Managing Global Affiliate Payments with Virtual Cards in Global Affiliate Services

Running Global Affiliate Services today is more complex than ever. Partners are scattered across continents, payout expectations are faster, and brands need systems that can scale without mistakes. A major challenge many teams face is managing global affiliate payments efficiently, securely, and transparently.

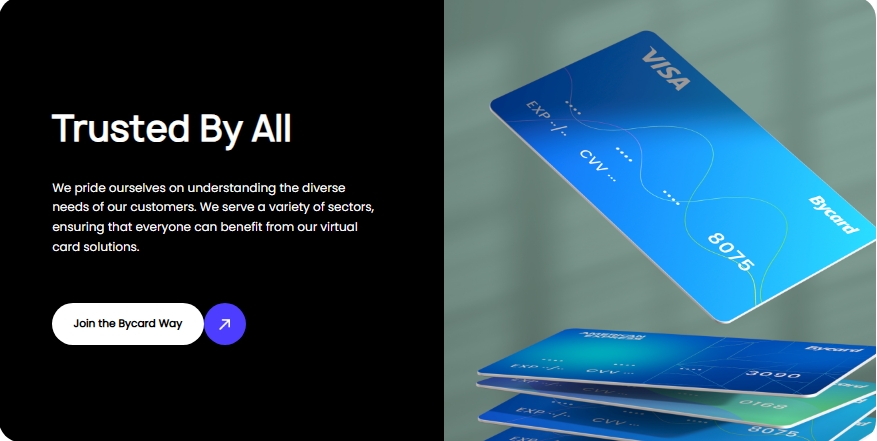

This is where virtual cards come in. Platforms like Bycard provide a flexible, trackable, and cost-effective way to handle payouts for Global Affiliate Services, giving teams visibility, control, and confidence in their financial workflows.

- Managing Global Affiliate Payments with Virtual Cards in Global Affiliate Services

- Challenges in Global Affiliate Payments

- Benefits of Virtual Cards in Global Affiliate Services

- Bycard: A Virtual Card Solution for Global Affiliate Payments

- Why Virtual Cards Fit Affiliate Workflows

- Integrating Virtual Cards into Your Workflow

- Affiliate Satisfaction and Retention

- Compliance and Security Considerations

- Comparing Virtual Cards to Traditional Payout Methods

Challenges in Global Affiliate Payments

For most Global Affiliate Services, cross-border payouts involve delayed transactions, currency conversion fees, manual approvals, and compliance hurdles. These delays can frustrate affiliates, hurt retention, and complicate financial reporting.

Virtual cards simplify these processes by providing instant, traceable, and secure payment credentials, reducing delays and making global affiliate payments smoother and more reliable.

Benefits of Virtual Cards in Global Affiliate Services

1. Faster Payouts

Virtual cards allow affiliates to access funds immediately, eliminating long bank transfer waits. Faster payouts improve trust and loyalty, which is crucial for Global Affiliate Services operating across multiple regions.

2. Tracking and Transparency

Every global affiliate payment made with a virtual card leaves a digital trail. Real-time tracking simplifies reconciliation, reduces errors, and ensures finance teams have clear insights into spending patterns.

3. Cost Control

Cross-border transactions often incur hidden fees. With virtual cards, teams can set spending limits, automate payouts, and reduce unnecessary costs, keeping global affiliate payments predictable and efficient.

4. Enhanced Security

Fraud risk rises with international transactions. Virtual cards can be single-use, merchant-specific, or time-limited, reducing exposure while maintaining seamless operations for Global Affiliate Services.

Bycard: A Virtual Card Solution for Global Affiliate Payments

Bycard is designed to address common pain points in Global Affiliate Services, offering features that streamline global affiliate payments:

- Instant Virtual Card Issuance: Generate cards in minutes for affiliates, campaigns, or projects.

- Global Acceptance & Multi-Currency Flexibility: Support affiliates in the US, Europe, and Asia, minimizing currency conversion challenges.

- Spend Control & Budget Management: Set limits, lock/unlock cards instantly, and monitor budgets in real time.

- Receipt Management & Reconciliation Tools: Simplify auditing with built-in reporting features.

- Flexible Top-Ups: Fund cards via traditional wire transfers or crypto payment, ensuring smooth operations worldwide.

Why Virtual Cards Fit Affiliate Workflows

Virtual cards are particularly suited for Global Affiliate Services because they integrate into existing workflows:

- Segmented Spending: Assign dedicated cards per affiliate or campaign to isolate budgets and simplify reporting.

- Real-Time Monitoring: Track transactions instantly on dashboards for accurate oversight.

- Enhanced Security: Reduce fraud risk and exposure by disabling compromised cards without affecting the main wallet.

By incorporating virtual cards from platforms like Bycard, teams can reduce manual work, streamline approvals, and maintain transparency across global affiliate payments.

Integrating Virtual Cards into Your Workflow

Teams can maximize value from virtual cards by:

- Assigning cards per platform (Facebook, Google, TikTok, LinkedIn, etc.) for campaign-specific spending.

- Linking card transactions to accounting tools or ERP systems for seamless reconciliation.

- Automating reporting and receipt management to reduce time spent on paperwork.

Practical steps like these, combined with Bycard’s features, make global affiliate payments predictable, efficient, and less prone to error.

Perfect Card for running ads!

Affiliate Satisfaction and Retention

Data shows affiliates value speed and reliability. Teams using virtual cards for global affiliate payments report:

- Higher partner satisfaction scores

- Improved engagement in campaigns

- Increased likelihood of long-term collaboration

For Global Affiliate Services, paying affiliates quickly and transparently translates directly into stronger relationships and consistent performance.

Compliance and Security Considerations

When managing global affiliate payments, Global Affiliate Services must remain compliant:

- Tax reporting and documentation

- PCI compliance for digital transactions

- Fraud monitoring and encryption

Virtual cards make compliance easier by providing a clear audit trail and reducing exposure to unauthorized use, without adding administrative burden.

Comparing Virtual Cards to Traditional Payout Methods

While traditional bank transfers and e-wallets are still common, they have limitations:

| Method | Speed | Transparency | Fees | Flexibility |

| Bank Transfer | Slow | Low | High | Medium |

| E-Wallet | Medium | Medium | Medium | Medium |

| Virtual Cards | Instant | High | Low | High |

For Global Affiliate Services, virtual cards strike the right balance between speed, control, and cost-efficiency for global affiliate payments.

Conclusion

Managing global affiliate payments doesn’t have to be slow or opaque. By embedding virtual cards into your payout strategy, especially with a platform like Bycard, you can issue payouts rapidly, gain clear visibility into spending, maintain tighter budgeting and control, and streamline reporting and reconciliation. These capabilities make Global Affiliate Services more efficient, transparent, and scalable from day one, even if your affiliates are spread across continents or just down the road.