Meta Pay: Overview on Setup, Usage for Users.

In Simple terms: Meta Pay formerly known as Facebook Pay, is a digital wallet tied to your Meta profile. It holds your cards and payments preferences and works inside Facebook and Instagram.

A secured digital wallet that lets you check out on Facebook and Instagram, store cards, and pay sellers fast. You can add a card, confirm your identity, and track purchases in one place. It replaces many flows you used under Facebook Pay and brings them together in one experience across apps. You use it to save cards, confirm payments, and manage receipts. You also use it to pay creators, shops, and charities inside the apps. The design keeps steps short, which helps conversion for buyers and sellers.

Where you see it in the apps

- Product detail pages with Buy buttons

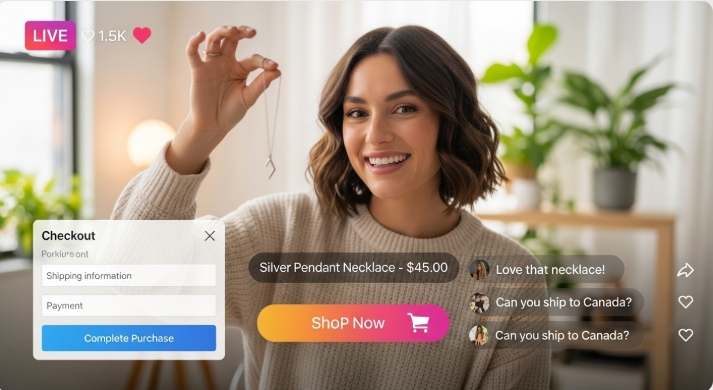

- Live shopping and creator storefronts

- Donations and event tickets

- In-app chat invoices and shop messages

- Meta Pay: Overview on Setup, Usage for Users.

- How does Meta Pay work across Facebook and Instagram?

- Who should use Meta Pay?

- How do you set up Meta Pay?

- How to add a card to Meta Pay?

- How do businesses use Meta Pay with a Meta business account?

- How do you pay safely with Meta Pay?

- What problems cause Meta Pay payments to fail?

- How can Bycard help with Meta Pay billing for ads or shops?

- How do you fix common wallet issues fast?

How does Meta Pay work across Facebook and Instagram?

Meta Pay works as a stored payment method inside both apps. You may still see Facebook Pay on some screens and help pages. The function now routes to the same wallet stack. Treat it as the same payment layer with an updated name.

When you tap Buy, the wallet fills in your saved card. You may confirm with a code, device biometrics, or bank app approval. You get an in-app receipt and an email. The order sits in your purchases view, where you can track status and contact the seller.

Why the flow helps conversion

- Fewer fields to type

- Saved addresses and cards

- Fast confirmation with your phone

- Clear receipts for easy follow-up

Who should use Meta Pay?

Sellers and buyers who transact inside the social apps should use it.

If you sell with Shops, Live Shopping, or in-app messages, the wallet reduces friction. If you buy from creators or brands, the flow saves time and keeps receipts tidy. Teams with a Meta business account also gain a simpler path for checkout tests and refunds.Use your site when you need custom taxes, bundles, or a complex cart. Link both paths so buyers choose what feels easier.

Good fits for the wallet

- Small shops moving from DMs to structured orders

- Creators with limited web checkout tooling

- Brands that want fewer abandoned carts inside the apps

Perfect Card for running ads!

How do you set up Meta Pay?

You open settings, add a card, and verify your identity.

The process takes a few minutes. You should finish it before your first order or live sale.

Basic steps

- Open Facebook or Instagram settings

- Find Payments or Wallet

- Add a card or bank method

- Complete identity checks if prompted

- Set a default payment method and address

Tips before your first purchase

- Confirm your email and phone

- Turn on device biometrics for faster approval

- Keep your app updated to the latest version

How to add a card to Meta Pay?

You add a card in your wallet settings and confirm ownership.

The app may ask for a one-time code or a bank app confirmation to complete the link. You can make a low-value test order with a free return window. Check that your receipt and address look correct.

Step-by-step card add

- Tap Payments or Wallet

- Tap Add Card

- Enter card number, name, and date

- Approve any bank prompt

- Set the card as default

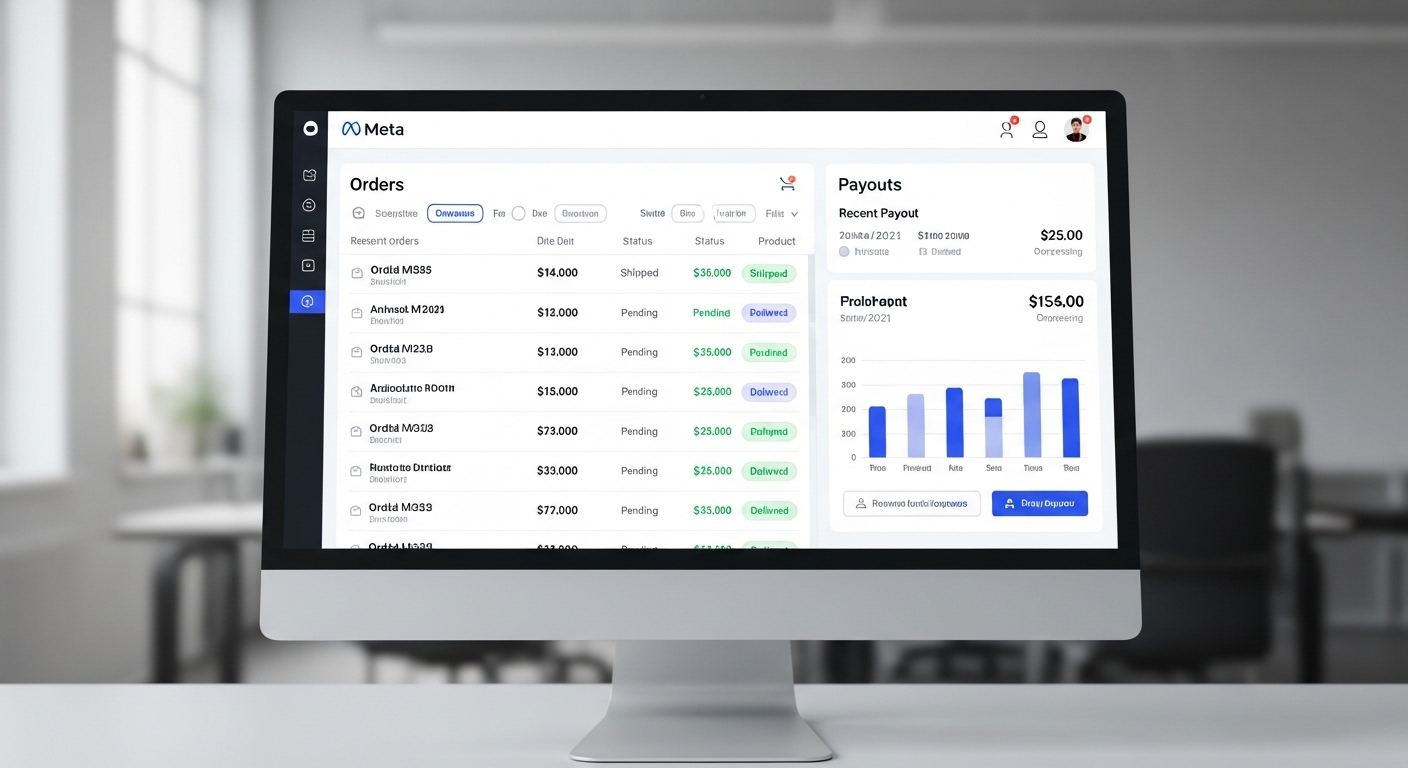

How do businesses use Meta Pay with a Meta business account?

Businesses use the wallet to reduce checkout friction inside the apps.

A Meta business account lets teams manage shops, customer messages, and payouts in one place. The wallet gives buyers a quick checkout. The business tools give you order views and support flows.

Why a Meta business account helps

- You manage roles for support and finance

- You see orders and refunds in one dashboard

- You connect catalogs and inventory to product tags

Simple checklist for sellers

- Verify your business details

- Add a support email and SLA for replies

- Map catalog SKUs to product tags and lives

How do you pay safely with Meta Pay?

You turn on authentication and keep details current.

The wallet supports device biometrics and one-time codes. Banks may also add their own checks for higher risk orders.

Easy safety wins

- Enable app lock and biometric login

- Approve only prompts you expect

- Review your saved cards every quarter

- Use strong passwords for your profile

Fraud red flags to avoid

- “Support” messages asking for your one-time code

- Links that jump outside Facebook or Instagram to unknown sites

- Requests to pay off-platform to dodge fees

Perfect Card for running ads!

What problems cause Meta Pay payments to fail?

Failures come from bank checks, expired cards, or network issues.

Most problems resolve when you update cards, confirm a bank prompt, or retry later. Some banks block social-commerce codes by default and need a call or app approval. If the charge fails more than twice and your bank shows no attempt, contact the seller and support with the exact time and order ID.

Quick fixes

- Update the card date or CVV

- Approve any bank challenge in your banking app

- Try a second card or a different network

- Re-open the app after an update

How can Bycard help with Meta Pay billing for ads or shops?

Bycard keeps your payment method stable during spikes.

You issue a virtual card for your Meta business account, lock it to the platform, and set a weekly cap that fits your plan. Real-time alerts fire on first charges, spikes, and decline clusters. If a card fails, you swap to a backup in seconds and keep checkout or ads live. Finance gets clean exports with the card name, campaign, and cost centre, which shortens reconciliation.

A Bycard setup you can copy

- Card name: (Any name that suits you)

- Cap: weekly spend + 10% buffer

- Lock: merchant and MCC for Meta transactions

- Alerts: first charge, 3 charges/5 minutes, 3 declines/10 minutes

How do you fix common wallet issues fast?

Review your saved methods each quarter. Keep two cards live. Make a tiny test order before each campaign or live sale. You follow a short, repeatable path every time.

Do not guess. Check signals and act in order.

Quick sequence

- Confirm app version and network

- Check bank prompts and approvals

- Update card date or add a new card

- Retry after 10 minutes

- Contact support with order ID and timestamp

Conclusion

Take Meta Pay(Facebook Pay) seriously if you sell or buy inside the apps. The wallet keeps checkout short, stores your methods, and tracks orders in one place. Set it up early, add two cards, and test a small order before you push traffic. If you manage a Meta business account, treat payments as a system. Use clear reports, simple playbooks, and a backup plan for peaks.

When you need stability during lives, drops, or ad pushes, pair the wallet with Bycard. Issue a virtual card, lock it to the merchant, set caps, and turn on alerts. Keep payments steady, keep receipts clean, and keep your buyers moving from view to order without friction.