Credit Card Strategy: Top 6 for Subscriptions and SaaS Tools

Subscriptions and SaaS tools now sit at the center of how people work, run businesses, and manage money. From creative software and cloud storage to analytics and collaboration tools, recurring payments are everywhere. That’s why having a clear Credit Card strategy for subscriptions isn’t about optimization for its own sake, it’s about control.

A practical Credit Card strategy helps you track recurring spend, avoid payment failures, manage renewals, and reduce unnecessary costs. Below are six approaches that people who actively manage SaaS spending rely on, with real-world application and tools like Bycard built into the process.

- Credit Card Strategy: Top 6 for Subscriptions and SaaS Tools

- Why Credit Card Strategy Matters for Subscription-Based Spending

- 1. Centralising Subscriptions as a Credit Card Strategy

- 2. Using Rewards-Based Cards for SaaS

- 4. Separating Business and Personal Spend

- 4. Preventing Failed Payments in Subscription Billing

- 5. Virtual Cards as a Practical Credit Card Strategy for Subscriptions

- 6. Managing Cash Flow Through Credit Card Strategy Timing

- How Bycard Enhances Your Subscription Management

- Common Subscription Mistakes That Weaken a Credit Card Strategy

Why Credit Card Strategy Matters for Subscription-Based Spending

Most subscription issues don’t come from big mistakes. They come from small, ignored charges, expired cards, or tools that quietly renew long after they’ve stopped being useful.

A structured Credit Card strategy brings:

- Visibility into recurring payments

- Fewer failed transactions

- Better budgeting for predictable expenses

- Clear separation between different types of spend

This foundation makes every other subscription decision easier.

1. Centralising Subscriptions as a Credit Card Strategy

One of the most effective ways to manage subscriptions is to stop spreading them across multiple cards. Centralising recurring payments is a Credit Card strategy that improves clarity instantly.

When subscriptions live on one dedicated card (or wallet):

- Reviews become faster

- Unexpected charges stand out

- Renewals are easier to anticipate

With platforms like Bycard, this approach becomes even more practical because you can centralise funding while still issuing separate virtual cards per subscription.

Running Regular Subscription Audits

Even with a clear card setup, small charges can accumulate unnoticed. A quick subscription audit every 2–3 months ensures you’re only paying for what you actually use. During these audits, check:

- Which tools are actively used

- Any duplicate subscriptions

- Upcoming renewals and trial expirations

By keeping audits short and systematic, your Credit Card strategy stays proactive rather than reactive.

2. Using Rewards-Based Cards for SaaS

Subscriptions are predictable, which makes them ideal for earning rewards. A well-planned Credit Card strategy factors in how recurring SaaS payments contribute to cashback or points.

Instead of thinking about rewards per transaction, this Credit Card strategy looks at:

- Total annual SaaS spend

- Which subscriptions qualify for rewards

- Whether recurring charges are being maximised

When subscriptions are tracked individually, as they are with Bycard’s virtual cards, it’s easier to see where value is being generated and where it isn’t.

4. Separating Business and Personal Spend

Mixing business and personal subscriptions on one card creates friction later, during reviews, tax prep, or budgeting.

A cleaner Credit Card strategy separates:

- Personal subscriptions (streaming, storage, lifestyle tools)

- Business SaaS tools (CRM, design, analytics, productivity)

Bycard supports this by letting users issue multiple virtual cards, each assigned to a specific purpose. This keeps records clean and makes spend analysis far more accurate.

Perfect Card for running ads!

4. Preventing Failed Payments in Subscription Billing

Failed payments are one of the most common, and disruptive, subscription problems. Cards expire, get replaced, or temporarily decline, causing tools to pause without warning.

A resilient Credit Card strategy accounts for this by:

- Monitoring failed transactions

- Keeping replacement cards ready

- Using systems that allow fast card updates

With Bycard, you can instantly generate or replace a virtual card tied to a specific subscription, reducing downtime and avoiding service interruptions.

5. Virtual Cards as a Practical Credit Card Strategy for Subscriptions

Virtual cards have become a core part of modern Credit Card strategy, especially for subscriptions.

They allow you to:

- Assign one card per SaaS tool

- Set spending limits that match subscription costs

- Cancel a subscription by freezing its card

Bycard is built around this use case, making virtual cards an everyday tool rather than a workaround. This is especially useful for free trials and short-term SaaS tools.

Catching Price Increases With the Right Credit Card Strategy

SaaS providers sometimes increase fees quietly, which can erode your budget over time. Tracking each subscription on its own card or virtual card makes price changes immediately visible. A simple monthly review of charges can help you:

- Identify unexpected rate hikes

- Adjust plans or downgrade services

- Avoid overpaying for unused features

This small step ensures your Credit Card strategy keeps your spend predictable and under control.

6. Managing Cash Flow Through Credit Card Strategy Timing

When subscriptions renew matters just as much as how they’re paid.

A thoughtful Credit Card strategy aligns billing cycles with:

- Salary dates

- Client invoice schedules

- Business cash flow peaks

This reduces pressure during low-cash periods and makes recurring expenses predictable. Virtual cards make this easier by letting you control limits and usage without changing your primary funding source.

How Bycard Enhances Your Subscription Management

If you’re serious about using credit cards to manage subscription spend, platforms like Bycard bring modern tools into play:

Instant Virtual Cards

Bycard issues virtual cards instantly, no waiting for a physical card. These are perfect for subscription billing because you can create cards on the fly, each with its own settings for renewals, limits, and purpose.

Spend Controls and Budget Management

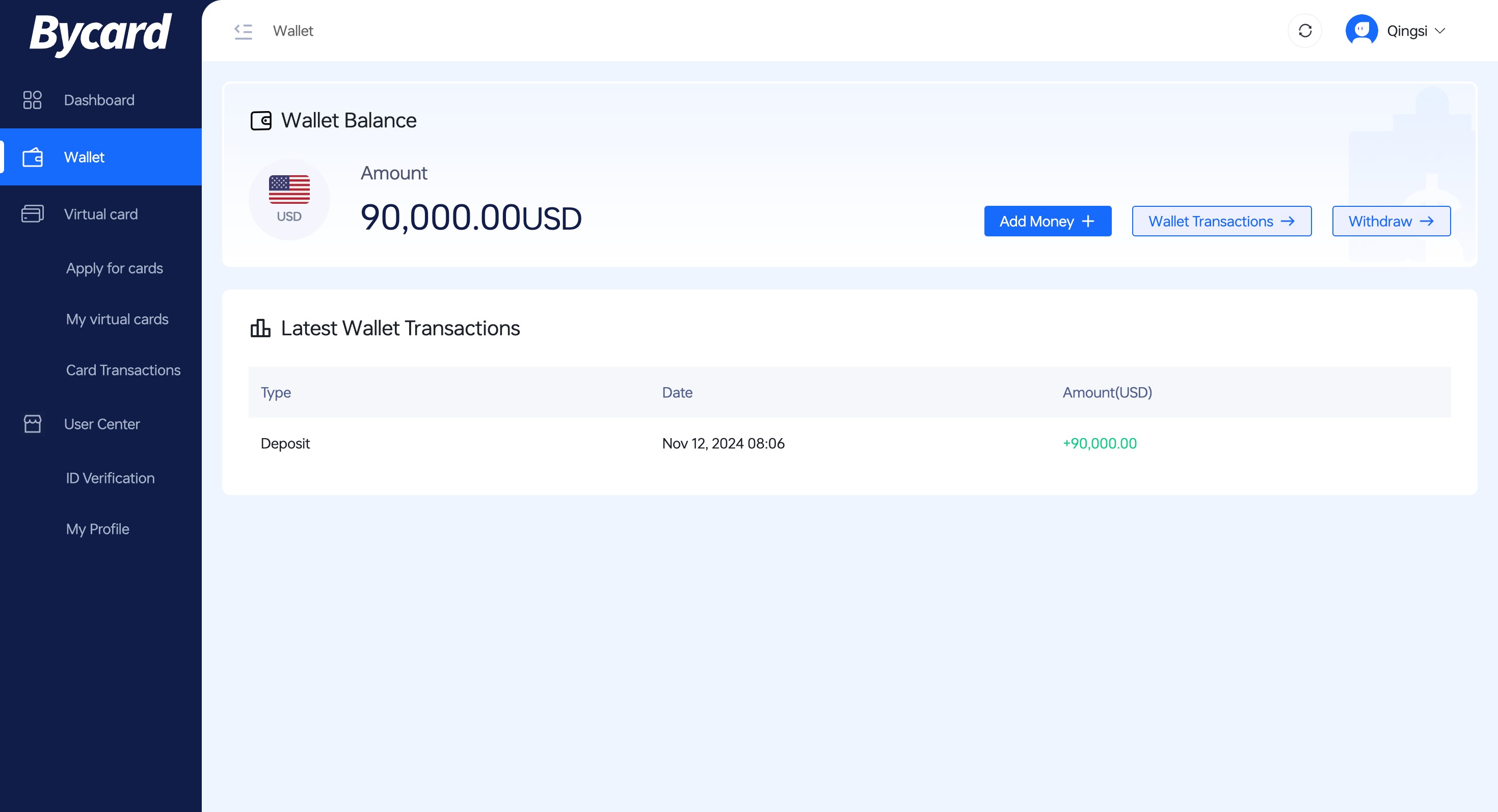

The dashboard provides real-time tracking of budgets, limits, and card-by-card expenses. That means your Credit Card strategy isn’t just about paying bills, it’s about controlling and forecasting spend.

Subscription and Bill Pay Tools

Bycard’s bill pay solutions let you manage all billing categories, subscriptions, digital services, advertising spend, from a unified dashboard. You can set reminders and automate payments without risk of missed renewals.

Expense Reporting and Reconciliation

Being able to generate accurate reports linking every card transaction to a subscription makes quarterly reviews and audits less stressful, a key ingredient in any actionable Credit Card strategy.

Global and Multi-Currency Support

If you manage international SaaS tools, Bycard supports multi-currency transactions, making it easier to settle recurring fees from tools based outside your home country without surprise conversion costs.

Common Subscription Mistakes That Weaken a Credit Card Strategy

Even with the right tools, strategy breaks down when subscriptions aren’t reviewed.

Common issues include:

- Letting unused tools renew

- Ignoring small recurring charges

- Not tracking failed payments

- Using one card without visibility

A consistent Credit Card strategy includes regular reviews, not just setup.

Conclusion

Subscriptions are designed to be easy to start and hard to notice over time. That’s why a clear Credit Card strategy matters.

When you centralise spending, use virtual cards intentionally, align billing with cash flow, and track subscriptions consistently, recurring payments stop being a blind spot.

Tools like Bycard make that process simpler, not by adding complexity, but by giving you control where it matters.