Practical Tips on How to Manage Money and Have Financial Control

Managing finances can feel overwhelming, but learning how to manage money effectively is essential for financial stability and long-term growth. From understanding your income to building wealth, solid money management strategies help you make informed decisions, reduce stress, and prepare for the future. With the right structure, habits, and tools like Bycard, you can simplify everyday financial tasks, track your spending, and stay in control of your goals with confidence.

- Practical Tips on How to Manage Money and Have Financial Control

- Understanding Your Income and Expenses: The Foundation of Money Management

- Budget Creation: Concrete Steps for Better Money Management

- Tracking Spending and Adjusting Your Budget

- Savings and Emergency Funds: Protecting Your Financial Stability

- Managing Debt While Building Financial Security

- Beyond Stabilization: Investing and Wealth Building

- Handling Irregular Income: Special Money Management Tips

- Tools and Apps for Money Management

- Effective Money Management Made Simple with Bycard

- Money Behavior: Mindset, Habits, and Psychological Factors

Understanding Your Income and Expenses: The Foundation of Money Management

Understanding how to manage money starts with clarity, knowing exactly what comes in and what goes out. List all your income sources, from your salary to freelance work, side hustles, or passive earnings, and then track every expense, including bills, groceries, subscriptions, and everyday spending. Categorize these expenses into fixed and variable costs, or wants versus needs, to see where your money truly goes. Using a spending tracker or tools like Bycard at this stage can uncover hidden patterns and make money management more intentional. In fact, studies show that people who monitor their expenses closely are 50% more likely to stick to a budget, a simple habit that builds the foundation for financial stability and long-term growth.

Budget Creation: Concrete Steps for Better Money Management

A well-structured budget is at the heart of how to manage money effectively. It gives your finances direction, helps you stay accountable, and ensures your spending aligns with your goals. Using core money management principles, you can build a plan that reflects your real income and priorities rather than guesswork. And since a budget is never static, pairing it with a spending tracker lets you compare planned versus actual spending, making adjustments that keep you realistic, flexible, and in control.

- List your bills: rent, utilities, loans, and essential subscriptions.

- Categorize spending: food, transportation, entertainment, savings.

- Set targets: define limits for each category based on income.

- Prioritize essentials: ensure needs are covered before wants.

Tracking Spending and Adjusting Your Budget

Monitoring your budget is as crucial as creating one. Using a spending tracker regularly helps you stay on top of your finances.

- Weekly check-ins: review categories to spot overspending.

- Adjust allocations: move funds from underused categories to areas where overspending occurs.

- Automate tracking: apps and tools simplify daily monitoring and reduce errors.

Consistent use of a spending tracker builds a clear understanding of cash flow, which is a key principle in money management.

Savings and Emergency Funds: Protecting Your Financial Stability

Even with a strong budget, unexpected expenses can still appear, a medical bill, job change, or urgent repair. That’s why effective money management goes beyond tracking and budgeting to include savings and an emergency fund. Building this safety net makes how to manage money less stressful, protects you from debt, and helps you stay focused on long-term goals instead of short-term crises.

- Aim to save 3–6 months of expenses in an emergency fund.

- Separate funds for short-term and long-term goals.

- Use automatic transfers to ensure consistency.

Managing Debt While Building Financial Security

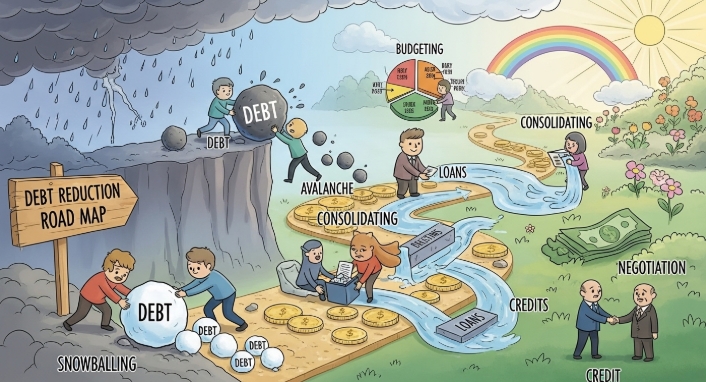

Debt management is a crucial part of learning how to manage money effectively. Unchecked debt can quickly undo even the best money management efforts, draining savings and creating unnecessary stress. Start by prioritizing high-interest debts, such as credit cards or payday loans, since they grow the fastest. Apply structured repayment methods like the debt snowball, tackling the smallest balances first for motivation, or the debt avalanche, which targets the highest interest rates for maximum savings. Use a spending tracker to monitor payments, track progress, and avoid missed deadlines. Managing debt with this kind of discipline not only complements your savings plan but also strengthens your overall financial stability.

Beyond Stabilization: Investing and Wealth Building

Once your finances are stable, focus on growing your wealth. Investing is a key step in advanced money management.

- Explore stocks, mutual funds, and retirement accounts.

- Reinvest earnings to compound growth over time.

- Regularly review investments as part of your spending tracker and budget adjustments.

Learning how to manage money beyond day-to-day stability allows you to build long-term wealth systematically.

Handling Irregular Income: Special Money Management Tips

For freelancers, entrepreneurs, or anyone with irregular income, learning how to manage money means building flexibility into your plan. Since income can fluctuate from month to month, having a system that adapts helps you stay steady through both high and low periods. Using intentional money management strategies and a reliable spending tracker allows you to visualize trends, prepare for lean months, and make smart decisions when earnings are strong, keeping your finances balanced and predictable over time.

- Estimate the lowest expected monthly income for budgeting.

- Allocate excess income in high-earning months to savings or debt reduction.

- Use a spending tracker to visualize trends and predict cash flow.

Tools and Apps for Money Management

Automation simplifies how to manage money, helping you save time, stay consistent, and reduce the chances of financial slip-ups. With the right tools, you can make budgeting, tracking, and saving almost effortless while still keeping control of your decisions.

- Bycard: Bycard offers a complete ecosystem for digital payments and expense control. You can automate transfers, manage recurring payments, and create separate virtual cards for bills, subscriptions, or personal spending

- Mobile budgeting apps: categorize expenses, set alerts, and monitor goals.

- Digital wallets: reduce dependence on cash and create a transparent record of your transactions. They help with tracking daily spending, simplifying bill payments, and supporting international transactions, especially valuable for freelancers or remote workers managing multiple currencies.

When you combine these digital tools, automation turns into a silent financial partner, handling routine tasks, minimizing errors, and freeing you to focus on what truly matters: long-term financial growth and peace of mind.

Effective Money Management Made Simple with Bycard

Using Bycard alongside your spending tracker ensures every dollar is accounted for, simplifies reconciliation, and helps you stick to a plan. It’s a practical companion for building financial stability, reducing stress, and eventually moving toward wealth-building goals.

- Virtual Cards: Create multiple virtual cards for bills, subscriptions, or personal spending. This helps separate categories and prevents overspending.

- Expense Tracking and Reporting: Automatically track transactions, categorize expenses, and generate detailed reports, perfect for keeping your spending tracker up to date.

- Budget Management: Set limits for each spending category and get notifications when you approach them. This keeps your budget realistic and actionable.

- Bill Payments: Pay recurring bills directly from Bycard and monitor due dates in one dashboard, reducing the risk of missed payments.

- Multi-Currency Support: Manage multiple currencies if you earn or spend internationally, making money management seamless for freelancers, remote workers, or frequent travelers.

- Automation Features: Automate savings transfers, payments, and reporting to maintain discipline without the manual effort.

Money Behavior: Mindset, Habits, and Psychological Factors

Financial habits and mindset play a major role in how to manage money. Being mindful of impulse purchases and tracking them with your spending tracker helps you stay aware of spending patterns. Establishing consistent routines for budgeting, saving, and reviewing expenses reinforces discipline and keeps your finances on track. It’s equally important to recognize emotional triggers for overspending and address them proactively. By understanding these behavioural patterns, you strengthen your money management practices and create lasting results that make financial control more sustainable and stress-free.

Perfect Card for running ads!

Conclusion

Mastering how to manage money is about building awareness, creating structure, and maintaining consistent habits. Start by understanding your income and expenses, then design a budget that aligns with your financial goals. Track spending diligently using a spending tracker and leverage tools like Bycard to automate payments, manage virtual cards, and monitor your progress. Prioritize savings, maintain an emergency fund, manage debt responsibly, and gradually explore investing to grow your wealth. With intentional planning and the right tools, effective money management becomes a sustainable part of everyday life.