Using Virtual Cards Like Bycard for Cross‑Border Spending Strategy

Cross-border payments are no longer limited to big corporations or frequent travelers. Freelancers, remote workers, online shoppers, startups, and even everyday consumers now make international payments regularly. However, foreign transactions often bring hidden challenges: high exchange rate markups, blocked payments, fraud risks, and limited acceptance of local cards.

That’s why virtual cards have become a strategic tool for individuals and businesses alike, especially when paired with a robust platform like Bycard. Bycard’s virtual card solution makes cross‑border payments easier, more controlled, and more secure, without the headaches that often come with traditional cards.

- Using Virtual Cards Like Bycard for Cross‑Border Spending Strategy

- How Virtual Cards Help in Cross‑Border Payments

- Bycard Virtual Cards Designed for Global Spending

- Virtual Cards and Cross‑Border Spending

- How to Use Bycard’s Virtual Cards for Cross‑Border Spending

- Choosing Bycard for Your Cross‑Border Spending Strategy

- The Challenges of Cross-Border Spending Without Virtual Cards

How Virtual Cards Help in Cross‑Border Payments

Cross‑border spending often comes with hidden foreign exchange fees, unexpected declines, and security concerns. Traditional physical cards may work, but they can attach high FX spreads or get blocked due to geographic restrictions. Virtual cards address many of these obstacles: real‑time issuance, spend limits, and enhanced global acceptance make them excellent solutions for managing international expenses efficiently and transparently.

Platforms like Bycard take this a step further by combining virtual card flexibility with purpose‑built features for global payments.

Bycard Virtual Cards Designed for Global Spending

Bycard is a digital payment platform that specializes in virtual card issuance, budgeting, and international expense management. Its virtual cards work across borders, support multiple currencies, and are accepted worldwide through major networks like Visa and Mastercard.

Here’s how Bycard brings value to users dealing with cross‑border spending:

Instant Virtual Card Issuance

With Bycard, you can get a virtual card in minutes with no lengthy application forms or waiting for physical cards. This ability to generate virtual cards on demand is particularly useful when you need fast access to foreign platforms or global subscriptions.

Global Currency and International Compatibility

Bycard virtual cards can be funded and spent in multiple currencies, so you avoid many of the usual problems with FX conversions that plague traditional bank cards. This makes international checkout smoother and more predictable.

Enhanced Security and Spend Control

Every virtual card from Bycard:

- Has a unique card number and CVV

- Can be limited in spending amount

- Can be locked or replaced instantly

That means even if card details are compromised, your core funds remain safe. It’s like having purpose‑built cards for every type of spending need without exposing primary accounts.

Tailored Solutions for Advertising and SMEs

One of Bycard’s standout features is dedicated virtual cards for media buying and advertising spend, covering platforms like Google, Facebook, TikTok, LinkedIn, Snapchat, and more. These cards help businesses track ad expenses and manage budgets per campaign, making virtual card payment integration simple and organized.

Bill Payments and Recurring Costs

Bycard also integrates bill payment functionality, meaning you can use virtual cards for recurring or one‑off bills across borders, everything from SaaS subscriptions to vendor invoices. This improves visibility and prevents missed payments due to currency issues or declines.

Virtual Cards and Cross‑Border Spending

Paying for SaaS and Global Tools

Software tools for CRM, marketing automation, cloud hosting, or team collaboration often bill in USD or EUR. Using a dedicated virtual card for each subscription, especially one from Bycard, makes reconciliation easier and isolates each vendor’s cost structure.

Ad Spend and Media Buying

Many businesses struggle to manage online campaign budgets across platforms. Bycard virtual cards allow teams to:

- Assign a unique card per campaign

- Set a spend limit

- Track expenses separately

This improves accountability, reduces overspend, and simplifies campaign accounting.

International E‑Commerce and Marketplaces

If you sell or buy across global marketplaces, having virtual cards reduces payment declines and gives you more control over transaction flows. Bycard’s multi‑currency support means you can handle payouts and purchases without frequent FX conversions.

Travel and Remote Work Expenses

When employees travel or work internationally, managing foreign spend with physical corporate cards can be unwieldy. By issuing virtual cards for travel expenses like flights, hotels, meals, and transport, finance teams can:

- Set strict travel budgets

- Monitor spend in local currencies

- Lock or decommission cards when travel ends

This keeps travel spend transparent and within approved limits.

How to Use Bycard’s Virtual Cards for Cross‑Border Spending

Using virtual cards from Bycard is straightforward:

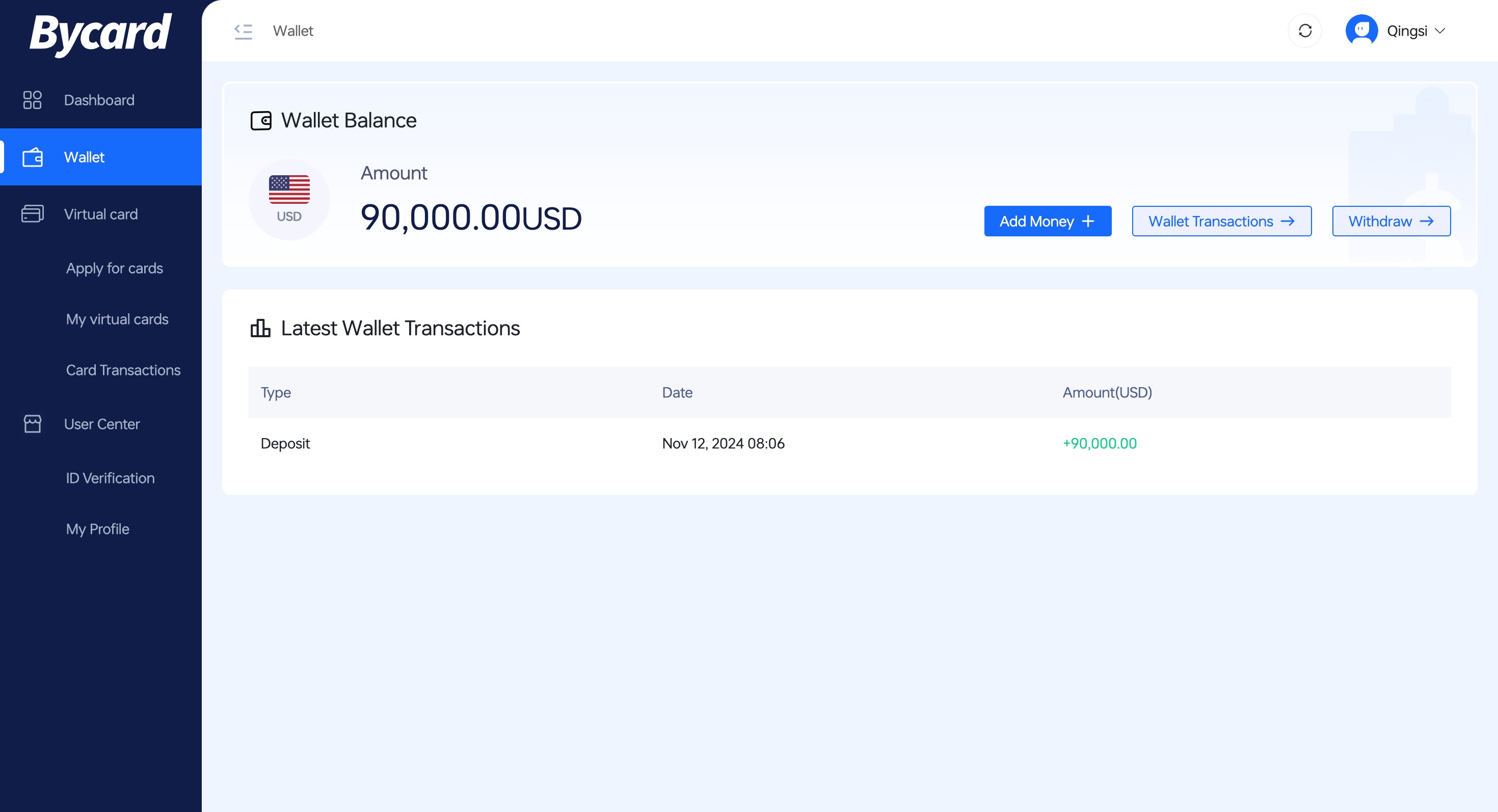

- Sign Up and Verify: Create an account and complete KYC verification.

- Fund Your Wallet: Add funds using supported methods including bank transfer or crypto like USDT.

- Generate a Virtual Card: Choose whether it’s single‑use, merchant‑specific, or multi‑use with limits.

- Use It Globally: Enter card details at checkout or link the card to platforms that accept international payments.

- Track and Manage: Monitor transactions in real time, freeze or cancel cards as needed, and automate reporting.

This workflow not only simplifies spending but also improves operational oversight across borders.

Choosing Bycard for Your Cross‑Border Spending Strategy

When evaluating solutions for global payments, consider:

- Speed: Instant virtual card creation eliminates delays.

- Security: Isolated virtual cards reduce risk exposure.

- Budget control: Spending limits and purpose‑built cards improve expense management.

- Global support: Multi‑currency capability and wide merchant acceptance make international transactions predictable and seamless.

Bycard ticks these boxes by merging virtual card technology with a full suite of finance tools tailored for both individual and business needs.

Perfect Card for International Payment!

The Challenges of Cross-Border Spending Without Virtual Cards

International transactions can fail or cost more than expected. Common issues include:

- Card declines due to country restrictions

- Hidden foreign exchange fees or poor FX rates

- Unclear billing descriptors

- Increased risk of fraud

Traditional debit or credit cards, especially those issued locally, often struggle with international acceptance. Virtual cards solve this by acting as globally recognized payment instruments linked to major card networks.

Conclusion

Global commerce is growing faster than ever. Whether you’re managing ad spend, paying SaaS vendors, handling travel costs, or buying overseas, cross‑border spending doesn’t have to be complicated or risky.

Using virtual cards, especially with a purpose‑built platform like Bycard, gives you the power to issue, control, and track international transactions with transparency and confidence. With quick issuance, multi‑currency support, and dedicated features for budgeting and business use cases, Bycard provides a complete toolkit to make cross‑border spending more efficient and smarter for modern finances.