Brex Card Review: Global Use & International Capabilities

The Brex Card is reshaping how modern businesses manage spending, especially those operating across borders or scaling quickly. Designed with startups, e-commerce brands, and tech companies in mind, it combines instant access to credit with smart financial tools and perks that support growth on a global scale.

With features like flexible credit limits, multicurrency support, and deep accounting integrations, Brex is more than just a corporate card, it’s a financial operating system built to keep up with today’s ambitious companies. But how well does it fit into your own business operations?

- Brex Card Review: Global Use & International Capabilities

- What Makes the Brex Business Credit Card Different?

- How Brex Adapts Its Card to Different Business Models

- Why the Brex Business Card Fits Modern Companies

- How the Brex Credit Card Performs Internationally

- Brex Business Card Eligibility: Who Qualifies?

- Other Uses for Brex Card Beyond Credit Lines

- Brex Card vs Bycard: What’s the Difference?

- Brex Card: The Key Metrics and Advantages

What Makes the Brex Business Credit Card Different?

The Brex Business Credit Card isn’t your typical corporate card. It’s built for fast-growing companies that don’t have time for generic expense systems. The Brex Business Credit Card works as a charge card with flexible repayment options, real-time expense tracking, and rewards tailored for startups, online businesses, and enterprises. Every swipe of a Brex Business Credit Card triggers automated receipt logging, team-level spending controls, and instant visibility for CFOs and founders.

Where traditional cards rely on personal credit, the Brex Business Credit Card skips that entirely. Instead, it evaluates your business revenue, cash balance, and financial activity. This approach makes the Brex Business Credit Card more accessible to VC-backed startups and new businesses, removing that dreaded personal guarantee.

If staying lean and efficient is your goal, then the Brex Business Credit Card is built to streamline your expense flow without bogging your team down.

How Brex Adapts Its Card to Different Business Models

The Brex Card isn’t split into multiple versions, instead, the same card adapts to your business model using custom limits, spending rules, and program-level configurations. Startups, e-commerce brands, and global teams all use the same Brex Card, but the way it functions looks different depending on the structure of your company.

Startup Configuration

Startup teams often use the Brex Card for runway management, SaaS payments, and scalable credit access without personal guarantees. Credit limits adjust as the company’s cash balance grows, and virtual cards help segment vendor spend.

E-commerce Configuration

Brands running DTC or marketplace storefronts use the Brex Card for inventory payments, advertising, shipping, and recurring tools like Shopify or Klaviyo. Flexible repayment terms help smooth out revenue cycles.

Enterprise & Global Teams Configuration

Larger teams use the Brex Card with multi-entity support, global reconciliation, and custom approval workflows. Virtual cards can be assigned per vendor, per employee, or per region, helping the finance team control spend at scale.

Why the Brex Business Card Fits Modern Companies

The Brex Card is built as an operational tool, not just a payment card. It combines spending controls, automated reconciliation, and instant virtual cards inside one system that scales with your company.

Unlimited Virtual Cards

Create vendor-specific or project-specific cards instantly. Freeze, replace, or limit them without touching your physical card.

Credit Limits Based on Business Performance

Spending power adjusts using your cash balance, deposits, and revenue, not your personal score.

Budget-Attached Cards

Cards can be tied to department budgets, enabling automated control at the source of spend.

Real-Time Bookkeeping

Brex automatically matches receipts, categorizes transactions, and syncs everything into accounting software.

Fraud and Policy Controls

Dynamic spend rules reduce expense misuse, while real-time alerts keep every transaction transparent.

How the Brex Credit Card Performs Internationally

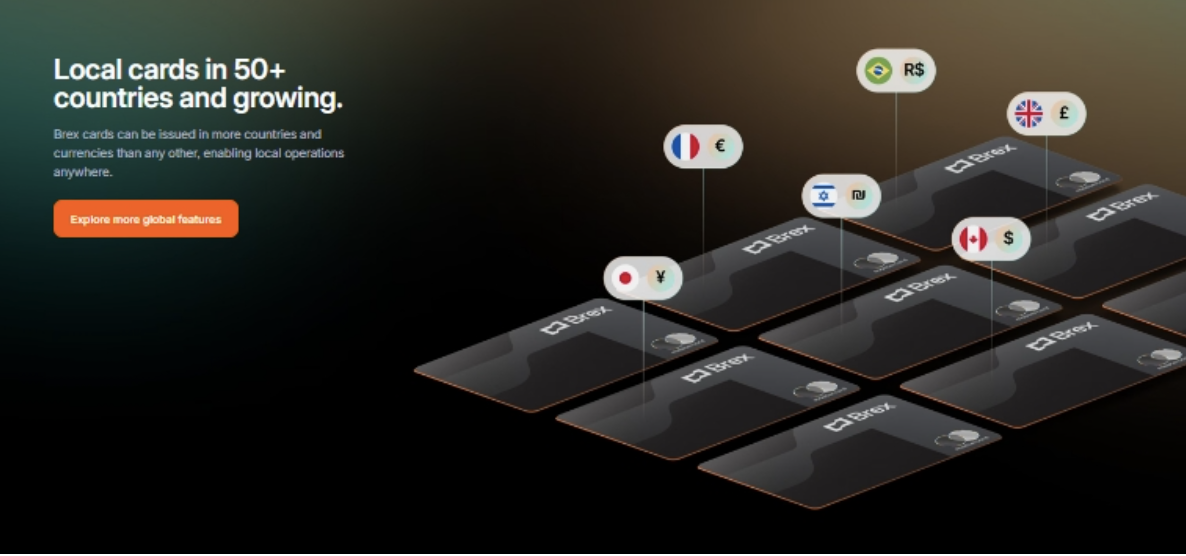

Wondering if the brex business card works just as well worldwide? The answer is yes. One huge advantage of paying with a brex business card overseas is the lack of foreign transaction fees. If you’re paying contractors in Mexico, booking hotels in Europe, or issuing cards to team members in Singapore, the brex business card supports international payments with ease.

Using a brex business card also means you’ll access global support, multicurrency billing, and international wire transfers. And because the brex credit card uses modern APIs and automated reconciliation, your finance team won’t need to spend hours doing manual conversion tracking.

Brex Business Card Eligibility: Who Qualifies?

Not all businesses qualify for a Brex Card, but there are clear criteria. Here’s what you’ll generally need to access the brex business card:

- A U.S.-registered company or entity

- Verified EIN and connected business bank accounts

- Minimum balance thresholds (typically at least $50,000 for startups, and $1M for enterprises with capital)

- Revenue visibility (especially for those using the brex credit card as revolving spend card)

Brex’s support team will work with you based on your business type, whether you’re using the brex credit card as a VC-backed founder or a scaling e-commerce merchant.

Other Uses for Brex Card Beyond Credit Lines

The Brex Card isn’t just for accessing credit. You can use the Brex Card as an operational tool, a hub for your spending ecosystem.

With a Brex Card, you can:

- Manage payroll and HR vendor payments where international transfers are needed

- Issue individual team cards for travel, software licenses, or department budgets

- Separate budgets across departments using the Brex Card dashboard to track and control spending

- Use Brex as a spending wallet if you don’t need traditional loans, just card-based funding with quick repayment cycles

This flexibility is particularly powerful for startups that want to stay agile.

Brex Card vs Bycard: What’s the Difference?

Choosing between the Brex Card and Bycard often boils down to how your business spends money. Both options help you manage expenses and issue cards across your team, but they function in different lanes. The Brex Business Credit Card was built with scaling companies in mind, teams that need corporate-level controls, global spending, and deep accounting compatibility. On the other hand, Bycard makes its mark with fast, flexible virtual cards made for digital ad spending and campaign-level budget control.

Here’s how they compare across key features:

| Feature / Capability | Brex Business Credit Card | Bycard |

| Ideal for | VC-backed startups, e-commerce brands, tech and global companies | Media buyers, freelancers, small digital-first businesses |

| Card Type | Corporate/charge-style business credit card | Virtual credit cards (VCCs), available instantly with 30+ BINs (Visa/Mastercard) |

| Approval | Based on business financials (no personal guarantee needed) | May require personal credit check; supports crypto-funding (USDT) |

| Global Spending | Strong international capabilities, no foreign transaction fees | Supports global spend; includes multi-currency wallets and crypto top-up options |

| Rewards | Tailored rewards on ads, SaaS, travel, and recurring business spend | Standard cashback; optimized for platform-specific ad budget management |

| Accounting & Integrations | Deep accounting and ERP integrations (QuickBooks, Netsuite, Xero), payroll support | Basic expense reporting and reconciliation; more focused on ad-spend splits and niche integrations |

| Unique Edge | Offers corporate credit, CFO-level controls, multi-entity dashboard, and scalable credit limits | Instant VCC issuance for ad campaigns, dedicated Facebook/TikTok VCCs, media-buying workflows, crypto funding |

| Best Use Case | Expense visibility, corporate spend control, international growth | Social media ad buying, fast virtual card access, multi-account VCC for campaigns |

Brex Card: The Key Metrics and Advantages

- Cost: The Brex Card has no annual fee

- Rewards Rate: Earn up to 8x points (depending on category) with a Brex Card

- Cash Back: Redeem card points for travel, crypto, or cash deposits

- Global Acceptance: The Brex Card works in over 200 countries

The Brex Card isn’t just another corporate card, it’s an access point to an ecosystem of smart spending tools and travel flexibility.

Conclusion

The Brex Card is built to make your financial life easier. You get spending power without personal guarantees, real-time tracking for every transaction, and rewards that actually support business growth, from cloud tools to advertising.

That said, not every business needs that level of infrastructure. If you’re a solo operator, media buyer, or running campaigns on platforms like Facebook and TikTok, the Brex Business Credit Card may feel like more firepower than you need. That’s where a platform like Bycard makes sense, especially if you want instant virtual cards, crypto top-ups, and budget control designed specifically for ad spend