Cost Control Strategies Every Expenses Business Needs to Stay Profitable

Cost control keeps businesses profitable even as inflation eats into margins and operational costs climb. Many organizations struggle not because of overspending, but because they lack visibility. Tools like Bycard provide real-time spend tracking, enforce limits on employees and departments, and automate reconciliation to stop leaks before they occur.

At its core, cost control isn’t about limiting growth or cutting staff, it’s about aligning every expense with your company’s goals. With tools like Bycard, businesses can monitor every transaction, enforce spending policies, and optimize business expenses without slowing operations. Whether you run a startup or a multinational, adopting structured cost management practices, and leveraging Bycard’s automation and expense controls, can be the difference between scaling efficiently or burning through resources.

- Cost Control Strategies Every Expenses Business Needs to Stay Profitable

- Why Cost Control Matters for Every Business Expenses

- Practical Strategies for Effective Cost Management

- Expense Control Made Easy with Real-Time Automation

- Common Mistakes in Cost Management and How to Avoid Them

- How Bycard Simplifies Cost Control for Business Expenses

- Turning Cost Control into a Growth Strategy

Why Cost Control Matters for Every Business Expenses

Rising vendor rates, logistics costs, and employee reimbursements all pile up fast. A Deloitte study found that poor visibility into business expenses can inflate total spend by up to 20%, simply because companies don’t track small leaks effectively.

Cost control allows businesses to stay lean and profitable by knowing where money is going and why. When done right, it fuels better pricing, smarter hiring, and stronger margins.

The goal isn’t to reduce spending at all costs, it’s to make every naira or dollar spent contribute to something measurable. That’s the core principle of strong cost management.

For example, instead of slashing the marketing budget, cost control helps you identify which campaigns drive the highest return. Instead of cutting travel, it lets you see which trips actually close deals. With structured expense control, you empower teams to spend responsibly, without micromanagement.

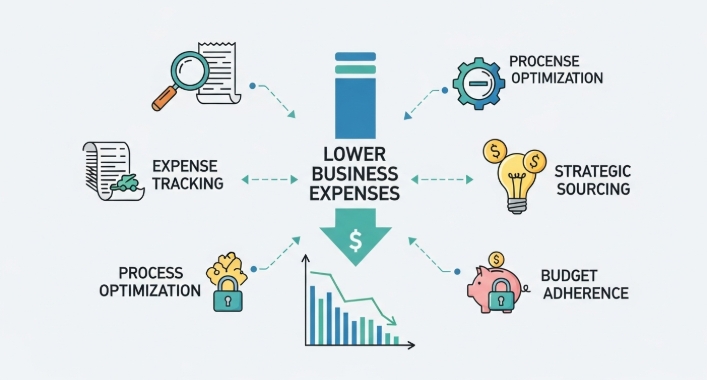

Practical Strategies for Effective Cost Management

Building a culture of cost control starts with visibility and accountability. Below are practical, proven strategies used by companies leading in cost management today:

1. Budget Forecasting and Variance Tracking

Create flexible budgets that adjust to actual performance. Track monthly variances between planned and actual spend, this keeps business expenses transparent and accountable.

2. Automated Expense Control Systems

Manual spreadsheets and delayed reconciliations are outdated. Automation tools bring expense control in real-time, capturing every transaction as it happens. You can set category-based limits, approval chains, and instant alerts for unusual activity.

3. Set Departmental Spending Policies

Not all teams spend equally. Setting department-based thresholds for expense control ensures no team overspends while others are underfunded.

4. Measure What Matters

Track metrics like Cost-to-Revenue Ratio, Expense-to-Sales, and Cash Flow Coverage. These metrics give context to your cost management strategy and help executives make informed choices.

When teams understand how their spending impacts overall goals, cost control stops feeling restrictive and becomes a shared responsibility.

Expense Control Made Easy with Real-Time Automation

Traditional expense management relied on spreadsheets and end-of-month reconciliations. Today, it’s all about real-time expense control.

Modern businesses are embracing automation tools that categorize, monitor, and analyse spending the moment it happens.

On Reddit, many finance managers discuss the frustration of delayed reporting, waiting weeks to discover budget overruns. Automation solves that. By connecting spend to live dashboards, companies instantly see where every dollar goes.

This level of transparency also strengthens cost management culture across departments. Employees spend more consciously when they know expenses are tracked in real-time, and managers can reallocate resources based on live data rather than outdated reports.

Automated expense control not only saves time but also eliminates human error and fraud, making expense control more precise, faster, and more reliable.

Common Mistakes in Cost Management and How to Avoid Them

While most businesses agree on the importance of cost control, many still fall into these common traps:

Over-cutting essential areas

Slashing budgets in marketing or R&D can hurt growth. Effective cost management identifies inefficiencies, not essential investments.

Ignoring Small, Recurring Expenses

Software subscriptions, late fees, and duplicate tools drain budgets quietly. These “invisible” business expenses can add up to thousands monthly if left unchecked.

Weak Policy Communication

If employees don’t understand the company’s expense control policy, even the best system fails. Training and clear documentation make all the difference.

No Collaboration Between Finance and Operations

Finance shouldn’t work in isolation. Cost control is most effective when teams align budgets with goals, ensuring decisions support both efficiency and growth.

How Bycard Simplifies Cost Control for Business Expenses

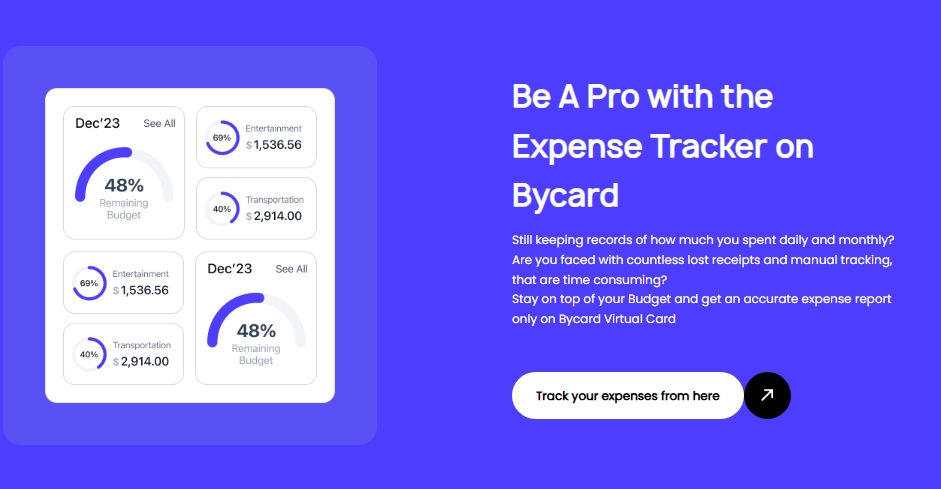

Among the top innovations in cost control, Bycard stands out as a platform built for modern financial teams. Unlike traditional tools that only track spending after the fact, Bycard gives businesses real-time power over cost management and expense control.

Here’s how Bycard transforms business expense tracking into a strategic advantage:

- Instant Visibility: Every transaction, whether it’s a marketing ad payment or team lunch, shows up instantly on the dashboard.

- Smart Spend Limits: Set predefined rules for departments or employees, ensuring expense control without slowing down workflow.

- Automated Reconciliation: No more chasing receipts or spreadsheets; every transaction syncs automatically.

- Purpose-Built Virtual Cards: Teams can use Bycard virtual cards for ad platforms like Google, TikTok, or Meta, ensuring total control and budget compliance.

- Integrated Analytics: Bycard helps finance teams visualize patterns and adjust budgets dynamically.

Bycard’s technology ensures that cost control isn’t a reactive process but a proactive strategy. It bridges visibility gaps, minimizes overspending, and gives decision-makers confidence to scale without financial friction.

Turning Cost Control into a Growth Strategy

The most successful companies view cost control not as a limitation but as an enabler of growth.

With the right cost management framework, you’re not just saving money, you’re reallocating resources toward what truly drives performance.

An efficient expense control system means you can invest more confidently in innovation, employee development, and expansion, knowing your spending foundation is stable.

Bycard has shown that structured business expenses oversight doesn’t restrict creativity, it fuels it. When teams have autonomy within clear limits, productivity soars.

Cost control is, therefore, less about restraint and more about focus. When done right, it creates space for companies to grow sustainably, without financial waste or guesswork.

Conclusion

At a time when financial discipline defines survival, cost control is no longer optional, it’s essential. Businesses that master it don’t just cut costs; they gain clarity, speed, and long-term advantage.

Through automation, structured cost management, and strategic expense control, companies can turn financial pressure into opportunity. And with tools like Bycard, staying profitable without cutting corners isn’t just possible, it’s the new standard.