3 Brex Alternatives for Spend Management and Payments

Running a business today means managing more than just money, it’s about controlling how your team spends, tracking expenses in real time, and ensuring every digital payments aligns with policy.

Brex has become one of the leading tools for modern companies that want smarter ways to manage business expenses, digital payments, and corporate cards under one roof.

But as more companies go global and use multiple tools, it’s worth exploring how Brex stacks up, and what alternatives might serve your specific needs better.

What Is Brex? A Quick Product Overview

Brex is an all-in-one financial platform built to simplify company spending, automate expense tracking, and streamline payments across teams, departments, and regions.

Originally known for its sleek corporate cards, Brex has evolved into a full-scale spend management solution used by startups, mid-sized companies, and even global enterprises.

Here’s what sets Brex apart:

1. Corporate Cards Designed for Control

Brex offers both physical and virtual corporate cards that can be issued instantly to employees or vendors.

Finance teams can set spend limits, merchant categories, and expiration dates per card.

Virtual cards make it easy to manage vendor-specific spend or subscription payments securely, reducing fraud risk and manual oversight.

2. Real-Time Expense Tracking

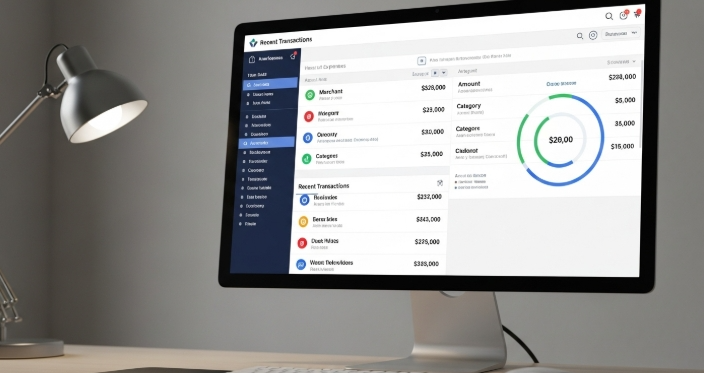

Every Brex transaction automatically appears in the dashboard, where expenses can be categorized, reviewed, and synced with accounting systems like NetSuite, QuickBooks, or Xero.

This level of automation saves hours in reconciliation and gives management clear visibility into who’s spending what.

3. Integrated Digital Payments

Brex supports ACH transfers, bill payments, and reimbursements, connecting business accounts directly with payees.

It’s not just a card platform, it lets you pay vendors, contractors, or partners from one interface, ensuring every digital payment ties back to your budget categories.

4. Automated Spend Management

The platform’s spend management tools allow finance leads to define policies, automate approvals, and generate detailed spending reports.

Dashboards show live insights into department-level budgets, enabling better forecasting and cost control.

5. Multi-Entity and Global Support

Brex supports companies operating in multiple countries, letting them manage global teams, currencies, and entities from one platform.

This makes it a solid choice for scaling startups or enterprises with distributed teams.

6. Rewards and Integrations

Cardholders earn points on business purchases, and the platform integrates with popular tools, Slack, Gusto, Rippling, and accounting platforms, helping teams manage finances where they already work.

When Brex Is the Right Fit

Brex works best for businesses that:

- Need corporate cards with spend control and approval flows.

- Want expense tracking and digital payments centralized in one place.

- Operate globally or have teams across multiple entities.

- Prefer automation over manual bookkeeping.

However, if your priorities lean toward multi-currency payments, lower FX fees, or specialized virtual card management, there are strong alternatives that might fit better.

What to Look for in a Brex Alternative

Before comparing tools, here are the criteria that matter most when evaluating spend management and payment platforms:

| Criteria | Why It Matters |

| Expense Tracking | Accuracy and automation reduce manual errors and save time. |

| Digital Payments | Needed for smooth vendor transactions, especially cross-border. |

| Corporate Cards | Enables employee spend control, fraud protection, and accountability. |

| Spend Management | Centralized control, approval workflows, and data-driven insights. |

With those in mind, let’s look at three strong alternatives to Brex, Airwallex, Wise, and Extend, and how they perform across these areas.

1. Airwallex — For Global Payments and Expense Tracking

Overview

Airwallex focuses on helping businesses operate globally. It combines multi-currency accounts, cross-border payments, and corporate cards with solid expense tracking tools.

Companies can hold, send, and receive money in multiple currencies without being hit with steep FX fees, something Brex users with global teams often appreciate.

Key Features

- Digital payments: Pay suppliers and contractors worldwide with low FX rates.

- Corporate cards: Issue physical and virtual cards instantly with real-time spend visibility.

- Expense tracking: Upload receipts, match transactions, and integrate with accounting software.

- Spend management: Create custom policies and approval workflows for each team or department.

Best For

Companies that make frequent international payments or manage multi-currency budgets will benefit most from Airwallex. It’s also ideal for remote teams with employees across different countries.

Where It Falls Short

Airwallex’s spend management tools are strong but slightly less advanced than Brex’s when it comes to automation and deep ERP integrations.

Rewards and perks are also minimal, which might matter for U.S.-based teams used to Brex’s card incentives.

2. Wise — For Transparent Digital Payments

Overview

Formerly known as TransferWise, Wise Business is built around transparent international payments.

It’s excellent for companies that don’t need a full spend management platform but still want good expense tracking, digital payments, and corporate cards for their teams.

Key Features

- Digital payments: Send and receive money globally with minimal FX markup.

- Corporate cards: Issue employee cards with set limits and real-time spend alerts.

- Expense tracking: Attach receipts, categorize spend, and export transaction data easily.

- Multi-currency wallets: Hold 40+ currencies and pay vendors from local accounts.

Best For

Small to mid-sized businesses that value simplicity and transparency in global payments.

Wise is great for teams with fewer layers of approval or where the finance process is relatively straightforward.

Where It Falls Short

Compared to Brex, Wise lacks the advanced spend management automation, things like policy enforcement, multi-entity control, and analytics dashboards.

It’s leaner but less feature-rich for larger teams.

3. Extend — For Advanced Virtual Card Spend Control

Overview

Extend specializes in virtual cards and spend management features tied to existing bank or card programs.

Instead of replacing your cards, it lets you issue digital cards to employees, vendors, or projects directly from your current account.

Key Features

- Virtual corporate cards: Create one-time, recurring, or project-based cards for better expense tracking.

- Spend management: Set limits, expiration dates, and approval levels for each card.

- Expense tracking: Real-time visibility and categorization of every transaction.

- API integration: Automate card creation and spend tracking through your ERP or payment system.

Best For

Teams that already have a banking relationship but want finer control over how their existing cards are used.

It’s also ideal for companies that pay multiple vendors and need quick, secure digital card issuance.

Where It Falls Short

Extend doesn’t provide a full banking or digital payments suite like Brex or Airwallex.

It’s best for enhancing card-based spend management rather than replacing broader financial tools. However, for businesses seeking a more modern and scalable virtual card experience, Bycard offers an intuitive, secure, and flexible solution designed for both startups and growing teams.

Feature Comparison: Brex vs Airwallex vs Wise vs Extend

| Feature | Brex | Airwallex | Wise | Extend |

| Expense Tracking | Excellent automation; auto-categorization & sync with ERP. | Strong multi-currency support. | Good receipt upload & export. | Very strong for virtual cards. |

| Digital Payments | ACH, bill pay, reimbursements. | Global payments with FX support. | Transparent international transfers. | Card-based vendor payments. |

| Corporate Cards | Physical & virtual cards with rewards. | Multi-currency cards with limits. | Debit & virtual cards. | Only virtual cards (API-friendly). |

| Spend Management | Advanced policies, approvals, reports. | Good for global operations. | Basic; good for small teams. | Excellent card-level control. |

How to Choose the Right Platform

| Recommended Platform | Scenario | Why |

| Brex | You want all-in-one finance automation | Combines cards, payments, and expense tracking. |

| Airwallex | You make frequent international payments | Better FX and multi-currency support. |

| Wise | You need simple, transparent global transfers | Straightforward and affordable. |

| Extend | You need flexible virtual card controls | Granular control per vendor or project. |

Perfect Card for running ads!

Conclusion

Brex offers an all-in-one finance platform with corporate cards, digital payments, and expense tracking. Airwallex focuses on cross-border payments with multi-currency accounts and low FX fees, while Wise provides a simple and transparent option for international transfers. Extend delivers card-level controls, but Bycard stands out with real-time tracking, flexible limits, and strong security. For businesses seeking efficient virtual card management, Bycard combines speed, flexibility, and control, making it the best choice for managing team and vendor expenses.delivers the strongest balance of control, speed, and visibility—making it the clear choice for modern spend management.