Payment Service Provider: How They Make Transactions Easier

A Payment service provider(PSP) connect businesses, customers, and financial networks to make transactions fast and secure. They enable merchants to accept various payment methods, manage subscriptions, and process cross-border transactions with ease.

The global PSP market, valued at over $100 billion in 2024, reflects the growing shift toward digital and mobile payments. By managing tasks like authorization, fraud checks, and settlements, PSPs help businesses maintain steady cash flow and deliver smooth payment experiences.

Bycard represents this new wave of practical PSPs. With tools for multi-currency processing, real-time reporting, and simple onboarding, Bycard allows businesses to start accepting payments quickly while staying organized and secure.

Understanding Payment Service Providers

A payment service provider facilitates online or in-person payments on behalf of merchants. Unlike traditional banks, PSPs handle the technical side of processing transactions, including authorization, security checks, and fund settlement. By simplifying these processes, PSPs allow businesses to focus on their core operations rather than financial logistics.

Popular PSPs like Bycard combine payment processing with features such as analytics and subscription management, helping businesses monitor transactions more effectively.

How A Payment Service Provider Operate

Payment service providers operate behind the scenes to ensure every transaction is processed securely. A typical process includes:

- Customer Initiates Payment: Choosing a payment method, card, digital wallet, or bank transfer, and entering details.

- Payment Authorization: The PSP confirms payment with the bank or network.

- Fraud and Security Checks: Encryption and fraud detection measures protect businesses and customers.

- Settlement: Funds are transferred to the merchant’s account, usually within hours to days.

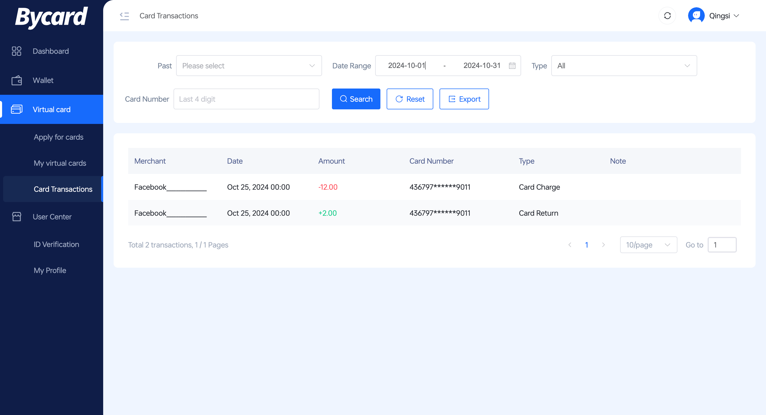

Bycard follows a similar structure, offering real-time transaction tracking and secure processing. Features like dashboards and multi-currency support simplify reconciliation and reporting for businesses.

Bycard in the Payment Service Provider Landscape

Bycard stands out as a modern PSP that balances efficiency, security, and accessibility. Its onboarding process is designed to minimize setup time, allowing businesses to start accepting payments quickly. Rather than overwhelming users with complex procedures, Bycard provides a streamlined registration process, verification, and account activation, giving merchants immediate access to essential tools.

Once onboarded, businesses gain operational visibility through Bycard’s real-time dashboards. These dashboards display all active transactions, subscription payments, and revenue trends, enabling merchants to monitor cash flow and detect irregularities quickly. Multi-currency support allows businesses to accept payments globally, while virtual cards and spending controls provide flexibility and security when managing multiple vendors or recurring payments.

Bycard’s onboarding and operational features translate directly into practical business outcomes. Small businesses and freelancers can reduce administrative overhead, track finances efficiently, and scale operations without delays. For example, an e-commerce store can manage subscription-based products while monitoring revenue in multiple currencies, and a freelancer can accept international payments securely without complex banking processes. These features demonstrate how Bycard supports operational efficiency and business growth in a real-world context.

Benefits of Using a Payment Service Provider

Using a PSP provides more than just payment processing, it directly impacts business efficiency and decision-making.

- Faster Onboarding: Bycard’s simplified signup process allows businesses to start accepting payments quickly, reducing downtime and speeding up revenue generation.

- Operational Visibility: Real-time dashboards and reporting give merchants insight into revenue trends, recurring billing, and transaction history, enabling better financial management.

- Efficiency and Security: Transactions are processed quickly with advanced fraud detection and encryption, ensuring both business and customer protection.

- Global Reach: Multi-currency support allows businesses to accept international payments without complex banking procedures.

- Cash Flow Optimization: Faster settlements and operational insights help businesses plan, budget, and scale efficiently.

Bycard combines these benefits with practical tools that reduce setup friction and simplify day-to-day payment management, allowing businesses to focus on growth, customer experience, and operational efficiency.

Key Features of Payment Service Providers

Payment service providers (PSPs) offer a range of features designed to simplify payments and improve business operations. Most PSPs, including Bycard, provide the following core functionalities:

1. Multiple Payment Methods

PSPs support a variety of payment options, including credit and debit cards, digital wallets, and bank transfers. This flexibility allows businesses to meet customer preferences and reduce abandoned transactions.

2. Security Measures

Security is a critical aspect of any PSP. Features such as encryption, two-factor authentication, and PCI DSS compliance protect sensitive payment data. Bycard enhances security with real-time fraud detection, transaction monitoring, and the ability to set spending limits on virtual cards. These measures give merchants confidence that both their funds and customers’ information are protected.

3. Reporting and Analytics

Detailed reporting and analytics help businesses make informed decisions. PSP dashboards provide insights on transaction volumes, revenue trends, payment success rates, and customer behavior. Bycard’s reporting tools allow businesses to generate actionable insights, identify patterns in spending, and reconcile accounts efficiently. This operational visibility is especially valuable for SMEs managing multiple revenue streams or subscription-based services.

4. Recurring Payments and Subscription Management

Many businesses offer ongoing services or subscription models, requiring reliable recurring payment capabilities. PSPs support automated billing and management of recurring transactions, reducing administrative overhead and minimizing missed payments.

5. Multi-Currency Support

Global commerce demands PSPs that can handle multiple currencies. Bycard allows businesses to process payments in different currencies without the need for complex banking arrangements, simplifying international sales and expanding market reach.

6. Operational Dashboards and User Controls

Beyond transactions, PSPs like Bycard offer operational dashboards that give merchants full control over their accounts. Users can monitor payments in real time, manage multiple virtual cards, set budgets, and generate reports for accounting or business planning. These features save time, reduce errors, and improve overall operational efficiency.

By integrating these features into a single platform, Bycard ensures that businesses of all sizes can manage payments seamlessly, maintain financial visibility, and deliver a smooth customer experience.

Considerations When Choosing a Payment Service Provider

Providers like Bycard emphasize transparency in pricing and ease of integration, helping businesses make informed decisions.

Businesses should consider factors such as:

- Transaction Fees: Vary by provider and payment method.

- Integration Options: How easily the PSP connects with existing systems.

- Support and Reliability: Availability of customer service and uptime guarantees.

- Regulatory Compliance: Adherence to regional and international standards.

Trends and the Future of Payment Service Providers

The PSP industry continues to evolve with trends such as:

- Real-Time Payments: Faster settlements for businesses and consumers.

- Cross-Border Transactions: Simplified global payments with currency conversion.

- AI-Powered Fraud Detection: Advanced tools to prevent unauthorized transactions.

- Mobile-First Solutions: Optimized for digital wallets and mobile payments.

Conclusion

Payment service providers are central to modern commerce, simplifying transactions for businesses and consumers alike. Bycard demonstrates how PSPs can combine security, speed, and accessibility, offering practical solutions for businesses looking to streamline operations and expand globally. Understanding the role of PSPs and evaluating options carefully can make a significant difference in business efficiency and growth.