Email Spoofing: How to Protect Your Finances and Use Virtual Cards to Stay Safe

Email spoofing has become one of the most common ways scammers trick businesses and individuals into sending money or sharing sensitive information. While most people have heard of phishing, few realize how often a spoof email can look identical to a legitimate message, especially when money is involved. The result? Lost funds, compromised data, and financial chaos that could have been prevented with the right tools, such as virtual cards from Bycard.

- Email Spoofing: How to Protect Your Finances and Use Virtual Cards to Stay Safe

- What Is Email Spoofing and Why It Works

- How Spoof Emails Leads to Financial Loss

- How Bycard Virtual Cards Stop Email Spoofing and Phishing Losses

- Checklist: How to Verify Payments and Use Virtual Cards Against Email Spoofing

- Vendor Verification Templates to Avoid Spoof Email Fraud

- Data and Real-World Context

- Bycard’s Approach to Securing Digital Payments

What Is Email Spoofing and Why It Works

Email spoofing happens when an attacker manipulates an email’s header to make it look like it came from someone you trust, a colleague, your bank, or even a familiar supplier. The goal is simple: make you believe the email is real, then trick you into taking action.

A typical spoof email might ask you to:

- Update your payment details.

- Confirm your account.

- Approve an urgent transfer.

Because email spoofing often looks legitimate, even experienced professionals can fall victim. Unlike obvious phishing attempts that rely on bad grammar or strange links, spoofing blends in, and that’s what makes it dangerous.

How Spoof Emails Leads to Financial Loss

When phishing attacks or spoof emails reach your inbox, they often target your payment processes. Scammers may send what looks like a supplier’s invoice or a colleague’s request to approve funds. Without proper verification, you might send real money to a fake account.

That’s where Bycard virtual cards come in. By generating unique, secure payment details for each transaction, you can prevent attackers from accessing your main account, even if a spoof email manages to deceive someone on your team.

How Bycard Virtual Cards Stop Email Spoofing and Phishing Losses

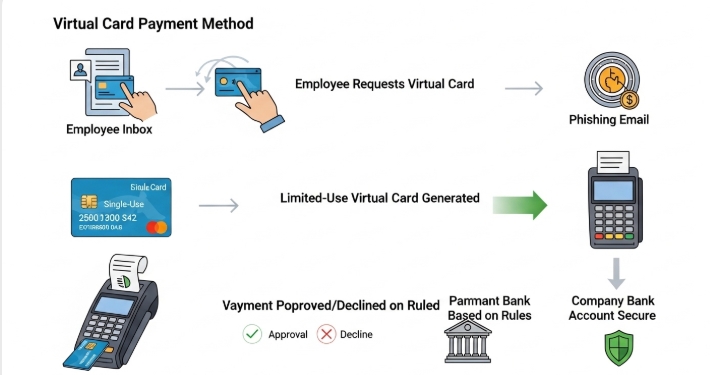

Virtual cards add a strong layer of security to your financial operations by separating your primary banking details from daily payments. With Bycard, this protection becomes simple, fast, and flexible.

1. Unique Card Numbers for Each Vendor

Create one-time-use or vendor-specific virtual cards. If a spoof email compromises a payment request, the attacker only gets access to that single, limited card, not your entire business account.

2. Custom Spending Limits

Set caps for each card so even if an unauthorized payment occurs, exposure is minimal. You decide how much, where, and when each card can be used.

3. Instant Freeze and Deactivation

Spot suspicious activity? Instantly freeze or cancel the card directly from your Bycard dashboard. No waiting, no lengthy calls to your bank.

4. Real-Time Transaction Tracking

Every payment is logged instantly, helping you identify fake invoices or irregular activity before it causes damage.

Real-World Example: How Bycard Stops an Email Spoofing Scam

Imagine your finance manager receives an email that appears to come from a trusted vendor requesting urgent payment to a “new account.”

Instead of transferring funds directly, your team issues a virtual card via Bycard for that vendor’s payment. When it turns out to be a spoofed email, the attacker gains nothing, you simply deactivate the card, and your actual funds stay untouched.

By inserting Bycard into your payment process, you create multiple layers of friction for fraudsters, every transaction is verified, limited, and fully traceable.

Checklist: How to Verify Payments and Use Virtual Cards Against Email Spoofing

| Step | Action | Why It Matters |

| 1 | Check the sender’s domain carefully. | A spoof email often changes one letter in the domain name |

| 2 | Hover over links before clicking. | Prevent phishing redirection to fake websites. |

| 3 | Verify payment requests with a second channel. | Always confirm by call or Slack message before sending money. |

| 4 | Use virtual cards for all supplier payments. | Protects main account data and limits exposure. |

| 5 | Assign one virtual card per vendor or department. | Prevents reuse and simplifies tracking. |

| 6 | Lock or freeze unused cards via Bycard’s dashboard. | Stops fraud instantly if a spoof email compromises details. |

| 7 | Reconcile transactions weekly. | Detects abnormal payments linked to phishing activity early. |

Vendor Verification Templates to Avoid Spoof Email Fraud

When you receive a spoof email requesting payment or banking changes, use these quick verification templates before acting.

Phone Script Template

“Hi [Vendor Name], this is [Your Name] from [Company]. I just received an email requesting a payment or account change. Can you please confirm if that request came from your team?”

Email Template

Subject: Payment Request Confirmation

Hi [Vendor Name],

We recently received an email asking for updated payment details. For security, we’re verifying directly with you before processing. Please confirm if this request is legitimate.

Best,

[Your Name]

Both templates ensure your verification happens through official channels, not through the possibly spoofed email itself.

Data and Real-World Context

According to the FBI’s Internet Crime Complaint Centre, business email compromise (BEC), which includes email spoofing and phishing scams, led to over $2.9 billion in adjusted losses in 2023. What’s alarming is that many victims had basic cybersecurity in place but lacked strong payment-layer protection, such as virtual cards.

By integrating Bycard into your financial workflow, you can shield your business from these losses. Instead of sharing static card details over email, you generate secure virtual cards for each transaction. This separation between your main account and the transaction layer drastically reduces exposure when spoof emails slip through.

Bycard’s Approach to Securing Digital Payments

What makes Bycard stand out in preventing email spoofing and phishing fraud isn’t just its technology, it’s the control it gives you.

- Instant card creation: Issue a new card within seconds for one-time use.

- Dynamic spending controls: Decide exactly where and how your funds can be used.

- Ad platform compatibility: Perfect for marketing teams making online spends securely.

- Multi-user access: Each department or team member can get their own secure card.

- Built-in fraud protection: Advanced data security and 3D Secure authentication add extra layers against phishing and spoofing attempts.

These features make Bycard’s virtual cards a simple yet powerful defense against email spoofing and spoof email attempts aimed at draining your funds.

Conclusion

The truth is, email spoofing and phishing aren’t going away. But with vigilance and tools like Bycard’s virtual cards, you can make sure they never succeed against you.

Each spoof email becomes just another failed attempt when your payment process is protected by smart spending controls and instant security actions.

So next time you receive an urgent request in your inbox, pause, verify, and use a Bycard virtual card instead of exposing your bank account. Because in a world full of digital deception, control is your strongest defense.