Business Expense Tracker: How to Manage and Simplify Your Business Finances

Every business loses money in small, unnoticed ways, a misplaced receipt here, a forgotten subscription there. These little leaks might seem insignificant, but over time, they quietly eat into profits and make it harder to see where your money really goes. That’s where a business expense tracker comes in. It’s more than a digital record of what you spend; it’s a system that helps you understand how money moves through your business, from employee reimbursements to recurring payments.

With a business expense tracker, you’re no longer scrambling to gather receipts or piece together expenses at the end of the month. It keeps everything organized in one place, helps you identify waste, catch duplicate charges, and simplifies reporting for accounting or audits, all while giving you real-time visibility into your finances.

- Business Expense Tracker: How to Manage and Simplify Your Business Finances

- What Is a Business Expense Tracker?

- Mini Case Study: How Expense Tracking Transformed One Business

- Why Tracking Business Expenses Matters

- Features to Look for in a Business Expense Tracker

- How a Business Expense Tracker Supports Better Decision-Making

- How Bycard Simplifies Expense Tracking

- Common Mistakes Businesses Make When Tracking Expenses

What Is a Business Expense Tracker?

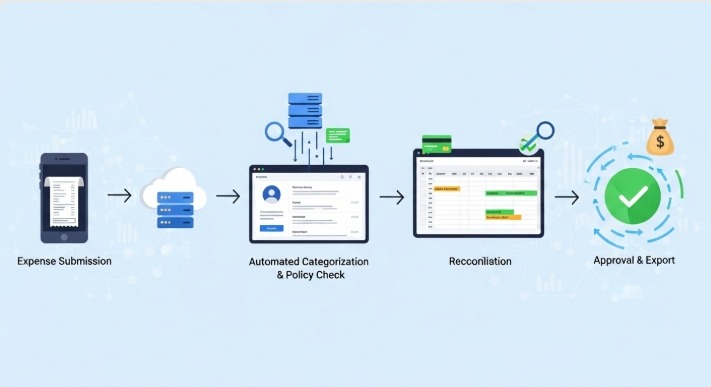

A business expense tracker is a digital tool that records, categorizes, and analyzes a company’s expenses. It automates what many business owners used to do manually, storing receipts, updating Excel sheets, and trying to balance budgets at month-end.

With a reliable tracker, you can:

- Record expenses in real time.

- Categorize spending (e.g., travel, supplies, utilities).

- Generate expense reports automatically.

- Monitor team or departmental budgets.

- Spot unnecessary or duplicate expenses quickly.

Mini Case Study: How Expense Tracking Transformed One Business

Take the example of a small logistics startup in New York. Initially, the founders relied on spreadsheets to manage expenses. Over six months, they noticed consistent budget overruns but couldn’t pinpoint where the leaks were.

After switching to a business expense tracker, they discovered that 18% of their monthly costs came from duplicate fuel reimbursements and unlogged card transactions. Within a quarter, they cut unnecessary spending by 22% and improved budget forecasting accuracy.

This is a practical example of how automation translates directly into savings and control.

Why Tracking Business Expenses Matters

When every expense is tracked automatically, it becomes easier to focus on growth instead of paperwork. A business expense tracker provides that visibility by turning raw spending data into useful insights. With it, businesses can:

- Stay compliant with tax regulations by maintaining accurate digital records.

- Detect overspending before it becomes a problem.

- Plan budgets based on real-time data rather than estimates.

- Save time on manual reconciliation and reporting.

Features to Look for in a Business Expense Tracker

Not all tools are created equal. The best business expense tracker should balance automation, accuracy, and ease of use. Here’s what to look for:

1. Real-Time Expense Recording

The ability to log expenses instantly helps prevent data loss and ensures spending reports stay current.

2. Receipt Scanning and OCR

Optical Character Recognition (OCR) lets you upload or snap receipts, and the system automatically extracts data like amount, vendor, and category.

3. Multi-User Access

A good tracker should allow teams to submit expenses individually while maintaining administrative control and approval workflows.

4. Expense Reports and Analytics

Visual reports and dashboards turn data into insights, helping you identify spending patterns or forecast future costs.

5. Integration with Payment Tools

Integration with banking or card solutions streamlines financial operations. For example, Bycard’s business expense tracker connects directly with your spending account, so every transaction updates your report instantly.

How a Business Expense Tracker Supports Better Decision-Making

A business expense tracker does more than record numbers; it gives you clarity. By tracking expenses across categories and departments, you can identify what drives profitability and what drains it.

Consider this scenario:

A small marketing agency notices that travel expenses have increased 25% over three months. With a tracker, they can quickly pinpoint the cause, perhaps too many client visits, and introduce virtual meetings to reduce costs.

Data like this makes decision-making proactive instead of reactive.

How Bycard Simplifies Expense Tracking

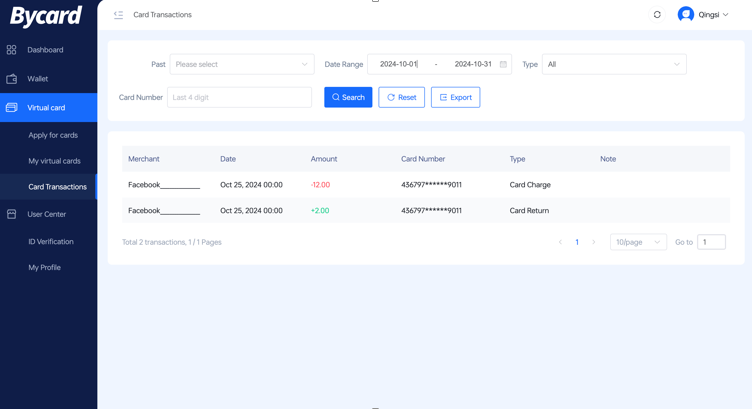

Bycard brings together expense tracking and payment management in one place. It offers both virtual and physical cards that automatically sync every transaction into your business expense tracker dashboard.

Instead of collecting receipts or waiting for month-end summaries, business owners can:

- View all spending in real time.

- Assign cards to team members.

- Generate categorized expense reports instantly.

The result is a simplified and transparent expense management process, no more guesswork, no more missed receipts.

Common Mistakes Businesses Make When Tracking Expenses

Mistakes happen, even with great tools. A business expense tracker like Bycard minimizes them by automating categorization and reconciliation. Still, there are a few common pitfalls businesses should watch out for:

- Delaying entries: waiting days to log expenses leads to lost or inaccurate data.

- Ignoring small expenses: minor costs like parking or snacks can add up over time.

- Poor categorization: grouping everything under “miscellaneous” makes analysis impossible.

- Not reconciling regularly: matching records with bank statements ensures accuracy and prevents fraud.

✔ Personalized Customer Service: One of the biggest advantages of traditional banks is the ability to interact with bank personnel for guidance on financial matters, including loans, mortgages, and investment options.

✔ Personalized Customer Service: One of the biggest advantages of traditional banks is the ability to interact with bank personnel for guidance on financial matters, including loans, mortgages, and investment options.

✔ Personalized Customer Service: One of the biggest advantages of traditional banks is the ability to interact with bank personnel for guidance on financial matters, including loans, mortgages, and investment options.

✔ Personalized Customer Service: One of the biggest advantages of traditional banks is the ability to interact with bank personnel for guidance on financial matters, including loans, mortgages, and investment options.

✔ Personalized Customer Service: One of the biggest advantages of traditional banks is the ability to interact with bank personnel for guidance on financial matters, including loans, mortgages, and investment options.

Conclusion

A business expense tracker is more than an organizational tool, it’s the foundation of healthy financial management. From reducing manual work to improving visibility and compliance, the right tracker keeps your business lean, efficient, and data-driven.

As a startup, a freelance operation, or a growing company, adopting a digital tracker like Bycard ensures that every expense tells a story, one that helps you manage smarter and grow confidently.