7 Most Common Business Scams You Should Know

Running a business today comes with significant financial risks, and Business Scams remain one of the most damaging threats. Fraudsters often exploit gaps in payment processes, vendor management, and internal workflows to siphon funds or commit fraud. Platforms like Bycard help businesses stay protected by offering virtual cards, spend-management tools, and structured payment controls that limit exposure to Business Scams. With features like vendor-specific cards, spend limits, and real-time monitoring, suspicious activity is easier to spot, making it possible to secure payments and reduce the impact of scams before they affect your bottom line.

- 7 Most Common Business Scams You Should Know

- 1. Online Payment Scams

- 2. Fake Vendor Scams

- 3. Phishing and Business Email Compromise (BEC)

- 4. Invoice Manipulation Scams

- 5. Ad Spend and Platform Fraud

- 6. Internal Employee Fraud

- 7. Subscription and Recurring Payment Fraud

- Practical SOPs Using Virtual Cards to Prevent Business Scams

- Fraud Detection Signals That Predict Business Scams Before Money Moves

- What To Do After You Suspect Business Scams

1. Online Payment Scams

Digital commerce created convenience, but it also opened the door to rapid online payment scams. These online payment scams include fake transactions, stolen card testing, chargeback abuse, fake buyers, and identity-based attacks.

What makes these online payment scams dangerous is their connection to larger Business Scams. Scammers often start with small online payment scams to test your weakness before expanding into larger fraud attempts.

Weak or outdated fraud detection makes it easier for attackers to slip in unnoticed. For businesses handling subscriptions or high-volume transactions, failing to spot early online payment scams can turn into months of hidden financial loss.

2. Fake Vendor Scams

Some of the most damaging Business Scams don’t rely on just one technique. Instead, they use a combination, for example, a vendor impersonation followed by a fraudulent invoice and then an online payment scam that drains funds.

These layered attacks are particularly dangerous because they exploit holes in procurement, approval workflows, and payment systems all at once. A business might believe it’s just paying a regular supplier, but if vendor identities weren’t verified and controls are weak, it could be falling prey to fake vendor scams that lead directly into payment fraud.

This is where isolation and control matter. If each vendor gets a dedicated virtual card, and payments are tied to invoice IDs and reconciliation workflows, then layered scams lose much of their power. Bycard supports this model: virtual cards, bill-pay, receipt management, and reconciliation built to work together for secure vendor payments.

3. Phishing and Business Email Compromise (BEC)

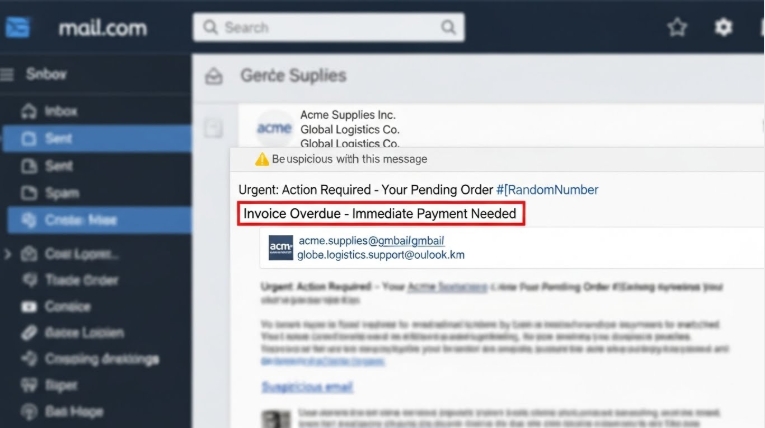

Fraudsters often target finance teams with emails that appear to come from executives, trusted vendors, or partners, requesting urgent or unusual payments. These phishing attempts are a common form of Business Scams and can bypass manual checks, especially when teams feel pressured to act quickly. Attackers may include fake invoice attachments, altered payment instructions, or urgent directives designed to trick staff. Bycard helps prevent these scams with structured invoice workflows, dual-approval processes, and vendor verification. Every payment is validated, reducing the risk of falling victim to fraudulent requests and keeping company funds secure.

4. Invoice Manipulation Scams

Invoice manipulation occurs when hackers or dishonest insiders alter legitimate invoices to redirect payments to fraudulent accounts. This is a widespread form of Business Scams that can easily slip through manual checks, especially in businesses with high payment volumes or multiple vendors. Attackers may change bank details, invoice amounts, or payment instructions while keeping other details intact to avoid suspicion. Preventing these scams requires structured controls, such as a 6-step invoice-approval SOP, dual sign-offs, and automated reconciliation. Bycard’s bill-pay and receipt-matching tools make it simple to spot discrepancies, flag suspicious payments, and ensure all transactions align with verified invoices.

5. Ad Spend and Platform Fraud

If your business runs ad campaigns on platforms like Google, Facebook, TikTok, or others, you’re especially vulnerable to online payment scams through ad fraud, stolen cards, or compromised ad accounts.

Using Bycard’s platform-specific virtual credit cards (VCCs) for each campaign isolates risk. Because each ad campaign gets a dedicated card with a tight budget and expiry, any compromise only affects that card, not your main account or vendor payments.

This practice significantly lowers exposure to Business Scams, especially recurring or automated attacks targeting ad budgets.

6. Internal Employee Fraud

Employees with access to payment systems may misuse funds or manipulate transactions. Structured approval workflows, dual sign-offs, and Bycard’s transaction tracking help prevent these internal Business Scams from going unnoticed.

7. Subscription and Recurring Payment Fraud

Automated subscriptions and recurring billing can be exploited by scammers through duplicate charges or fake accounts. Monitoring recurring transactions and using vendor-specific virtual cards reduce the risk of these Business Scams.

Perfect Card for safer business transactions!

Practical SOPs Using Virtual Cards to Prevent Business Scams

To help you close loopholes in procurement and payment, here’s a ready-to-use 6-step invoice-approval SOP. You can plug this into your operations today, especially if you use Bycard virtual cards and bill-pay functionality.

Invoice-Approval SOP (6 Steps)

1. Centralized Invoice Submission

Request all invoices through one secure email or portal.

Require vendor name, address, invoice number, amount, and payment details.

2. Vendor Verification

For new vendors, confirm business registration, address, and contact info.

Match all details with existing records before approving payments.

3. Dedicated Virtual Card

Create a Bycard virtual card for each vendor or invoice.

Set spend limits equal to the approved amount.

4. Dual Sign-Off

At least two people must approve the invoice (procurement + finance).

Cross-check invoice with previous orders and delivery confirmations.

5. Controlled Payment

Pay only with the assigned virtual card and tag the invoice number in metadata.

Avoid shared cards or unrestricted payment methods.

6. Quick Reconciliation

Use Bycard’s receipt-matching tools to verify payment vs. invoice.

Flag any mismatches immediately and store records for auditing.

Fraud Detection Signals That Predict Business Scams Before Money Moves

A big part of preventing Business Scams lies in fraud detection long before you click “Pay.” Here are key signals to monitor, and how Bycard’s tools help you catch them:

- Unmatched payment metadata: if a payment goes out but has no corresponding invoice or approved request. Bycard’s receipt management and reconciliation flag this instantly.

- Unexpected vendor card use: payments outside business hours, unusual amounts, or transactions at unfamiliar merchant categories, virtual-card spend controls block or alert on these.

- Frequent small payments or test charges: often a precursor to larger online payment scams, regular monitoring helps detect anomalies.

- Vendor change-requests via email without proper verification: a common sign of fake vendor scams plus phishing. SOP + vendor verification step helps mitigate this.

- Multiple invoices from the same vendor with different payment details: red flag for vendor imposters or account takeovers.

What To Do After You Suspect Business Scams

- Freeze or deactivate all virtual cards associated with suspicious vendors or campaigns.

- Reconcile payments vs. invoices immediately; flag any mismatches.

- Audit vendor list, verify identities for all vendors with recent payments.

- Rotate vendor payment methods, issue new cards or require re-verification and KYC.

- Report the fraud internally, update your SOPs, and retrain relevant staff on the invoice-approval process. Using Bycard’s audit trails and receipt logs makes this easier.

- Consider limiting vendor payment to virtual-card-only or digital-payment-only workflows to reduce risk long term.

Conclusion

Business Scams are real, evolving, and capable of draining budgets, vendor trust, and company reputation. Bycard helps businesses stay ahead with virtual cards, real-time fraud detection, budget controls, vendor verification, and structured invoice workflows. Using these tools, payment systems shift from a potential liability into a strong defense layer, reducing exposure to scams and making it easier to manage payments securely.