Click to Pay: An Improvement in Online Checkout and Payments

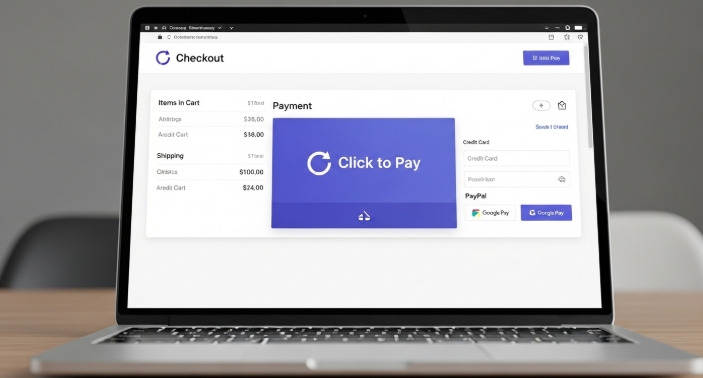

Online checkout continues to evolve, and one solution that stands out for smoother transactions and stronger security is Click to Pay. As more consumers shift to digital payments, businesses need ways to reduce checkout friction, prevent abandoned carts, and simplify payments. The service provides a consistent, card-network–supported experience across devices and browsers.

Reports indicate that nearly 70% of online carts are abandoned, often due to long or complex checkout forms. With global digital payments expected to surpass $9 trillion in 2025, reducing friction with tools like Click to Pay is increasingly vital.

- Click to Pay: An Improvement in Online Checkout and Payments

What Click to Pay Solves in Online Checkout

Traditional checkout forms ask for card numbers, expiry dates, addresses, and verification steps. The system streamlines this into a single, secure click. Benefits include:

- Faster checkout completion

- Fewer repeated card entries for returning users

- Reduced failed payments due to input errors

- Lower fraud risk thanks to network-backed authentication

By merging convenience with security, Click to Pay meets both consumer expectations and merchant needs.

How Click to Pay Works

Click to Pay works directly with major card networks (Visa, Mastercard, Amex). Here’s a detailed workflow:

- User Identification: The system recognizes returning users via email, device ID, or network login.

- Card Retrieval: Stored cards linked to the profile are displayed, tokenized for security.

- Tokenization & Authentication: Each transaction uses a unique token rather than the actual card number. Authentication methods like 3D Secure or biometric verification can be applied.

- Payment Completion: The transaction is processed without exposing sensitive card details.

- Integration: Merchants can integrate the service through supported payment gateways, often with minimal code changes.

Bycard virtual cards complement this flow by providing per-merchant or one-time-use cards, particularly useful for recurring payments or cross-border transactions.

Merchant Requirements for Smooth Integration

To implement feature effectively, merchants should:

- Confirm card network support (Visa, Mastercard, Amex)

- Add Click to Pay buttons on checkout pages

- Enable tokenized card storage and retrieval

- Test flows across devices, browsers, and mobile platforms

- Provide fallback options for unsupported cards

- Track metrics such as approval rate, cart abandonment, checkout time, and average order value

- Test recurring payments or subscription flows with Bycard virtual cards to reduce token expiration issues

- Monitor fraud alerts and implement real-time notifications for unusual activity

Perfect Card for running ads!

Regional Adoption and Availability

Click to Pay is expanding globally. Key markets include:

| Region | Adoption Status | Notable Merchants |

| USA | Widely available | Amazon, Best Buy, Target |

| Canada | Growing adoption | Shopify merchants |

| Europe | Pilots in select markets | Carrefour, Zalando |

| Asia | Limited rollout | Selected e-commerce platforms |

| Africa | Emerging adoption | Select fintechs and online stores |

Bycard: Enhancing Click to Pay Security and Flexibility

Bycard offers virtual cards that complement Click to Pay by providing secure, flexible payment options.

Key benefits:

- Virtual Cards: One-time or per-merchant cards reduce exposure

- Fraud Reduction: Per-merchant metadata improves detection

- Spending Control: Real-time limits, locks, and transaction tracking

- Global Payments: Multi-currency support simplifies international transactions

These features make Bycard a practical tool for merchants using this feature, especially for recurring or cross-border payments.

Click to Pay vs Other Checkout Methods

| Feature/Method | Click to Pay | Apple/Google Pay | PayPal | Browser Autofill | Bycard Virtual Card |

| Card network support | Yes | Limited | No | Only stored cards | Yes |

| Device consistency | High | Mobile-focused | Medium | High | Medium |

| Tokenized transactions | Yes | Yes | Yes | No | Yes |

| Cross-browser support | Yes | Limited | Medium | Yes | Medium |

| Fraud protection | Network-backed | Device-backed | Medium | Low | Enhanced via per-merchant & virtual cards |

| Best for | Quick online checkout | Mobile users | Online payments | Autofill convenience | Recurring payments, spend control, enhanced security |

Privacy and Compliance

Merchants adopting Click to Pay must carefully navigate privacy and regulatory obligations to protect users and minimize liability:

- Data Collection: Click to Pay stores tokenized card data rather than full card numbers, reducing exposure in case of breaches. Merchants should ensure tokens are encrypted and handled according to industry standards.

- User Consent: Users must explicitly agree to store and use their cards for future transactions. Clear consent flows, privacy notices, and opt-in checkboxes are essential for transparency.

- Regulations: Compliance with global and local privacy laws is mandatory. This includes GDPR in Europe, PDPA in some Asian countries, and local regulations in regions like Africa. Merchants should maintain accurate records of user consent and card storage practices.

- Merchant Responsibility: Businesses must provide clear disclosures, allow users to manage or delete stored payment methods, and ensure secure handling of sensitive information. Regular audits and employee training can help maintain compliance.

- Bycard Integration: Using Bycard virtual cards further enhances compliance by reducing exposure to real card data, enabling per-merchant or one-time-use cards, and supporting detailed transaction tracking. This adds a layer of security while maintaining transparency for regulators and users.

By implementing these practices, merchants can safely leverage Click to Pay while maintaining trust, minimizing fraud risk, and adhering to global data protection standards.

Advancements in Click to Pay Technology

As e-commerce grows, Click to Pay will become a standard checkout option worldwide. When combined with tools like Bycard:

- Payments are faster and more secure

- Checkout errors are minimized

- Fraud exposure is reduced

- Finance teams gain visibility and control

Businesses adopting this technology with virtual cards are better positioned to deliver a seamless, secure payment experience for all customers.

Conclusion

Click to Pay is steadily becoming a core part of modern checkout experiences, reducing friction and helping merchants increase completed transactions. But adoption isn’t just about enabling the feature, it’s about optimizing performance, managing edge cases, and ensuring the payment flow stays fast, secure, and predictable for every customer.

Bycard strengthens this process even further. With virtual cards built for transparent tracking, controlled spending, and secure transactions across multiple merchants, businesses get an added layer of reliability that complements them seamlessly.