Security Code on Card: How It Works, Why It’s Important, and How to Protect It

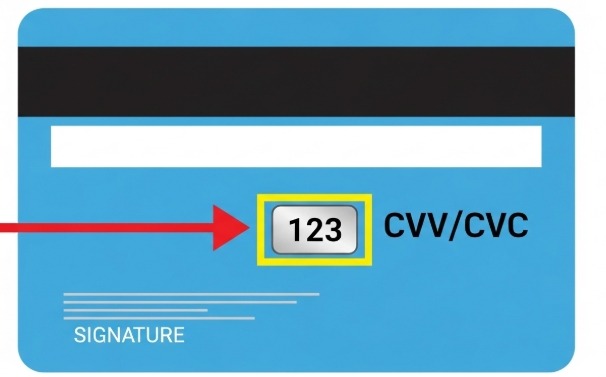

When you make an online purchase or link your card to a payment app, you’re often asked for a short three- or four-digit number, that’s the security code on the card. It may look like a random set of digits printed beside the signature panel or on the front of your card, but it plays a crucial role in protecting your payments.

This code, often labeled CVV, CVC, or CID depending on your card provider, serves as proof that you have the actual card in hand when authorizing digital or phone transactions. It’s one of the simplest yet most effective barriers against unauthorized use. Today, the security code on cards has evolved beyond physical plastic, virtual cards from platforms like Bycard now generate dynamic versions of these codes, giving users more control, transparency, and real-time security for every transaction.

Types of Security Codes on Cards

| Card Type | Name of Code | Location | Digits |

| Visa, Mastercard, Discover | CVV (Card Verification Value) | Back of the card, near the signature strip | 3 |

| American Express | CID (Card Identification Number) | Front of the card, above the main card number | 4 |

| General/Other | CVC (Card Verification Code) | Usually back, near signature panel | 3 |

The security code on card is a secondary authentication layer. When someone enters the card number and expiry alone, fraud becomes easier, but requiring the security code helps verify that the user really has the card in hand.

Why the Security Code on Card Matters (And Its Limits)

H3: Enhanced Fraud Protection

When you buy something online or over the phone, the merchant can request the security code as proof that the person entering the payment details holds the physical card (or knows the extra code). Without it, someone with just the card number and expiry might succeed.

Because many merchants and payment gateways are prohibited from storing that code after the transaction, even if a database is hacked, the stolen card details may be less useful without the security code.

Regulatory and Practical Constraints

However, the security code on card has its boundaries:

- It is a static value (not changing per transaction), so if someone obtains it, it can be reused.

- Some merchants may not require it (for instance, subscriptions or “vaulted” card setups) and thereby weaken this protection layer.

- The Payment Card Industry Data Security Standard (PCI DSS) forbids merchants from storing that code after authorization.

- Because it’s printed, it could be copied by a bad actor (e.g. via skimming or photographing your card).

So while the security code on card is a useful additional barrier, it’s not foolproof.

How the Security Code on Card Fits Into Payment Flows

Here’s how that 3- or 4-digit code becomes part of a payment:

- You enter card number, expiry, and security code on card when making a purchase online.

- The merchant’s system sends those details (plus other transaction data) to the card issuer for authorization.

- The issuer checks whether the security code matches what it expects.

- If it matches and other checks (balance, fraud detection) pass, the transaction is approved; otherwise, it’s declined.

The security code on card helps reduce risk in the “card-not-present” scenario, but in face-to-face settings (with chip, contactless, or swipe), terminals verify other embedded security features rather than that printed code.

In more modern systems, some cards generate dynamic codes (i.e. codes that change per transaction), which further mitigate static-code risks.

Safety Tips for the Security Code on Card

Knowing how the security code on card works is useful, but protecting it is equally critical. Below are actionable precautions:

| Action | Why It Helps |

| Never share your security code over email, SMS, or social media | Phishers often ask for that last piece of info |

| Only use card payments on sites with “https” and trusted reputations | Ensures encryption of transmitted data |

| Use virtual cards with constrained limits | If someone steals it, damage is limited |

| Monitor transaction history frequently | You’ll catch unauthorized use early |

| Lock or disable a card when not in use | Especially useful for cards used only occasionally |

These steps help safeguard the security code on the card from falling into malicious hands.

How Virtual Cards Like Bycard Strengthen Security Beyond the Code

As payments move increasingly online, the security code on card remains vital, but it’s no longer enough on its own. That’s where virtual card systems, such as Bycard, are redefining what card security looks like in a digital-first world. Rather than replacing the traditional code, they build on it, giving users more control, visibility, and safety over how each transaction happens.

With Bycard, every virtual card is issued with its own security code on card, just like a physical card. The difference is that these digital versions live inside a secure platform, eliminating risks tied to lost or skimmed cards. If one card’s details are ever compromised, you can instantly lock, disable, or delete it, without disrupting your other cards or accounts.

Security That Adapts to You

Bycard strengthens protection by blending control with convenience, designed for people who make frequent online payments, manage budgets, or run digital businesses.

- Spending limits and usage controls: set caps or merchant-specific rules to prevent overspending or unauthorized activity before it even happens.

- Instant issuance and replacement: generate a new card in seconds when isolating a payment, testing ads, or responding to a potential breach.

- Lock and unlock on demand: freeze a card temporarily if you notice anything suspicious, and unfreeze it once verified.

- Global access with multi-currency support: shop and pay securely across borders without exposing your main account.

- Advanced tracking and reporting: view all transactions in real time, identify anomalies early, and maintain a clear record for every card.

Bycard layers proactive monitoring, user-driven controls, and real-time response into one system, ensuring that static printed codes evolve into a fully dynamic defense against today’s digital fraud tactics.

Use Cases & Best Practices with Bycard + Security Code

Scenario: Running Multiple Ad Campaigns

Many advertisers use separate cards for each platform (e.g. Google Ads, Facebook Ads). With Bycard, you can create multiple virtual cards each with its own security code on card. If one campaign’s card is compromised or overcharged, you shut down just that card, not your whole account.

Scenario: Subscription Services or SaaS Apps

If you use a card for recurring payments, the merchant may vault your card info including the security code on card (if allowed). With Bycard, you can:

- Use a card with a low spending limit so that even if the security code on the card is stored, the exposure is minimal.

- Replace or cancel that card without touching other services.

Scenario: Overseas & Multi-Currency Transactions

Because Bycard supports many currencies and issues cards accepted globally, your security code on card remains functional everywhere you transact, no need to carry physical travel cards or worry about local fraud.

Perfect Card for running ads!

Conclusion

The security code on card may look like a small detail, but it plays a crucial role in protecting digital payments. As a 3- or 4-digit code printed on your card, it adds an important layer of verification during online and remote transactions, helping to block unauthorized use when only the card number and expiry date are known. Still, its limitations, being static and visible, mean users must take precautions by keeping it private, monitoring transactions, and using it only on trusted platforms. Virtual card systems like Bycard build upon this foundation, combining the traditional security code on card with modern safeguards such as instant issuance, card locking, spending limits, and real-time reporting. In high-risk or fast-moving payment environments, these added layers make a significant difference, giving individuals and businesses stronger control and reducing their exposure to fraud.