Old Navy Credit Card Benefits and the Best Ways to Maximize Them

The Old navy credit card is more than a way to earn discounts at Old Navy and other Gap Inc. stores, it can help you manage apparel spending efficiently while building rewards over time. Paired with tools like Bycard, which lets you create virtual cards, set spending limits, and track purchases, shoppers and small business owners can gain greater control over both personal and campaign-related expenses. Understanding how the old navy cc and old navy mastercard differ ensures you maximize rewards and keep spending organized.

- Old Navy Credit Card Benefits and the Best Ways to Maximize Them

- Understanding the Old navy credit card and who issues it

- How the Old navy credit card rewards system works

- Old navy mastercard: More flexibility, same rewards

- Comparing the store Old navy credit card vs old navy mastercard

- Why Choose Bycard for Smarter Spending Control

- How to make the most of your Old navy cc

- Old navy cc perks worth noting

- Potential downsides of the Old navy credit card

- When the Old navy credit card makes sense (and when it doesn’t)

Understanding the Old navy credit card and who issues it

The Old navy credit card is issued by Barclays US Consumer Bank, replacing the former Synchrony partnership. It’s linked to the Gap Inc. family, Old Navy, Gap, Banana Republic, and Athleta, and rewards you for shopping across all those brands.

It comes in two main forms:

- Store-only Old navy credit card: usable only at Gap Inc. stores.

- Old navy mastercard: can be used anywhere Mastercard is accepted.

Both versions help you earn points, but your earning rate and redemption flexibility depend on where you shop.

How the Old navy credit card rewards system works

Here’s the short version: the Old navy credit card earns you points for every dollar spent, and you can redeem those points for reward certificates at any Gap Inc. store.

| Spending Category | Earning Rate | Notes |

| Old Navy, Gap, Banana Republic, Athleta | 5 points per $1 | Applies to all brands in the family |

| Everyday purchases (with old navy mastercard) | 1 point per $1 | Works outside Gap Inc. stores |

| Navyist (VIP tier) | Extra bonus points & free shipping | Achieved after 5,000 points |

500 points = $5 reward. Rewards can be used in $5 increments toward future purchases, and points expire after 24 months of inactivity.

Best Card for payments!

Old navy mastercard: More flexibility, same rewards

The old navy mastercard version extends your purchasing power beyond Gap Inc. stores. It’s accepted anywhere Mastercard is, meaning you can earn points on gas, groceries, and bills.

However, non-Gap purchases only earn 1 point per dollar. So while the old navy mastercard adds convenience, it doesn’t multiply your rewards unless you’re still shopping mainly within Gap Inc.

Other perks with the old navy mastercard include:

- Contactless payments.

- Fraud protection via Mastercard’s Zero Liability policy.

- Access to Mastercard offers and experiences.

If you like simplicity and flexibility, the old navy mastercard gives you both while still keeping your loyalty tied to Old Navy rewards.

Comparing the store Old navy credit card vs old navy mastercard

| Feature | Old Navy Credit Card | Old Navy Mastercard |

| Where you can use it | Only at Old Navy, Gap, Banana Republic, Athleta | Anywhere Mastercard is accepted |

| Earning rate at Old Navy & Gap Inc. | 5 points per $1 | 5 points per $1 |

| Earning rate elsewhere | — | 1 point per $1 |

| Issuer | Barclays US Consumer Bank | Barclays US Consumer Bank |

| Foreign transaction fee | 3% (on Mastercard) | 3% |

| APR | Variable (around mid-20s) | Variable (around mid-20s) |

| Annual fee | $0 | $0 |

| Perks | In-store rewards, VIP upgrade | Global acceptance, Mastercard extras |

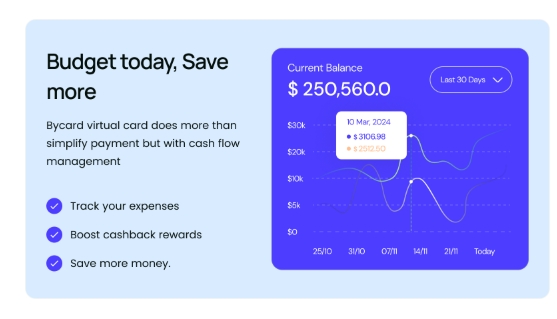

Why Choose Bycard for Smarter Spending Control

Bycard isn’t a store card, it’s a virtual card and expense control platform designed for people and teams who want flexibility beyond loyalty programs.

Unlike the Old Navy credit card, which rewards purchases at select retail brands, Bycard focuses on helping you manage, monitor, and protect your payments across all merchants.

With Bycard, you can:

- Create instant virtual cards for online shopping, subscriptions, or team expenses.

- Set individual spending limits and expiration dates to prevent overspending.

- Lock and unlock cards instantly for better payment security.

- Upload receipts automatically and track every transaction in one dashboard.

- Fund cards in multiple currencies or crypto, ideal for global or cross-border use.

Whether you’re running marketing campaigns, managing budgets, or just want tighter control over personal or team purchases, Bycard gives you full visibility without the risk of carrying debt or paying high APRs.

How to make the most of your Old navy cc

Whether you hold the store card or the old navy mastercard, these practical steps ensure you get maximum value:

- Apply during promotions: You’ll often get 20–30% off your first purchase.

- Pay off your balance monthly: APR hovers in the mid-20s, too high for carrying debt.

- Track your points: Redeem rewards in $5 increments before they expire.

- Use your old navy cc strategically: Keep it for clothing purchases and sales seasons.

- Upgrade to Navyist (VIP): Once you earn 5,000 points, you get extra benefits like free shipping, special sales, and bonus points.

This is where the Old navy credit card shifts from a store gimmick to a real money-saver, if used intentionally.

Old navy cc perks worth noting

The old navy cc offers a few additional benefits under the Navyist Rewards program:

- Free 3–5 day shipping on qualifying orders.

- Bonus points events several times per year.

- Early access to new product launches.

- Free basic alterations at Banana Republic (in some versions).

- Priority customer service support.

Potential downsides of the Old navy credit card

Even though the Old navy credit card looks appealing for frequent shoppers, a few points to consider before applying:

- High APR: A variable rate around 25–27% can cancel out all rewards if you carry balances.

- Limited redemption: Rewards are only redeemable within Gap Inc. brands.

- Foreign transaction fee: Around 3% on the old navy mastercard when used abroad.

- Points expiration: 24-month limit on unused points.

So the card works best when you shop consistently and pay your balance in full every month.

When the Old navy credit card makes sense (and when it doesn’t)

It makes sense if:

- You shop at Old Navy, Gap, or Athleta multiple times a year.

- You want to stack in-store promotions and cardholder discounts.

- You pay off balances on time.

It doesn’t make sense if:

- You don’t shop Gap Inc. brands regularly.

- You prefer cash-back or travel rewards that are more flexible.

- You carry balances and pay interest monthly.

For most shoppers, the Old navy credit card is a great secondary card, not your primary spending tool.

Conclusion

The Old navy credit card works well for loyal shoppers who regularly buy from Old Navy or other Gap Inc. brands, helping you stack discounts, earn free shipping, and build simple rewards over time. The old navy mastercard adds more flexibility by extending those perks to everyday spending outside the store.

For anyone who also manages team purchases, online ads, or small business expenses, pairing your old navy cc with Bycard’s virtual-card system can streamline how you track and control fashion-related spending. You keep earning your Old Navy rewards while gaining tighter budget oversight and faster reconciliation.