Cash Management: How Businesses Can Stay Liquid and In Control.

If you run a business, you already know that making sales is only half the story. What keeps your operations alive is your ability to control how money moves in and out of your business. That’s where cash management comes in, the quiet but powerful engine behind every stable and growing company.

Good cash management helps you meet obligations on time, plan confidently, and seize opportunities when they show up. If you are handling daily expenses, saving for expansion, or just keeping your business liquid, understanding the flow of money is key.

- Cash Management: How Businesses Can Stay Liquid and In Control.

- Why Cash Management Matters for Every Business

- The Core Pillars of Cash Management

- Common Cash Flow Management Challenges and How to Tackle Them

- How Different Businesses Approach Cash Management

- Managing Cash Flow More Efficiently with Bycard

- Creating a Strong Cash Management Strategy for Long-Term Growth

- Simple Habits for Stronger Cash Management

Why Cash Management Matters for Every Business

Cash management isn’t just a financial term; it’s a survival skill for business owners. It covers everything from how you handle cash flow management to how you maintain a cash reserve and ensure overall liquidity.

Without strong cash management, even profitable businesses can face trouble. A company might show impressive revenue on paper but still struggle to pay salaries or suppliers if cash flow management is irregular. Maintaining a steady rhythm between what comes in and what goes out keeps your operations running smoothly and helps you avoid unnecessary borrowing.

For small and medium businesses, this can be the difference between scaling successfully and shutting down early. The ability to monitor liquidity, plan a solid cash reserve, and stay proactive about cash flow management defines how resilient your business will be in the long run.

The Core Pillars of Cash Management

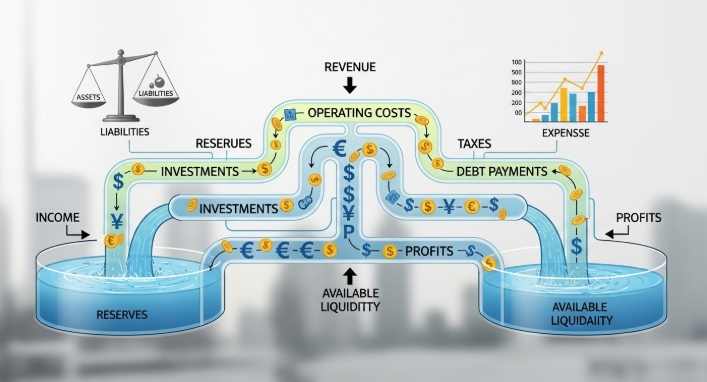

Effective cash management rests on three major components: cash flow, cash reserve, and liquidity. These three work together to help you anticipate challenges, maintain flexibility, and make strategic moves confidently.

Tracking and Optimizing Cash Flow

Your cash flow management shows how money enters and leaves your business. It tells you if your business can cover day-to-day expenses without delay. Managing cash flow effectively means understanding when payments come in, when bills go out, and how long you can keep the balance in your favor.

Businesses that prioritize cash flow management tend to make decisions more confidently. They know when to reinvest, when to hold back, and how to maintain control even in uncertain seasons. The more you know about your inflows and outflows, the easier it is to spot potential shortfalls and act before they become major issues.

Building and Maintaining a Cash Reserve

A cash reserve is your financial safety net; the money you set aside to cushion your business from unexpected expenses or downturns. Whether it’s a sudden equipment repair, a delayed client payment, or a slow sales month, your cash reserve keeps your business stable.

The goal isn’t just to have extra money sitting idle, but to plan how much should go into your reserve and when to use it. Many experts recommend setting aside enough to cover three to six months of operating costs, but even a modest reserve can make a difference in emergencies. Having that backup builds confidence and ensures your cash management plan remains effective under pressure.

Ensuring Liquidity at All Times

Liquidity measures how easily your assets can be turned into cash. A business might own valuable equipment or inventory, but if it can’t be converted to cash quickly, it can’t help you meet urgent payments. Maintaining liquidity ensures that your business can pay suppliers, employees, and bills without delay.

The balance lies in keeping enough liquid assets to stay flexible while still investing in growth. This balance is one of the most practical signs of healthy cash management.

Perfect Card for managing your business cash flow!

Common Cash Flow Management Challenges and How to Tackle Them

Even with the best intentions, many businesses run into common pitfalls when managing cash flow and liquidity. Late client payments, unexpected expenses, or inaccurate forecasting can all disrupt your plans.

When cash flow management tightens, some businesses resort to high-interest loans or delay supplier payments, but those short-term fixes often create bigger problems later. The better route is to build systems that give you visibility and control.

Tracking your inflows and outflows weekly, automating invoices, and separating your cash reserve from your operational funds are all practical ways to improve cash flow management. Over time, these small adjustments build stronger liquidity and reduce stress when financial surprises happen.

How Different Businesses Approach Cash Management

Cash management takes different shapes depending on the size and structure of a business. What a small startup prioritizes for survival isn’t the same as what a large company optimizes for growth. But across the board, the same foundations, strong cash flow, a reliable cash reserve, and healthy liquidity, remain essential.

Small Businesses: Staying Cash Flow Positive

For small business owners, cash management is often about immediate control. Most focus on daily cash flow management and maintaining enough liquidity to meet short-term expenses like payroll, rent, or supplier payments.

A consistent challenge here is visibility, many rely on manual tracking or delayed reporting, which makes managing cash flow reactive instead of strategic. Even a simple improvement, like reviewing cash inflows weekly and keeping a dedicated cash reserve, can stabilize operations and prevent cash shortages.

Mid-Sized Companies: Building a System for Liquidity

Mid-sized businesses typically move from survival to structure. They begin to integrate tools that automate cash flow tracking, manage liquidity across accounts, and set aside defined percentages for their cash reserve.

At this stage, the focus shifts from just “having cash available” to optimizing how that cash is used. Managing cash flow efficiently allows these businesses to invest confidently, negotiate better supplier terms, and reduce their dependency on external financing.

Large Enterprises: Strategic Cash Management at Scale

For large organizations, cash management becomes part of strategic planning. They track multiple layers of cash flow, maintain diverse liquidity sources, and align their cash reserves with long-term forecasts.

These companies often monitor key performance indicators tied to liquidity, ensuring their assets can be quickly converted to cash if needed. The goal isn’t only to stay liquid but to ensure every unit of cash supports broader business objectives.

That’s why more business owners are embracing digital tools like Bycard, to simplify how they monitor cash flow, manage liquidity, and build stronger cash reserves without losing sight of day-to-day operations.

Managing Cash Flow More Efficiently with Bycard

While traditional methods like spreadsheets can help, digital tools have made cash management far simpler and more transparent. This is where Bycard comes in, offering business owners a more efficient way to stay on top of their finances.

Bycard helps you see your cash flow in real time, track spending patterns, and plan ahead with greater accuracy. With its simple interface, you can set goals for your cash reserve, monitor your liquidity, and manage payments all in one place.

Instead of juggling multiple systems, Bycard streamlines cash flow management so you can focus on strategy rather than spreadsheets. For growing businesses, that clarity makes decision-making easier and helps avoid unnecessary financial strain.

Creating a Strong Cash Management Strategy for Long-Term Growth

No matter the size of your business, building a long-term cash management plan keeps you ahead of uncertainty. A strategy built around consistency, control, and awareness ensures that your business can respond to change without losing momentum.

Reviewing Cash Flow Regularly

Regularly reviewing your cash flow helps you spot trends and prepare for seasonal shifts. Maybe certain months bring slower income or higher expenses, adjusting ahead of time can prevent cash shortages. Frequent reviews also make managing cash flow less reactive and more strategic.

Protecting Your Liquidity

Liquidity protection means keeping quick access to funds. That might mean balancing how much you store in your main account versus your reserve or using short-term instruments that can be easily liquidated. Healthy liquidity ensures you never miss opportunities or struggle to cover unexpected costs.

Strengthening Your Cash Reserve

Think of your cash reserve as a dynamic safety net, it should grow as your business grows. Revisit it every few months to adjust the amount based on your revenue, expenses, and future goals. This habit ensures your cash management plan scales with your business and remains practical, not rigid.

Simple Habits for Stronger Cash Management

- Review cash flow weekly

- Keep your liquidity flexible

- Build a cash reserve that covers at least three months of expenses

- Separate operational and reserve funds

- Use Bycard to simplify cash flow management

These small habits build consistency, and consistency builds financial strength.

Conclusion

Good cash management isn’t about hoarding money; it’s about keeping your business flexible, informed, and ready. When your cash flow, liquidity, and cash reserve are balanced, you can navigate slow months, plan expansions, and make confident moves without second-guessing your financial position.

Bycard makes that process smoother by giving you real-time visibility, better control, and reliable tools for managing cash flow. Whether you’re tightening your systems or scaling up, Bycard helps you stay in charge of your money, and by extension, your business’s future.