Managing Recurring Costs with Payments & Subscription Tools

Payments & subscription management is becoming essential as recurring charges appear everywhere, from SaaS licenses and marketing tools to streaming services and ongoing ad platforms. For businesses and individual consumers alike, the problem is the same: keeping those recurring outflows under control without blocking the services you need. A practical, low-friction way to get control is to pair virtual cards and modern expense tools with a clear approach to payments & subscription management.

- Managing Recurring Costs with Payments & Subscription Tools

- Why recurring payments & subscription get messy

- Using Virtual Cards for Payments & Subscription Control

- Map every subscription to an owner and a purpose

- Practical Payments & Subscription Rules to Adopt Today

- The compliance and security layer

- How marketing and media teams can treat ad spend like a subscription

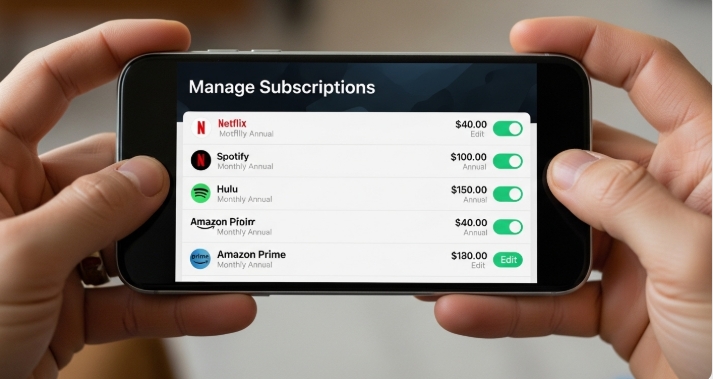

- Consumers: Regaining Control of Payments & Subscription

- Measuring success: what to track

Why recurring payments & subscription get messy

Two reasons subscriptions spiral out of control: visibility and control. Visibility fails when different teams or family members sign up with personal cards, or when billing emails go to one inbox and accounting sits in another. Control fails when cards are shared widely and there’s no way to limit spend or cancel quickly.

By removing the friction between provisioning payments and tracking expenses, many companies reduce unauthorized or duplicate subscriptions by 20–40%, simply because it becomes easier to see and act on each recurring line item.

Using Virtual Cards for Payments & Subscription Control

Virtual cards let you issue a dedicated card number for a single vendor or subscription. That means:

- You can set a single monthly limit (so a runaway bill can’t exceed the cap).

- You can cancel or rotate the card instantly if the vendor is compromised.

- You get a separate ledger entry for each subscription, which makes reconciliation simpler.

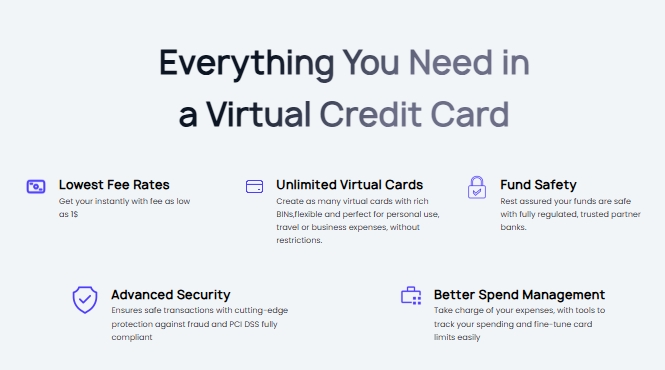

Bycard offers instant virtual cards, fast activation (cards in minutes), and per-card controls that map directly to ad platforms and other services, useful for splitting ad accounts or vendor subscriptions without sharing a master corporate card. These features reduce reconciliation time and help track who’s paying what.

Perfect Card for managing subscriptions!

Map every subscription to an owner and a purpose

Every recurring cost should have an owner and a clear purpose. Create a simple subscription register that includes:

- Owner or requester (who initiated the payment)

- Purpose (e.g., “CRM – HubSpot, Marketing automation”)

- Renewal date and billing cycle

- Card used and spending cap

When integrated with a payment’s platform, this setup can automatically pull invoices and receipts, linking each to its subscription. Bycard’s receipt management tools, for example, sync charges, receipts, and notes in one dashboard, helping small teams reconcile faster and avoid double billing.

Practical Payments & Subscription Rules to Adopt Today

- Issue one virtual card per subscription or vendor. Label it clearly.

- Set hard monthly limits and expiration dates aligned to contract terms.

- Route all vendor invoices to a shared accounting inbox and connect them to the card.

- Review recurring charges quarterly and cancel anything unused for 30+ days.

These rules are simple to adopt and massively reduce manual reconciliation. When you pair them with a virtual-card provider that supports multi-currency spend and easy top-ups (important for international tools and ad platforms), the administrative overhead drops further. Bycard supports global acceptance and multi-currency use, so teams running global campaigns or paying international vendors don’t have hidden conversion surprises.

The compliance and security layer

When managing recurring payments in the U.S., compliance and data protection are crucial. Businesses handling recurring payments & subscription data must follow PCI DSS (Payment Card Industry Data Security Standard) to protect customer card information.

Virtual cards make PCI compliance easier by isolating card data per vendor. If one merchant’s database is breached, other subscriptions remain unaffected. This limits financial exposure and simplifies auditing.

Security-wise, virtual cards offer benefits like:

- Tokenization: Replaces sensitive card numbers with encrypted tokens.

- Spending limits and expiration: Reduces the chance of overbilling.

- Instant deactivation: Protects against unauthorized charges or stored card misuse.

How marketing and media teams can treat ad spend like a subscription

Media buyers run many running campaigns and often create multiple ad accounts. Treat each major campaign or platform subscription as a discrete recurring cost and assign a card. For example:

- Facebook Ads — card #FB-Q4

- Google Ads — card #G-SEO-2025

- TikTok Boosts — card #TT-STORE

By issuing platform-specific virtual cards you avoid the “one-card-stops-everything” failure mode. Bycard has tailored solutions for major ad platforms (Facebook, Google, TikTok, Bing, etc.) so teams can provision cards that match the platform and reconcile ad invoices quickly. This is particularly useful where campaigns scale faster than finance can react, a common leak point for ad budgets.

Consumers: Regaining Control of Payments & Subscription

If you’re managing personal subscriptions, adopt the same discipline at a smaller scale:

- Use one virtual card for entertainment subscriptions and another for productivity tools.

- Check your statements monthly for duplicate charges (trial renewals that slipped).

- Use the card’s lock/unlock feature if a subscription feels suspicious.

Virtual cards offer an easy way to trial services without exposing your main account number. If you want to stop a renewal, you can rotate or cancel the virtual number rather than asking the vendor for a refund.

Measuring success: what to track

Smaller teams that adopt per-subscription cards and integrated receipt management often reduce reconciliation time by half and reduce unwanted recurring spend by a measurable amount within two reporting cycles.

Track these KPIs monthly:

- Number of active subscriptions (trend downwards after cleanup).

- Spend per subscription (identify outliers).

- Time to reconcile (should fall when card-level tagging is in place).

- Number of cancelled/duplicate subscriptions discovered.

Conclusion

Payments & subscription headaches are organizational problems disguised as payment issues. Fixing them requires a small set of process changes plus tools that enforce those processes, instant virtual cards, budget controls, bill pay, receipt management, and simple reconciliation.

Providers that bundle these features let businesses and consumers treat recurring spend with clarity and confidence. Bycard’s suite of virtual cards, budget management, and reconciliation tools is built for that linked workflow, provisioning, tracking, and closing the loop between spend and accounting in one place.