Latest News and Updates on Chase Cards

Chase Cards continue to dominate conversations around rewards credit cards, travel benefits, and long-term value. From refreshed premium products to changes in bonus rules and point redemptions, the Cards ecosystem has seen meaningful updates that affect both new applicants and existing cardholders.

With digital payments evolving rapidly, alternative solutions like virtual cards are also gaining traction, including offerings from platforms like Bycard. This piece covers the latest news and updates on Chase Cards, while showing how modern payment innovations fit into the broader landscape.

- Latest News and Updates on Chase Cards

- Why Chase Cards Still Lead the Market

- Chase Cards Current Offers You Should See

- Changes to Points Redemption

- Chase Cards Welcome Bonus Rule Changes

- Quarterly Bonus Category Trends

- Approval Rules and Application Trends

- What’s Actually Improved for Travel

- Chase Cards Fees, APRs, and Cost Considerations

- Chase Cards Compared: Which Ones Are Gaining Value?

- Chase Cards and the Trifecta Strategy

Why Chase Cards Still Lead the Market

Chase Cards remain competitive because they balance rewards, flexibility, and brand stability. While many issuers experiment with short-term incentives, long-term focus on usability.

Key reasons Chase Card still matter:

- A unified Ultimate Rewards ecosystem

- Strong travel and cash-back crossover

- Consistent updates rather than sudden overhauls

Meanwhile, solutions like virtual cards, including those offered by Bycard, are reshaping how people and businesses handle global payments, ad spend, and budgeting in real time. Unlike traditional credit cards, virtual card platforms take fintech beyond traditional interest and rewards into practical spend control and security features that cater to modern workflows.

Recent updates show Chase Cards leaning into practical benefits, tighter eligibility rules, and clearer positioning for different user types.

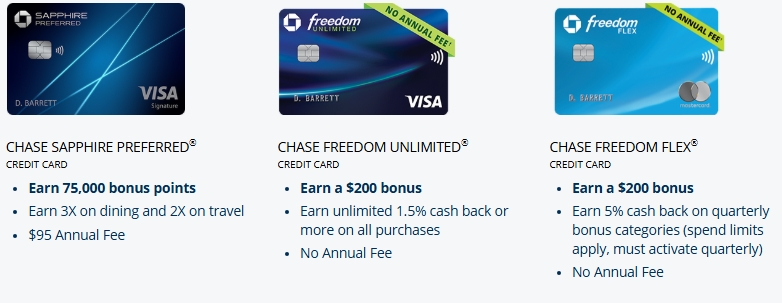

Chase Cards Current Offers You Should See

Here are some key Chase Cards available right now and their most recent offers:

Chase Sapphire Reserve

- Annual fee: $795 (updated June 23, 2025)

- Bonus: Up to 100,000–125,000 points on eligible spending (varies by promotion)

- Earning: 8× points on travel through Chase Travel, 4× on direct airline/hotel bookings, 3× dining, 1× other purchases

- Key travel perks: Priority Pass lounge access, annual travel credits, hotel and lifestyle statement credits

Chase Sapphire Preferred

- Annual fee: $95

- Bonus: Historically up to 100,000+ Ultimate Rewards points after meeting spend requirements (based on offer availability)

- Strong travel and dining rewards.

Chase Freedom Unlimited

- Annual fee: $0

- Bonus: $200 after spending $500 in the first 3 months

- Rewards: 5% cash back on travel booked through Chase Travel, 3% on dining and drugstore purchases, and 1.5% on all other purchases.

Other Chase Cards:

- Freedom Rise: 1.5% cash back, no annual fee

- Co-branded reward cards like the IHG One Rewards and Marriott Bonvoy cards with sizable bonus offers and travel perks featured on Chase’s newest offers page.

These offers change regularly, so checking Chase’s official site before applying is always recommended.

Changes to Points Redemption

One of the most impactful shifts among Chase Cards is how Ultimate Rewards points are redeemed through the Chase Travel portal.

Current changes include:

- The Points Boost program, where certain travel bookings can earn up to 2× points value on premium hotels and flights

- For points earned prior to October 26, 2025, some redemptions can still qualify for a 1.5× travel redemption through the portal until October 2027

- Redemptions after that date are subject to Point Boost terms, which may vary by travel partner and booking type.

This makes redemption strategy more important, maximizing value requires understanding which bookings qualify for boosted value.

Chase Cards Welcome Bonus Rule Changes

Welcome bonuses remain a strong driver of applications, but eligibility rules have quietly evolved.

Recent Cards bonus updates include:

- More specific “once per card” bonus language

- Longer waiting periods between bonuses

- Stricter enforcement of existing policies

These changes reduce short-term churn and reward users who plan applications strategically.

Quarterly Bonus Category Trends

Rotating bonus categories remain a strong feature for many Chase Cards, especially within the Freedom family.

Current trends include:

- Dining frequently appears as a 5% bonus category

- Seasonal travel and partner categories often included

- Bonus caps and activation deadlines are typically announced quarterly

For users with predictable spending patterns, these rotating bonuses can significantly increase overall value.

Approval Rules and Application Trends

Approval rules continue to shape how people approach Chase Cards. While Chase hasn’t officially announced major policy shifts, application data and user reports suggest tighter enforcement.

Current trends include:

- Continued application of the 5/24 rule

- Higher standards for premium Card

- Increased focus on income and relationship history

What’s Actually Improved for Travel

The Chase Sapphire Reserve overhaul stands out among recent Chase Card updates.

Key changes to the Chase Sapphire Reserve

Earn rates after June 23, 2025:

- 8× points on all Chase Travel purchases through the portal

- 4× points on flights and hotels booked directly

- 3× points on dining globally

- 1× point on other purchases

New and expanded credits:

- $300 annual travel credit

- $500 annual hotel credit through The Edit (split as $250 twice per year)

- Credits for StubHub and Viagogo tickets up to $300 annually

- Dining credits tied to Exclusive Tables experiences

- Subscriptions such as Apple TV+ and Apple Music credits and other lifestyle credits (e.g., Peloton, Lyft offers)

These changes are designed to offset the $795 annual fee and provide members with close to $2,500+ in potential value per year when credits are fully utilized.

Perfect Card for running ads!

Chase Cards Fees, APRs, and Cost Considerations

Fees on Chase Card varies widely:

- Premium products like the Sapphire Reserve have higher fees (now $795) but also more credits

- Mid-tier cards like Sapphire Preferred hold lower fees ($95) with solid rewards

- No-fee options like Freedom Unlimited and Freedom Rise deliver cash back without annual costs

APR and balance transfer offers change frequently; always check current Chase terms before applying. Cash back and point earnings assume full utilization of bonuses and credits.

Chase Cards Compared: Which Ones Are Gaining Value?

Some Chase Cards stand out more now than others:

High potential value:

- Chase Sapphire Reserve: Strong travel credits and premium perks

- Chase Sapphire Preferred: Balanced travel rewards and lower annual fee

- Chase Freedom Unlimited: Solid everyday cash back

Situational value:

- Co-branded hotel cards with high bonus offers and travel partnerships

- Cards with boosted quarterly categories (e.g., Freedom Flex)

Comparison based on your lifestyle and spending habits will determine which Chase Card delivers the most value.

Chase Cards and the Trifecta Strategy

The Chase Trifecta continues to be a popular strategy for maximizing Ultimate Rewards points using:

- A premium travel card (e.g., Sapphire Reserve)

- A rewards booster (e.g., Freedom Unlimited)

- A bonus category card (e.g., Freedom Flex)

Pooling points across these Chase Cards enhances redemption flexibility and overall value.

Conclusion

Chase Cards continue to evolve in ways that reward strategic planning and real spend behavior, not just sign-up bonuses. The refreshed Chase Sapphire Reserve, with its $795 annual fee and expanded benefits, represents one of the biggest changes in the Chase Cards lineup and reflects a broader shift toward bundled credits and travel perks.

For users focused on travel and structured rewards, Chase Card remains a compelling choice, but understanding current offers, fees, and credits is key to making the most out of them.