Some cards:

- Don’t support 3D Secure

- Trigger delayed authorization responses

- Enter payment review after top-up

TikTok Ads appears less tolerant of these issues during balance funding. Facebook Ads, on the other hand, focuses more on whether recurring charges succeed over time.

This difference explains why a Virtual Card might work perfectly on Facebook Ads but fail on TikTok Ads.

Virtual Cards for Facebook Ads vs TikTok Ads: Key Differences

| Aspect | Facebook Ads | TikTok Ads |

| Billing Structure | Postpaid, recurring billing | Prepaid balance funding |

| Risk Sensitivity | Evaluates long-term reliability | Evaluates first transaction heavily |

| Card Changes | Frequent changes reduce trust | Changes are common but risky |

| Failure Impact | Ads stop after failed billing attempts | Ads stop instantly when balance runs out |

Understanding these differences helps advertisers choose how to deploy virtual cards effectively on each platform.

How Advertisers Use Virtual Cards Successfully on Facebook Ads

Based on real-world usage:

- One virtual card per ad account

- Buffer funds left for postpaid charges

- Minimal card replacements

- Monitoring billing thresholds closely

Facebook Ads rewards predictability. The longer a Virtual Card works without issues, the more reliable the account becomes.

How Advertisers Use Virtual Cards Successfully on TikTok Ads

For TikTok Ads, a different strategy works better:

- Start with small balance top-ups

- Test Virtual Cards before scaling

- Match currency and region carefully

- Keep backup cards ready

Here, speed and preparation matter more than long-term card history.

Where Bycard Fits into Virtual Card Use for Ads

Key Bycard features that matter for Virtual Cards include:

- Instant virtual card creation for fast setup

- Spending limits per card, ideal for campaign control

- Multi-currency support for global ad accounts

- Real-time transaction tracking for visibility

- Dedicated cards per platform or campaign

For Facebook Ads, this structure supports stable postpaid billing. For TikTok Ads, it enables safer testing and controlled top-ups.

Why Advertisers Choose Bycard for Virtual Cards

Advertisers managing multiple ad accounts often choose Bycard because it:

- Simplifies tracking ad spend across platforms

- Reduces exposure of primary bank accounts

- Supports high-frequency online transactions

- Aligns with how ad platforms evaluate payment methods

Rather than reacting to declined payments, advertisers can manage Virtual Cards proactively, which is exactly what Facebook and TikTok expect from reliable advertisers.

Conclusion

Virtual Cards are no longer optional in paid advertising. They’re part of the infrastructure that keeps campaigns running.

Facebook Ads and TikTok Ads apply different payment logic, different risk signals, and different expectations. Advertisers who understand these differences, and use the right Virtual Card setup experience fewer interruptions and more consistent delivery.

When paired with platforms like Bycard that are built for online ad payments, Virtual Card stop being a weak point and start becoming a competitive advantage.