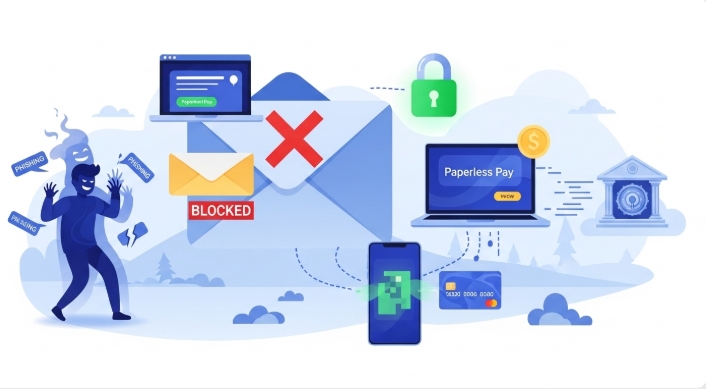

Paperless pay: Using Virtual Cards and Digital Payments to Reduce Email-Scam Risk

Paperless pay is more than a cost-cutting idea, for teams running advertising, subscriptions and repeat supplier payments, paperless pay transforms how risk is managed day-to-day. For companies moving money across campaigns and vendors, a paperless pay approach replaces paper checks and manual instructions with traceable, programmable payments that are far harder for fraudsters to exploit. Bycard’s platform and its virtual cards and digital payments toolset fit naturally into this shift, especially for B2B payment environments where visibility and control are everything.

- Paperless pay: Using Virtual Cards and Digital Payments to Reduce Email-Scam Risk

- Why Paperless Pay Matters for B2B Payment Teams

- Virtual Cards That Block Common Email-Scam Attempts

- Integrating Digital Payments Into Your Paperless Pay Workflow

- Prevention steps you can implement

- Tying Bycard features to each prevention step

- Secure B2B Payment Workflows with Virtual Cards

- Practical Metrics to prove Paperless Pay is working

Why Paperless Pay Matters for B2B Payment Teams

If your organisation handles b2b payment volumes, agency buys, supplier retainer payouts or recurring SaaS payments, then paperless pay should be part of your fraud prevention playbook. Paperless pay reduces manual handoffs and centralises approvals, which means fewer opportunities for a fraudster to slip in a fake invoice or an email asking to “change bank account details.”

What makes paperless pay powerful for b2b payment flows is a combination of two things: first, payments originate in the same system that holds the approved invoice and audit trail; second, that system can execute those payments via controlled digital rails. Bycard’s product stack, instant virtual card issuance, budget management, bill pay and reconciliation, is built to replace fragile paper processes with electronic checks and balances.

Virtual Cards That Block Common Email-Scam Attempts

When you introduce virtual cards into your paperless pay workflow, you change the economics of the attack.

- Virtual cards are single-use or have tight limits. If a fraudster tricks someone into handing over a virtual card number, the exposure is tiny.

- Virtual cards are tied to a payment context (invoice ID, campaign tag, supplier), so reconciliation will immediately flag mismatches.

- Virtual cards reduce reliance on emailed bank-detail changes; instead, payments are issued against card numbers your system created.

Bycard’s virtual cards are designed for speed and control, instant issuance, BIN coverage across major schemes, and granular spend limits, which makes them a practical way for b2b payment teams to adopt paperless pay without long vendor procurement cycles.

Integrating Digital Payments Into Your Paperless Pay Workflow

Digital payments are the rails that move approved money once your paperless pay process confirms an invoice. Moving from cheques to digital payments closes the “paper window” that fraud relies on.

- Digital payments carry metadata (payer, payee, invoice reference) that cheques don’t. That metadata is the core of a paperless pay audit trail.

- When a digital payment is paired with a virtual card, reconciliation becomes near-real time, simplifying exception handling and making email-based spoofing easier to spot.

Bycard combines virtual cards with bill pay, receipt management and reconciliation tools so teams can enact paperless pay end-to-end: issue an invoice, verify it, create a virtual card tied to that invoice, pay the vendor, and automatically reconcile, all inside the same ecosystem. That reduces the manual interventions fraudsters try to exploit.

Prevention steps you can implement

- Map the current state

List every payment that still touches paper or email. Identify the most frequent b2b payment rails and the highest-value suppliers. That’s your paperless pay priority list. - Set an invoice submission standard

Require invoices into a portal (or via an authenticated invoice email) so you have a single source of truth for approvals. Link each invoice to a payment instruction inside your payment platform. - Use virtual cards for supplier and campaign spend

Issue one virtual card per invoice or campaign. Limit the card’s amount and lifetime. If an email requests a change of payment details, require a matched virtual card and a phone verification before any action. - Route payments to digital payments rails only

Stop issuing cheques to suppliers who can accept digital payments. For others, use virtual cards so you keep control even if the supplier’s onboarding is partial. - Automate reconciliation

Match payments to invoices automatically. Flag any virtual card charge that has no approving invoice in the system, that’s a direct red flag in a paperless pay program. - Train the team and suppliers

Train AP and campaign teams on the “why” and the “how.” Provide supplier onboarding templates and a short checklist to accept virtual card payments. With paperless pay, suppliers should get a clear, simple onboarding path.

Tying Bycard features to each prevention step

- Virtual cards → Issue instant virtual cards for campaign buys and vendor payments; use spend limits and expiry rules to contain risk. Bycard offers instant activation and multiple BINs to support this.

- Budget management → Set campaign budgets and require approvals before virtual card issuance; this makes paperless pay a control, not just a convenience.

- Bill pay + receipt management → Centralise invoice capture and receipt matching so that every digital payment has a no-surprises audit trail. Bycard’s bill pay and receipt tools reduce the “we paid it but can’t find the invoice” problem.

- Reconciliation & expense reporting → Automate matchbacks and create exception alerts when a virtual card transaction lacks an associated invoice; these are the fastest indicators of attempted fraud.

Secure B2B Payment Workflows with Virtual Cards

Even small changes can make paperless pay effective immediately. Begin by routing invoices digitally for all non-critical suppliers, eliminating paper cheques. For high-volume B2B payments and ad platforms like Facebook, Google, and TikTok, use virtual cards, Bycard offers tailored solutions for these platforms to simplify setup and control spend. Require verification for any supplier bank changes to reduce email-fraud risk, activate automated reconciliation to catch unmatched transactions, and provide suppliers with a short guide on accepting virtual cards and digital payments. These practical moves strengthen oversight and reduce fraud exposure fast.

Practical Metrics to prove Paperless Pay is working

When you run a paperless pay programme with virtual cards and digital payments, track these metrics weekly:

- % of supplier invoices received electronically (target: increase month-on-month), this measures the paperless pay adoption rate.

- % of b2b payment volume executed via virtual cards or digital payments vs. cheques, this shows risk migration away from paper.

- Average time from invoice receipt to payment, shorter times usually mean fewer manual handoffs and a stronger paperless pay process.

- Number of email-based change requests flagged and manually verified, tracks how often fraud attempts reach your team.

- Exception rate in reconciliation (payments with no invoice), a low number means your paperless pay and virtual card pairing is working.

Perfect Card for running ads!

Conclusion

Paperless pay changes how businesses handle risk, offering the speed, visibility, and control that paper processes simply can’t match. For teams managing ad spends, supplier payments, or recurring expenses, combining digital payments with virtual cards creates a safer and more efficient workflow. Bycard brings these elements together through instant virtual cards, budget management, bill pay, and reconciliation tools, making it easier for organisations to adopt paperless pay confidently and protect their finances from email-based scams.