How to Get a Credit Card With Smooth Virtual Options

Getting a credit card can feel like a big financial step, one that opens doors to convenience, flexibility, and global payments. But the process can also be intimidating, especially with terms like credit score, interest rates, and annual fees floating around. For many people, figuring out how to get a credit card means navigating a lot of fine print just to make everyday payments easier.

That’s why digital alternatives like Bycard are becoming so popular. While traditional credit cards give you access to borrowed funds, virtual credit cards like Bycard let you enjoy the same convenience, but with your own money. You’re not dealing with credit limits or interest charges; instead, you’re using a prepaid card designed for safe, seamless online transactions.

Why Understanding How to Get a Credit Card Still Matters

Even if you plan to use a virtual credit card, it’s helpful to understand how traditional credit cards work. Knowing how to get a credit card, what lenders check, and what makes a “good” credit profile helps you make smarter choices overall.

According to a 2024 Experian report, the average U.S. credit card balance is around $6,365. For many, that debt comes from not fully understanding how credit cards function. That’s why more users are now shifting to virtual credit cards, they offer similar benefits without the risk of borrowing.

How to Get a Credit Card vs. How Virtual Credit Cards Work

Here’s a quick look at the difference between traditional credit cards and virtual credit cards like Bycard:

| Feature | Traditional Credit Card | Virtual Credit Card (Bycard) |

| Funding Source | Borrowed from bank (credit line) | Preloaded with your own money |

| Credit Check Required | Yes | No |

| Interest or Late Fees | Yes | None |

| Approval Time | Can take days | Instant setup |

| Security | Physical card with risk of loss | Fully digital, secure, and disposable |

| Best For | Building long-term credit | Everyday payments, subscriptions, and online shopping |

So, if your goal is convenience, security, and spending control, not debt, Bycard offers everything you need without the complications of a traditional credit system.

How Bycard Works

Here’s how to get started with Bycard if you want a secure, digital way to manage your spending and build good financial habits:

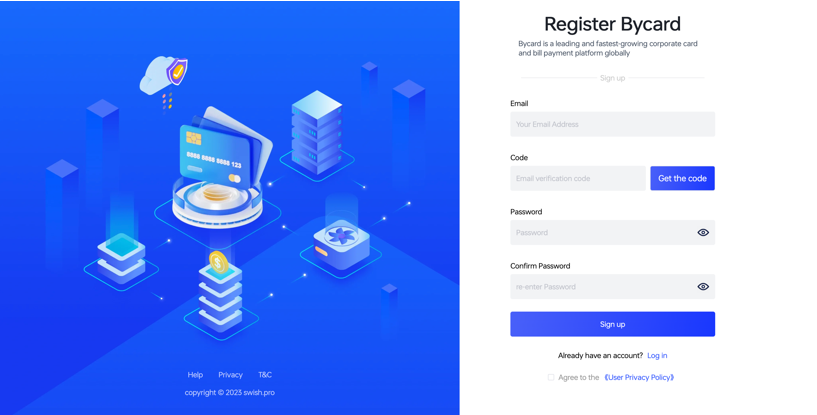

Step 1: Sign Up or Log In

Use the Bycard login or registration screen. Enter your email, set a password, and verify your account via the email code.

Step 2: Complete ID Verification (KYC)

Once logged in, go to the User Center → ID Verification to complete your KYC. This step ensures your account is fully authorized for transactions.

Step 3: Apply for Virtual Cards

Navigate to “Apply for Cards” or “My Virtual Cards” to create a new virtual card. Each card comes with its own security code, transaction limit, and spending controls.

Step 4: Use Your Virtual Card for Transactions

Enter your card details and security code when shopping online or linking it to payment apps. You can lock or unlock your card anytime, set budgets, or delete it instantly if you notice suspicious activity.

Step 5: Monitor and Manage Cards

Track transactions in real time via your dashboard. Set spending alerts, manage multiple cards for different purposes, and export reports for budgeting or accounting.

Why Virtual Credit Cards Are the Modern Answer

Essentially, it gives you credit-card-level convenience with debit-level control. While learning how to get a credit card is useful, many people now realize they don’t need one to enjoy the same benefits. With Bycard, you can:

- Pay securely across global merchants.

- Avoid debt and interest charges entirely.

- Keep your primary bank details private.

- Instantly create or delete cards for subscriptions or online stores.

- Manage all transactions in one simple dashboard.

Common Mistakes to Avoid When Using Any Card

Whether it’s a credit card or a virtual one, responsible management is key:

- Don’t overspend just because it’s easy.

- Avoid using one card for every single expense, separate them by purpose.

- Always review transactions and set alerts.

- Use secure sites for online shopping.

Small habits like these help you protect your funds and improve your overall financial awareness.

Conclusion

Learning how to get a credit card is valuable, but understanding modern alternatives is even more important. Virtual credit cards like Bycard give you control, privacy, and convenience, all without the pressure of managing debt or worrying about approval.

If you want a secure way to pay online, track expenses, and keep your finances simple, Bycard offers everything you need in a few clicks. It’s not just a card, it’s a modern way to manage your money..