Adpos: Best VCC Virtual Cards for Facebook Ads Payments

When you run paid campaigns across multiple ad platforms, nothing halts momentum faster than a failed payment. For media buyers and agencies, a single blocked card can pause ad delivery, break performance streaks, and cause missed opportunities. That’s where Adpos steps in, a virtual card provider built specifically for seamless ad payments, especially across Facebook ads and other major platforms.

Adpos isn’t just another VCC provider; it’s designed for ad buyers, agencies, and performance marketers who need stable, trackable, and fast funding. Here’s what makes it a reliable choice for ad payments and how it stands out in performance and control.

- Adpos: Best VCC Virtual Cards for Facebook Ads Payments

Why Adpos matters for Facebook ads payments

Running Facebook ads comes with its own challenges. Ad rejections, card declines, and sudden account flags are part of the game. But what most advertisers don’t realize is that many Facebook ad account funding card issues start with failed payments, not policy violations.

Adpos was created to solve this, to make funding Facebook ad accounts stable, flexible, and resilient. Whether you’re running one campaign or managing hundreds for clients, the platform offers instant card creation, multiple currency options, and strong merchant approval success.

Adpos helps marketers:

- Avoid campaign pauses due to declined charges.

- Assign a unique card per campaign or client.

- Track real-time spending across ad platforms.

- Set caps to prevent overspending or unauthorized charges.

It’s a simple change that delivers real impact, better cost control, uninterrupted delivery, and a clearer view of where every dollar goes.

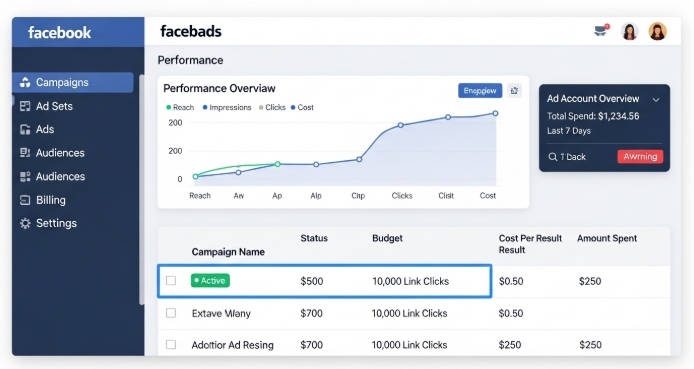

How Adpos works across ad platforms

Adpos issues virtual cards for ads that work seamlessly on Facebook, Google, TikTok, Snapchat, and more. Each card can be named by campaign, client, or objective, and locked to specific ad merchants.

For example, a digital agency running ads for ten clients can issue ten cards, each capped by daily or weekly spend. This means no campaign exceeds its budget, and reconciliation becomes straightforward at the end of each billing cycle.

Key capabilities for ad teams

- Instant VCC generation for ad campaigns

- Merchant and platform-level spend lock

- Real-time spending dashboard with analytics

- Multi-currency support (USD, GBP, EUR, NGN, and others)

- Fast funding and withdrawal options

These make Adpos a flexible payment solution for performance-driven teams that rely on ad platforms with different billing behaviors.

Perfect Card for running ads!

Key features that make Adpos different

While several virtual card providers exist, few are purpose-built for advertising payments. Its system is engineered to minimize payment declines and maximize delivery consistency.

| Feature | Descripton | Why it matters |

| Instant Card Creation | Generate and activate cards in seconds. | Keeps campaigns running without billing delays. |

| Merchant Lock | Restrict card usage to ad platforms like Facebook or Google. | Prevents misuse or off-platform charges |

| Dynamic Spend Control | Set per-card spend limits and reset cycles. | Simplifies budget tracking across multiple clients. |

| Multi-Currency Funding | Supports USD, GBP, EUR, NGN, and others. | Makes global campaign billing easier. |

| High Payment Success Rate | 98% uptime reported by users. | Reduces ad pauses due to failed transactions. |

| Team Dashboard | Manage roles, approvals, and logs. | Ideal for agencies and media buying teams. |

These are not just “nice-to-have” features; they directly impact campaign reliability.

A marketer using Adpos can launch or scale campaigns with confidence that their ad spend will go through, a vital edge when competition and timing define results.

Adpos pricing and funding model

One of the key things marketers look for in any payment solution is transparency.

Adpos structures its pricing with flexibility, allowing users to issue cards on demand and fund them instantly.

| Plan Type | Ideal For | Monthly Fee | Card Issuance Fee | Funding Fee | Notes |

| Starter | Freelancers / Small advertisers | $0 | $1 per card | 1.5% | Single-user access |

| Business | Growing agencies | $25 | $0.75 per card | 1.2% | Includes analytics dashboard |

| Enterprise | Media networks & resellers | Custom | Custom | 1% or less | API and bulk funding options |

The key advantage is that Adpos doesn’t hold funds hostage, top-ups are instant, withdrawals are fast, and the system integrates easily into ad workflows.

For agencies running multiple Facebook ads accounts, this saves hours of reconciliation time each month.

Managing Facebook ads payments with Adpos

A stable Facebook ad account funding card means your campaigns stay live without interruptions.

Before getting into the process, it’s worth clarifying the question ‘What is a Facebook ad account’. It’s the billing and management hub where advertisers control payments, campaigns, and account spending. When a payment method fails or gets flagged, that entire ad account can be paused, which often affects delivery and campaign performance.

That’s where this card system helps maintain stability by isolating risk and simplifying budget tracking.

How it works

- Create one card per ad account or campaign.

- Set a spending limit and renewal date.

- Fund through a verified source (bank or crypto-friendly options).

- Monitor real-time spend and decline logs.

This model prevents ad account suspensions triggered by charge declines, a problem that plagues many media buyers.

Example:

An agency managing 15 client accounts can assign one card to each. If a charge fails on one, it doesn’t impact the others. Facebook recognizes each card as an isolated payment method, ensuring ads continue to run smoothly.

Like Bycard, this setup includes merchant-specific locks and card-level controls but leans heavier toward ad-funding resilience, prioritizing successful transactions with Facebook’s billing systems rather than just flexibility in issuing cards.

Why advanced payment solutions matter across ad platforms

While many reviews mention virtual cards for ad payments, few explain why some solutions like Adpos perform better across different ad platforms. The difference often lies in how these systems handle stability, analytics, and integration, the core elements that keep ad delivery consistent.

Here’s what sets a strong ad payment solution apart:

- Reduced account flagging risks:

It uses a transaction pattern that mirrors legitimate payment behavior Facebook’s algorithm recognizes, helping reduce the chance of ad account suspensions triggered by failed or suspicious charges. - Deeper reporting and analytics:

Instead of lumping all spend into one figure, Adpos provides card-level analytics, revealing which campaign or buyer caused a spike in cost or decline in performance, a feature that matters across all major ad platforms. - API and automation support:

For agencies managing multiple clients, Adpos’s API allows automated card creation and renewals. This improves workflow efficiency and minimizes human error in high-volume operations. - Multi-currency flexibility:

With support for multiple currencies, users can fund ads in their preferred denomination, reducing conversion fees and ensuring stable, predictable campaign budgets.

Platforms like Bycard share similar principles, offering instant virtual card issuance, per-platform spending caps, and advanced controls that keep campaigns live while simplifying reconciliation across ad platforms.

Adpos and other ad platforms

While many advertisers first use virtual cards for Facebook Ads, the same wallet system extends across multiple ad platforms. You can issue cards for:

- Google Ads

- TikTok Ads

- Snapchat Ads

- LinkedIn Ads

Each card operates independently but draws from a single funding source. This creates a clear, centralized structure, especially useful when managing global campaigns or running A/B tests across multiple channels.

Example workflow:

A media buyer allocates $2,000 to Facebook, $1,000 to TikTok, and $500 to Google Ads, all from one wallet. Each platform gets its own card and spending cap, while reports are synced back into one dashboard for easier reconciliation and performance tracking.

Platforms like Bycard enhance this setup by allowing instant virtual card creation for each campaign or client. With per-platform spending caps, quick freeze options, and clean transaction logs, teams can maintain tighter control over costs and prevent funding errors that could pause delivery.

Conclusion

Anyone who has dealt with failed ad payments or bounced billing retries knows how quickly they can disrupt campaigns and drain budgets. Adpos tackles this challenge by combining real-time funding, merchant-specific controls, and agency-ready dashboards that keep ad accounts running smoothly and spending transparent. Its tiered plans also make it flexible, offering quick access for small advertisers and scalable options for large teams managing multiple clients.

Bycard, delivers similar advantages in tracking and instant card issuance but focuses more on simplicity and speed. In contrast, Adpos leans into consistency and account stability, making both platforms useful for different stages or sizes of advertising operations across Facebook and other ad platforms.