Payment Rails: What Payment Rails Are and How to Select the Right System for Your Transactions

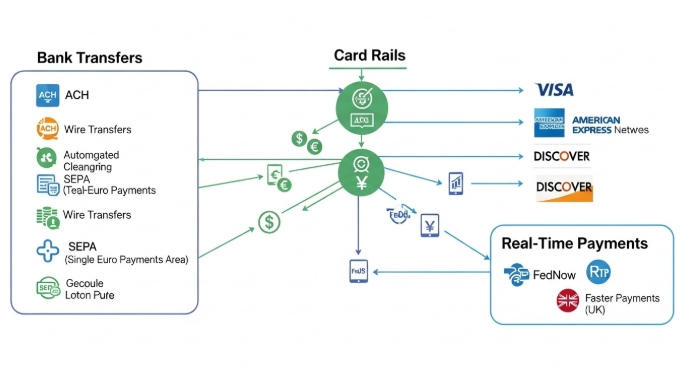

Payment rails are the networks that move money from one party to another, forming the backbone of every transaction. From paying vendors and managing subscriptions to sending international payouts or handling digital ad spend, the rails a business chooses affect speed, cost, and reliability.

Different types of payment rails suit different needs, some are built for instant transfers, others for low-cost high-volume payments, cross-border flexibility, or even virtual and crypto-enabled transactions. Knowing how these systems work helps businesses make smarter choices for their payments and financial operations.

What Are Payment Rails?

Think of payment rails as the highways and financial networks that money travels on. When you pay a vendor, settle a subscription, or send funds internationally, that money doesn’t teleport, it moves through systems that handle authorization, settlement, and security.

Each type of rail has unique characteristics: speed, fees, regional coverage, and infrastructure requirements. Some rails are built for instant transfers, others for low-cost volume, some for cross-border flexibility, and others for integrating with newer technologies like crypto or virtual wallets. Knowing the differences helps you make better financial decisions.

Types of Payment Rails

| Type of Payment Rail | Examples / Typical Usage | Settlement Time | Strengths | Tradeoffs |

| Bank-transfer rails | ACH (U.S.), SEPA (Euro-zone), local bank rails | 1–3 business days; faster with instant options | Low-cost, reliable for payroll, subscriptions, vendor payments | Slower than instant rails; limited cross-border reach |

| Card rails | Visa, Mastercard, Verve | Instant authorization; settlement 1–3 days | Global acceptance, convenience for e-commerce and subscriptions | Interchange fees, chargeback risk |

| Real-time / instant rails | RTP (U.S.), PIX (Brazil), UPI (India) | Seconds or near-instant | Speed; ideal for marketplaces, gig economy, urgent payouts | Not available everywhere; adoption varies |

| Cross-border rails | SWIFT, Visa Direct, Wise | Hours to days | Global reach, multi-currency support | FX costs, regulatory requirements, slower settlement |

| Mobile-money / wallet rails | Mobile wallets, regional digital wallets | Instant (within ecosystem) | Useful in regions with limited banking; easy P2P payments | Limited acceptance outside ecosystem; cash-out delays |

| Virtual-card / prepaid rails | Virtual cards, prepaid wallets | Depends on underlying rail | Great for spend control, ad campaigns, subscriptions; instant issuance | Card-network fees; acceptance limits |

| Blockchain / crypto rails | Stablecoins, token-based transfers | Seconds to minutes | Low-cost, programmable, borderless transfers | Regulatory and compliance complexity; volatility risk |

Why Payment Rails Matter

Choosing the right payment rails can make a noticeable difference in operations. For instance, a company processing thousands of transactions monthly could save 20–30% in fees by using a mix of cost-effective rails for routine payments and faster rails for urgent payouts.

Speed isn’t just about convenience. In marketplaces or gig-economy businesses, instant payments improve trust and satisfaction. On the other hand, slower but low-cost rails are perfect for payroll or recurring vendor payments where timing isn’t critical.

Payment rails also influence fraud prevention and compliance. Card networks often have strong built-in protections, while real-time rails may rely more on verification and secure APIs. International transactions require careful consideration of regulations, FX rates, and settlement transparency.

How to Select the Right Payment Rail

Choosing the right payment rail depends on your business model, transaction type, and operational priorities. The table below maps common business needs to recommended rails:

| Business Need | Recommended Rail |

| Subscription billing | Card rails for recurring payments |

| Marketplace or gig payouts | Real-time rails for instant transfers |

| Global vendor payments | Cross-border rails with multi-currency support |

| High-volume microtransactions | Instant rails or low-fee bank transfers |

| Treasury optimization | Blockchain / stablecoin rails for programmable payments |

When evaluating payment rails, consider these key factors:

- Speed: Do you need instant payments or can you accommodate batch settlements?

- Fees: Typical costs vary, ACH ~$0.20–$1, card rails 1.5–3.5%, cross-border 3–7%.

- Geographic coverage: Not all rails are available in every region.

- Integration: Check API access, reporting capabilities, and reconciliation tools.

- Fraud & compliance: Ensure the rail aligns with your risk exposure and regulatory requirements.

Bycard: A Modern Virtual‑Card Solution on Payment Rails

Bycard is a fintech platform that leverages modern payment rails to simplify payments and expense management. Key features and strengths include:

- Instant Virtual Card Issuance: Create virtual cards in minutes, no waiting for physical cards or long approvals.

- Spending Control: Set spending limits, lock/unlock cards, and assign them for specific vendors or purposes (e.g., ad campaigns, subscriptions, vendor payments).

- Multi-Currency & Crypto Top-Ups: Fund cards with traditional currencies or stablecoins like USDT for seamless international and digital payments.

- Global Acceptance: Backed by Visa/Mastercard rails, making cards widely accepted online and internationally.

- Expense Management Tools: Track bills, receipts, and expenses in real-time; reconcile payments efficiently.

- Campaign & Digital Spend Support: Dedicated cards per ad campaign simplify budgeting, tracking, and reporting.

Strengths of Bycard on Payment Rails:

- Fast onboarding and instant card issuance.

- Strong control and security for spend management.

- Multi-currency support for global operations.

- Integrated tracking, reporting, and reconciliation features.

Considerations:

- Standard card network fees (interchange or foreign-currency charges) may apply.

- Virtual cards rely on underlying card networks, which can limit acceptance in certain regions.

- Large payments may still be more cost-effective via traditional bank rails.

When to Choose Modern Payment Rails for Your Transactions

- Ad spend & marketing campaigns: Isolate budgets per campaign, simplify reporting

- Subscription-heavy services / SaaS: Prevent overbilling by assigning cards per subscription

- Freelancers & remote teams: Pay contractors globally without local bank accounts

- Small businesses / e-commerce: Streamline international vendor payments

- Budget-conscious firms: Set limits, track spend, and control expenses in real-time

Bycard effectively combines the flexibility of fintech with the reliability of global payment rails, giving businesses agility, control, and visibility over their transactions.

How Payment Rails Are Evolving

- Universal real-time rails connecting multiple countries

- Programmable payments triggered by smart contracts

- AI-powered fraud detection and risk scoring

- Hybrid rails integrating traditional banking, card networks, and blockchain

Businesses that adapt early can reduce costs, improve efficiency, and stay competitive.

Perfect Card for running ads!

Conclusion

Payment rails are the backbone of modern finance. Choosing the right rails—and pairing them with tools like Bycard, can enhance speed, reduce fees, ensure compliance, and improve financial control.

Bycard isn’t just a card issuer, it leverages global payment rails with instant virtual cards, multi-currency support, and expense management features, making it a practical solution for businesses handling ad spend, subscriptions, vendor payments, or global operations.